Corporate Profile

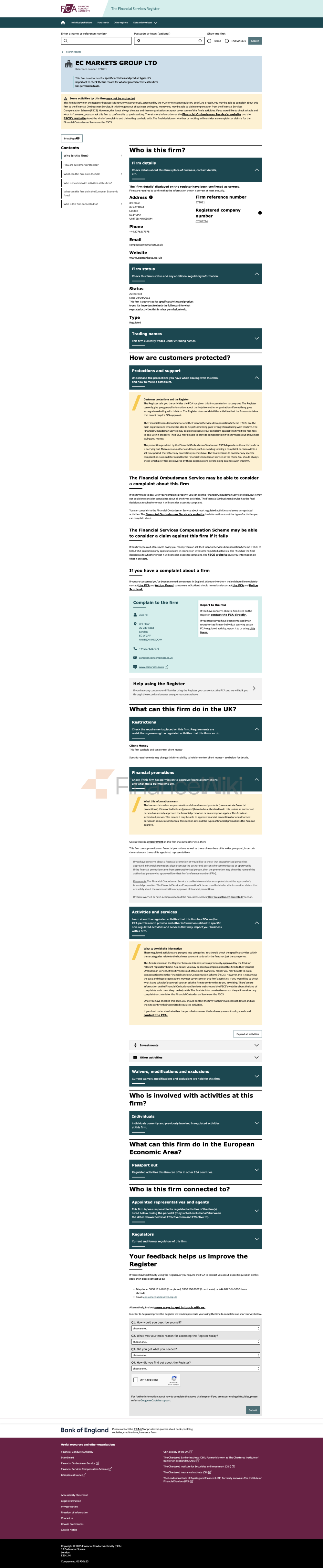

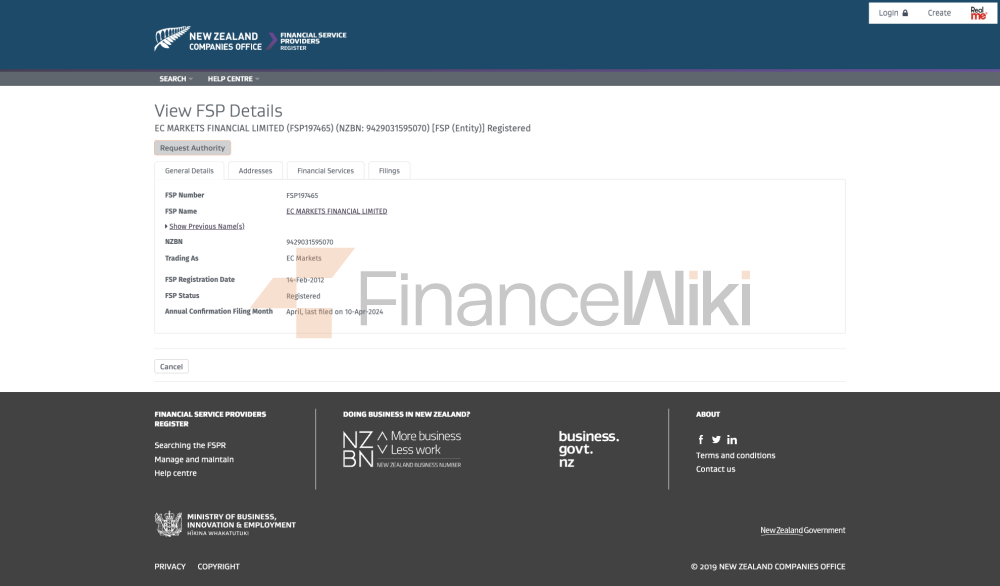

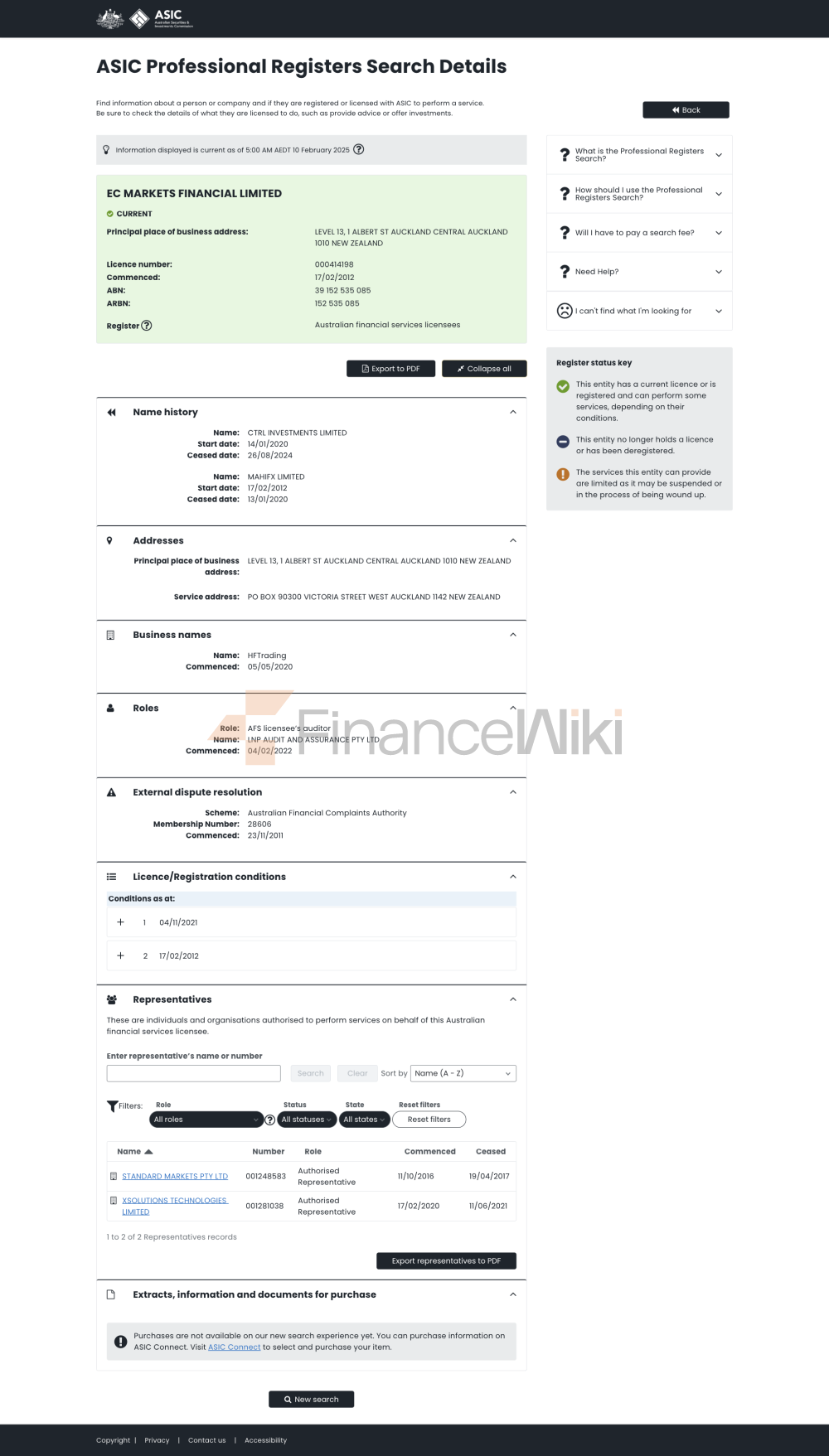

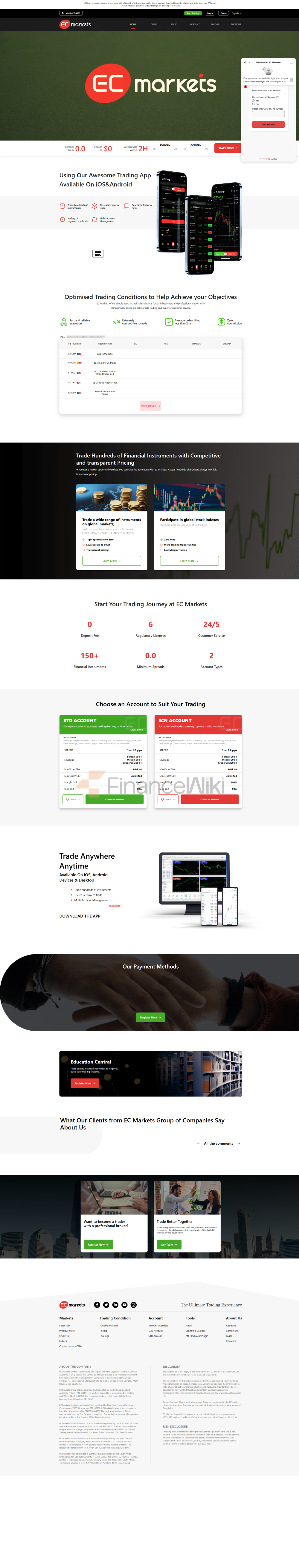

EC Markets Is A Professional Online Trading Broker, Established In 2011, Dedicated To Providing Global Investors With Cross-market Financial Trading Services. The Company Is Headquartered In The United Kingdom And Holds A Pass-through License (license Number: 571881) Issued By The Financial Marekt Conduct Authority (FCA). Its Business Scope Covers Foreign Exchange, Precious Metals, CFD Stock Index, Crude Oil And Other Financial Products. As A Broker With Many Years Of Market Experience, EC Markets Has Won The Trust Of Global Traders With Its Efficient Technology Platform, Diverse Trading Tools And Strict Compliance Operations.

Regulatory Information

EC Markets Is Regulated By The Financial Marekt Conduct Authority (FCA) In The UK And Strictly Adheres To The Regulator's Client Funds Rules. All Client Funds Are Segregated And Deposited In The World's AAA-rated Bank Barclays To Ensure The Safety Of Funds. The FCA's Supervision Ensures The Transparency And Fairness Of EC Markets' Operations, While Also Providing Additional Protection For Investors. In Addition, EC Markets Is Regularly Audited To Ensure That Its Business Operations Comply With Regulatory Requirements.

