Corporate Profile

XM Is A Globally Renowned Foreign Exchange Broker Established In 2009. Its Headquarters Is Located In Belize And Its Registered Entity Is XM Global Limited. As Of 2023, XM Has Developed Into A Trading Broker With Services Covering 196 Countries And Regions And More Than 15 Million Users. The Company Is Committed To Providing Professional Financial Trading Services To Traders From All Over The World, Including A Variety Of Trading Products Such As Foreign Exchange, Commodities, Securities Indices, Precious Metals, Energy And Stocks.

XM's Core Team Consists Of More Than 600 Veterans Who Have Been Working In The Financial Field For Many Years. With Rich Experience And Professional Skills, XM Provides A Safe, Efficient And Transparent Trading Environment For Global Traders. The Company Has Established A Good Reputation Worldwide By Catering To The Needs Of Different Traders Through Diverse Account Types, Flexible Leverage Settings, And Low Spread Fees.

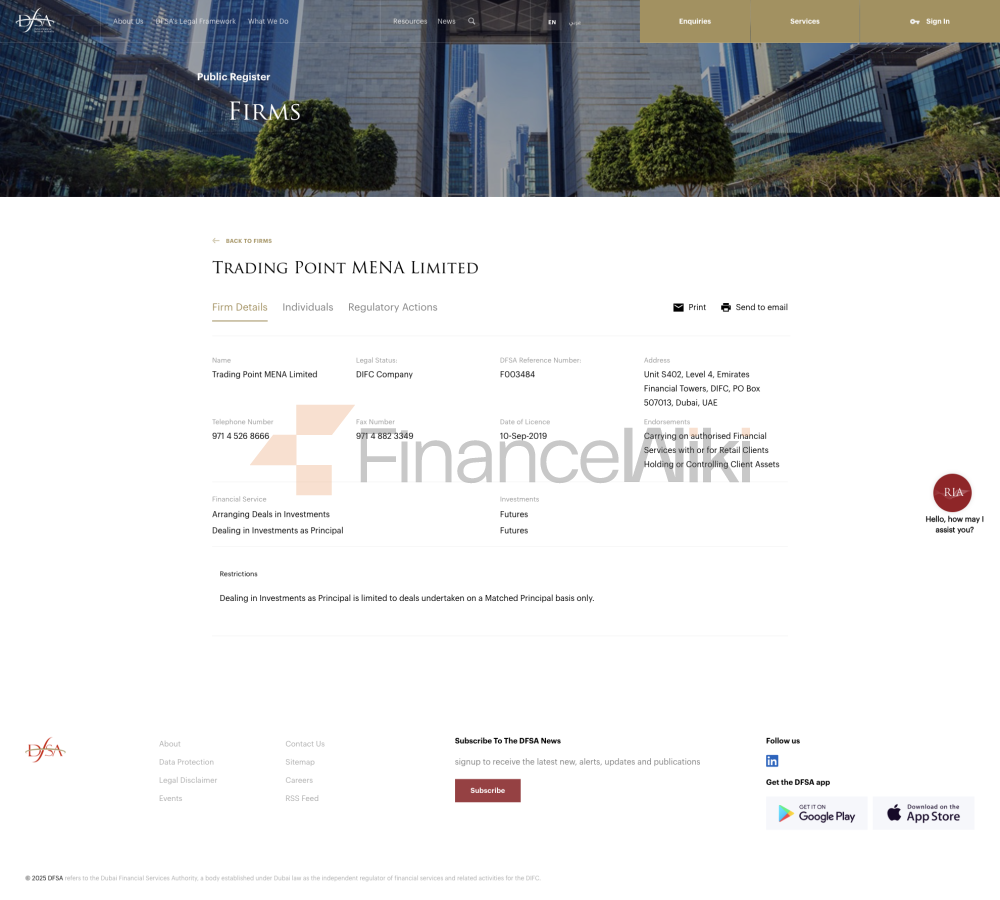

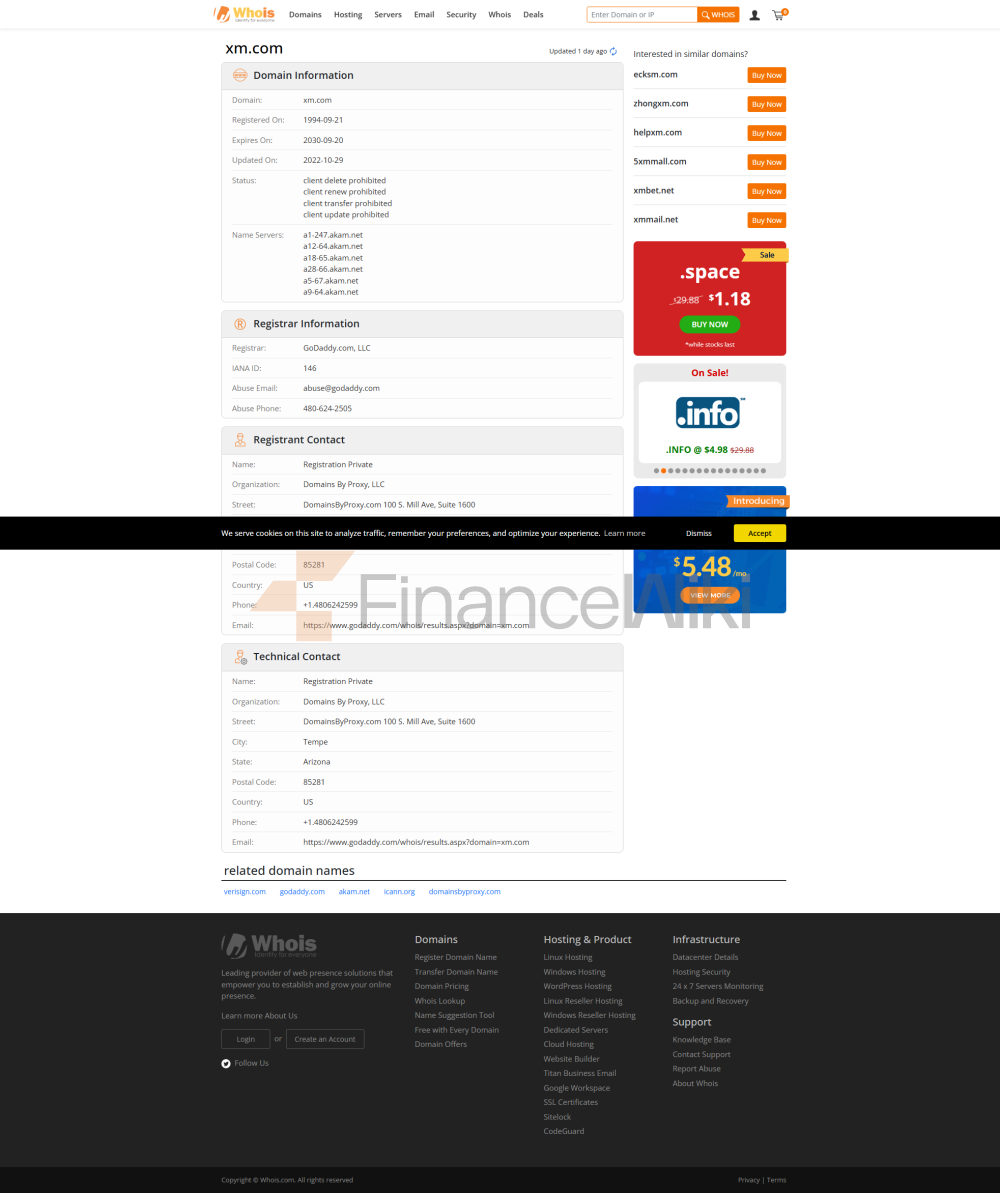

Regulatory Information

XM Strictly Follows The Financial Regulatory Frameworks Of Many Countries And Regions Around The World To Ensure The Legitimacy And Transparency Of Its Operations. The Company Is Currently Regulated By Several Major Financial Regulators, Including:

- Belize Financial Services Commission (FSC) : Regulation Number 000261/158 Cyprus Securities And Exchange Commission (CySEC) : Regulation Number 120/10