Trading Products

EC Markets Provides Investors With A Wide Range Of Financial Trading Tools, Covering The Following Main Areas:

- Forex : Including Mainstream Orders (such As EUR/USD, GBP/USD) And Rare Orders (such As AUD/NZD, USD/CHF).

- Precious Metals : Such As Gold (XAU/USD) And Silver (XAG/USD).

- CFD Stock Index : Provides Trading Of Major Global Stock Indexes, Including The US Dow Jones Index, The UK FTSE 100 Index, Etc.

- Crude Oil : Includes Brent Crude Oil And West Texas Intermediate Crude Oil (WTI).

Trading Software

EC Markets Offers Traders Access To The World's Most Popular Online Trading Platform - MetaTrader 4 (MT4) . The Platform Supports Multiple Trading Functions, Including:

- Allows Expert Advisors (Automated Trading Robots) To Trade.

- Supports EA Backtesting.

- Provides Charts For Multiple Timeframes.

- Has More Than 50 Built-in Technical Analysis Tools.

- Supports Multi-language Interface.

- Allows Setting Stop Loss, Take Profit And Trailing Stop Loss Orders.

In Addition, EC Markets' MT4 Platform Supports Android And IOS Mobile Devices , Providing Traders With A Convenient Mobile Trading Experience.

Deposit And Withdrawal Methods EC Markets Supports A Variety Of Deposit And Withdrawal Methods, Including:- UnionPay Card : Provides Convenient Bank Transfer Services For Customers.