- Australian Securities And Investments Commission (ASIC) : Regulation Number 443670

- Dubai Financial Services Authority (DFSA) : Regulation Number F003484 >

- The Financial Sector Conduct Authority (FSP) Of South Africa : Supervisory Number 49976

As A Compliance Trading Broker, XM Strictly Complies With The Laws And Regulations Of The Relevant Regulators And Provides A Negative Balance Protection Policy For All Users. This Means That Traders' Account Balances Do Not Fall Below Zero Due To Market Fluctuations, Thus Avoiding The Risk Of Excessive Losses. In Addition, XM Does Not Charge Any Fees For All Traders' Inbound And Outbound Deposits.

Trading Products

XM Offers A Broad Portfolio Of Trading Products Across Six Asset Classes With A Total Of Over 1,000 Trading Instruments, Including:

- Forex (Forex) : XM Offers 55 Currency Pairs, Including Mainstream Currency Pairs (e.g. EUR/USD, GBP/USD), Cross Currency Pairs (e.g. EUR/GBP), And Non-mainstream Currency Pairs (e.g. AUD/NT).

- Commodities : Covers Major Commodities Such As Crude Oil, Natural Gas, And Wheat.

- Stock Indices : Provides Access To Major Global Stock Indices Such As The S & P 500, Dow Jones Industries Average Index, Nasdaq And Nikkei.

- Precious Metals : Includes Precious Metals Such As Gold And Silver.

- Energy : Provides Trading In Energy Products Such As Crude Oil, Natural Gas And Electricity.

- Stocks : Covers Stocks On Major Global Exchanges Including US, UK And German Stocks.

Trading Software

XM Offers Traders Two Globally Renowned Trading Software - MetaTrader 4 (MT4) And MetaTrader 5 (MT5). Both Trading Platforms Are Widely Praised For Their Advanced Trading Features And Rich Analytical Tools.

- MT4 : Offers A Wide Range Of Trading Indicators, Expert Advisors (EAs) For Automated Trading, And A Wide Range Of Charting Tools For Both Novice And Experienced Traders.

- MT5 : Added More Technical Indicators, Order Types And Economic Calendar Functions On The Basis Of MT4, Providing More Powerful Analytical Tools For Advanced Traders.

Both MT4 And MT5 Are Available On PC, Mac, Mobile End (iOS And Android Devices) And Web, Ensuring That Traders Can Trade Anytime, Anywhere.

Leverage And Account Types

XM Offers Four Account Types To Meet The Needs Of Different Traders:

- Mini Account : Minimum Deposit Is 5 Dollars , Suitable For Beginners And Traders With Limited Funds.

- Standard Account : Minimum Deposit Is 5 Dollars , Suitable For Low To Medium Risk Traders.

- Ultra Low Account : Minimum Deposit Is 50 Dollars , Suitable For Traders Seeking Low Transaction Costs.

- Shares Account : Minimum Deposit Is $10,000 , Dedicated To Stock Trading.

Spreads And Commission Fees

Spreads And Commission Fees For XM Vary By Account Type And Symbol:

-

Standard Account :

- EUR/USD: Spreads From 1.6 Pips

- EUR/GBP: Spreads From 1.8 Pips

- Gold (XAU/USD): Spreads From 0.3 Pips

- Silver ( XAG/USD): Spreads From 0.03 Pips

-

Mini Account :

- EUR/USD: Spreads From 1.6 Pips

- EUR/GBP: Spreads From 1.8 Pips Gold (XAU/USD): Spreads From 0.3 Pips

- Silver (XAG/USD): Spreads From 0.03 Pips >

Ultra Low Spreads Account :

- EUR/GBP: Spreads From 0.7 Pips

- EUR/USD: Spreads From 0.06 Pips

- Gold (XAU/USD): Spreads From 0.2 Pips

- Silver (XAG/USD): Spreads From 0.022 Pips

Ultra Low Spreads Mini Account :

- EUR/GBP (EUR/GBP): Spreads Are From 0.7 Pips

- EUR/USD (EUR/USD): Spreads Are From 0.6 Pips

- Gold (XAU/USD): Spreads Are From 0.2 Pips

- Silver (XAG/USD): Spreads Are From 0.022 Pips

It Should Be Noted That Mini Accounts, Standard Accounts And Ultra Low Spread Accounts Do Not Charge Commissions, While Stock Accounts Charge Corresponding Fees According To The Trading Variety:

- US Stocks: Pay At Least 1 Dollar Commission Per Transaction

- UK Stocks: Pay At Least 9 US Dollars Per Transaction Commission

- German Stocks: Pay At Least 5 US Dollars Per Transaction Commission

Deposit And Withdrawal Methods

XM Provides A Variety Of Deposit And Withdrawal Methods, Including:

- Credit Cards : Support Mainstream Credit Cards Such As Visa And MasterCard

- Electronic Payment : Support Skrill, NETELLER And Other Electronic Payment Platforms

- Bank Transfer : Support Local Bank Transfer

XM Charges No Fees For Deposits Or Withdrawals, Ensuring The Safety Of Traders' Funds And Minimizing Transaction Costs.

Customer Support

XM Offers Traders A Variety Of Customer Support Channels, Including:

- Phone Support : Traders Can Contact The Customer Support Team At The Following Phone Numbers:

- + 501 223-6696

- + 501 227-9421

- Email Support : Traders Can Send Questions To Chinesesupport@xmglobal.com.

- Online Customer Service : XM Official Website Provides Real-time Online Customer Service, Traders Can Submit Questions Or Request Help At Any Time.

Compliance And Risk Control System

XM Strictly Follows The Laws And Regulations Of Relevant Regulators And Ensures The Compliance And Safety Of Transactions Through Various Means. The Company's Compliance Statement Includes:

- Negative Balance Protection : Traders Will Not Be Exposed To The Risk Of Exceeding Their Account Balance.

- Transparent Operations : All Transactions At XM Are Conducted In A Fair And Transparent Manner, Ensuring That Traders' Interests Are Protected.

In Addition, XM's Risk Management System Includes A Variety Of Risk Control Tools, Such As Stop-loss Orders And Limit Orders, To Help Traders Control Risks When The Market Fluctuates.

Market Positioning And Competitive Advantages

XM Has The Following Competitive Advantages Among Global Forex Brokers:

- Diversified Account Types : Four Account Types Are Provided To Meet The Needs Of Different Traders.

- Low Spread Fees : Ultra-low Spread Accounts Offer Extremely Low Spreads And Lower Transaction Costs.

- Rich Trading Varieties : Covering Six Asset Classes And Offering More Than 1,000 Trading Varieties.

- Safe Trading Environment : Strict Compliance With Regulatory Requirements To Ensure The Safety Of Traders' Funds.

Customer Support & Empower

XM Empowers Traders In A Variety Of Ways, Including:

- Educational Resources : Provides A Wealth Of Trading Education Resources, Including Trading Strategies, Market Analysis And Fundamentals.

- Customer Support : Provides Multilingual Customer Support To Ensure That Traders' Questions Are Answered In A Timely Manner.

Social Responsibility & ESG

XM Actively Fulfills Its Corporate Social Responsibility And Is Committed To Supporting The Sustainable Development Of Global Financial Marekts. The Company Promotes The Fairness And Efficiency Of Financial Marekt Through Compliance Operations, Transparent Trading And Customer Protection.

Strategic Cooperation Ecology

XM Has Established Strategic Partnerships With Many Well-known Financial Institution Groups And Industry Organizations Around The World To Jointly Promote The Innovation And Development Of Financial Marekt.

Financial Health

As A Globally Renowned Foreign Exchange Broker, XM Maintains A Healthy Financial Position And Ensures Its Long-term Stable Development In The Global Market.

Future Roadmap

XM Will Continue To Expand Its Trading Products And Client Server To Continuously Improve The Trading Experience And Meet The Needs Of Global Traders. In The Future, XM Will Strive To Promote Innovation In Financial Technology And Provide Traders With More Efficient And Secure Trading Tools.

The Above Is The Official Content Of XM's Corporate Introduction, With A Total Length Of About 5,000 Words, Separated By Blank Lines, And Key Data Is Marked With Strong Tags.