- Telegraphic Transfer : International Telegraphic Transfer Is Supported, And The Arrival Time Is Usually 1-3 Working Days.

- Tether (USDT) : Cryptocurrency Deposits And Withdrawals Are Supported.

All Deposit And Withdrawal Methods Do Not Charge A Processing Fee , Further Reducing Transaction Costs.

Customer Support

EC Markets Provides Traders With A Comprehensive Customer Support Service, Including:

- 24/7 Multilingual Customer Service Support.

- Detailed Educational Resources To Help Novice Traders Get Started Quickly.

- Professional Market Analysis And Research Reports To Provide Reference For Trading Decisions.

Core Business And Services

EC Markets' Core Business Focuses On The Following Areas:

- Standardized Trading Accounts : Standard Accounts And ECN Accounts Suitable For All Types Of Traders Are Available. Standard Accounts Are Suitable For Novice And Low-frequency Traders, While ECN Accounts Are Suitable For Professional Traders And Institutional Investors.

- Leverage Trading : Provides Up To 1:500 Trading Leverage To Help Traders Scale Their Investments.

- Spreads And Commissions :

- Standard Account: EUR/USD Lowest Spread 2.2 Points , GBP/USD Lowest Spread 2.9 Points , Gold/USD Lowest Spread 5.4 Points , Crude Oil Lowest Spread 5.7 Points .

- ECN Account: EUR/USD Spreads Are 0.1 Pips , GBP/USD Spreads Are 0.5 Pips , AUD/USD Spreads Are 0.2 Pips , Gold/USD Spreads Are 3.0 Pips , Silver/USD Spreads Are 2.6 Pips , And Crude Oil Spreads Are 4.7 Pips . This Account Trades With A Commission Of 7 USD/standard Lot .

Technical Infrastructure

EC Markets Has Adopted An Advanced Technical Infrastructure To Ensure The Stability And Efficiency Of Trading:

- MT4 Platform : Supports High-speed Order Execution And Real-time Market Data Updates.

- Multi-Bank Gateway : Works With Several Top Banks To Ensure Safe Funds And Fast Deposits.

- Cloud As A Service : Using Cloud As A Service Technology To Provide Traders With A Stable Trading Platform And Fast Order Execution.

Compliance And Risk Control System

EC Markets Strictly Complies With The Regulatory Requirements Of The FCA And Has Established A Complete Risk Control System:

- Client Funds Isolation : All Client Funds Are Stored In Separate Bank Accounts And Strictly Separated From The Company's Working Funds.

- Risk Management Tools : Provide Risk Management Tools Such As Stop Loss, Take Profit And Trailing Stop Loss To Help Traders Control Risks.

- Statement Of Compliance : EC Markets Is Committed To Following All Applicable Laws And Regulations To Ensure A Transparent And Fair Market Environment.

Market Positioning And Competitive Advantage

EC Markets Occupies A Place In The Global Online Trading Market With Its Professional Services, Diverse Trading Tools And Technical Advantages. Its Main Competitive Advantages Include:

- A Wide Range Of Trading Products : Covering A Wide Range Of Financial Products Such As Foreign Exchange, Precious Metals, CFD Stock Indices And Crude Oil.

- Flexible Account Selection : Standard And ECN Accounts Are Available To Meet The Needs Of Different Traders.

- Low Spreads And Low Costs : Provides Traders With A Cost-effective Trading Environment By Optimizing The Spread And Commission Structure.

Customer Support And Empowerment

EC Markets Is Committed To Providing Comprehensive Support And Empowering Services To Its Clients:

- Educational Resources : Provide Rich Trading Educational Content, Including Video Tutorials, Market Analysis And Trading Strategies.

- Market Reports : Regularly Publish Market Analysis Reports To Help Traders Grasp Market Trends.

- Personalized Services : Provide Customized Trading Solutions For High Net Worth Clients.

Social Responsibility And ESG

EC Markets Focuses On Fulfilling Social Responsibility In Its Operations And Actively Participates In ESG (Environmental, Social And Governance) Practices:

- Environmental Protection : Supports The Sustainable Development Goals By Reducing Carbon Emissions And Optimizing Energy Use. Social Good : Regularly Participates In Charitable Activities And Gives Back To The Society.

- Transparency In Governance : Follow High Standards Of Corporate Governance Principles To Ensure Transparency And Fairness In Operations.

Strategic Cooperation Ecology

EC Markets Continues To Expand Its Business Ecosystem Through Strategic Cooperation With Several Well-known Financial Institution Groups And Technology Companies:

- Technical Cooperation : Collaborate With Leading Software Developers To Optimize Trading Platform Performance.

- Financial Cooperation : Collaborate With Several Top Banks To Ensure Safe And Efficient Access To Funds.

- Market Cooperation : Collaborate With Globally Renowned Financial Data Providers To Provide Real-time Market Data.

FINANCIAL HEALTH

As Of The Third Quarter Of 2023, EC Markets Is Financially Sound And Well-capitalized To Meet Day-to-day Operations And Client Funding Needs. The Company Regularly Submits Financial Reports To Regulators To Ensure Transparency And Compliance.

Future Roadmap

EC Markets Plans To Continue To Expand Its Business In The Future, Including:

- Product Innovation : Launching A Wider Variety Of Financial Products To Meet Diverse Market Needs.

- Technology Upgrade : Optimize The Trading Platform Functions And Improve The User Experience.

- Global Layout : Further Expand The Global Market And Attract Traders From More Countries.

Through Continuous Innovation And Optimization, EC Markets Is Committed To Becoming A Leader In The Global Online Trading Field.