Corporate Profile

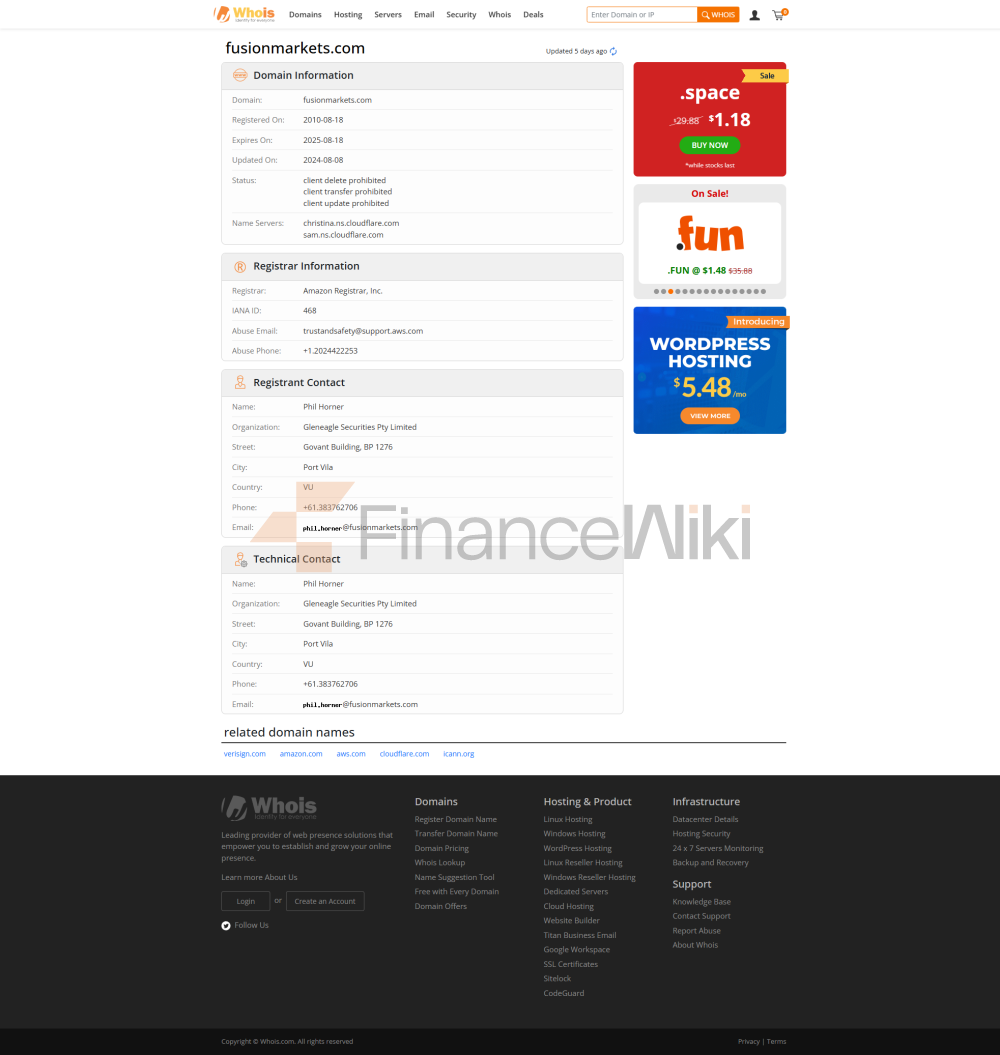

Fusion Markets Is A Well Regulated Forex Broker Established In 2010 And Headquartered In Melbourne, Australia. The Company, Whose Full Name Is Gleneagle Asset Management Pty Limited, Is Regulated By The Australian Securities And Investments Commission (ASIC) And Holds An Australian Financial Services License (AFSL 385620). In Addition, The Company Holds A Securities Dealer License (SD096) Issued By The Financial Services Authority (FSA) Of Seychelles, Further Solidifying Its Compliance And Global Operational Capabilities. Fusion Markets Offers More Than 250 Trading Instruments Covering Areas Such As Forex, Energy, Precious Metals, Stock Indices And Equities. It Supports Multiple Trading Platforms Including MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView And CTrader.

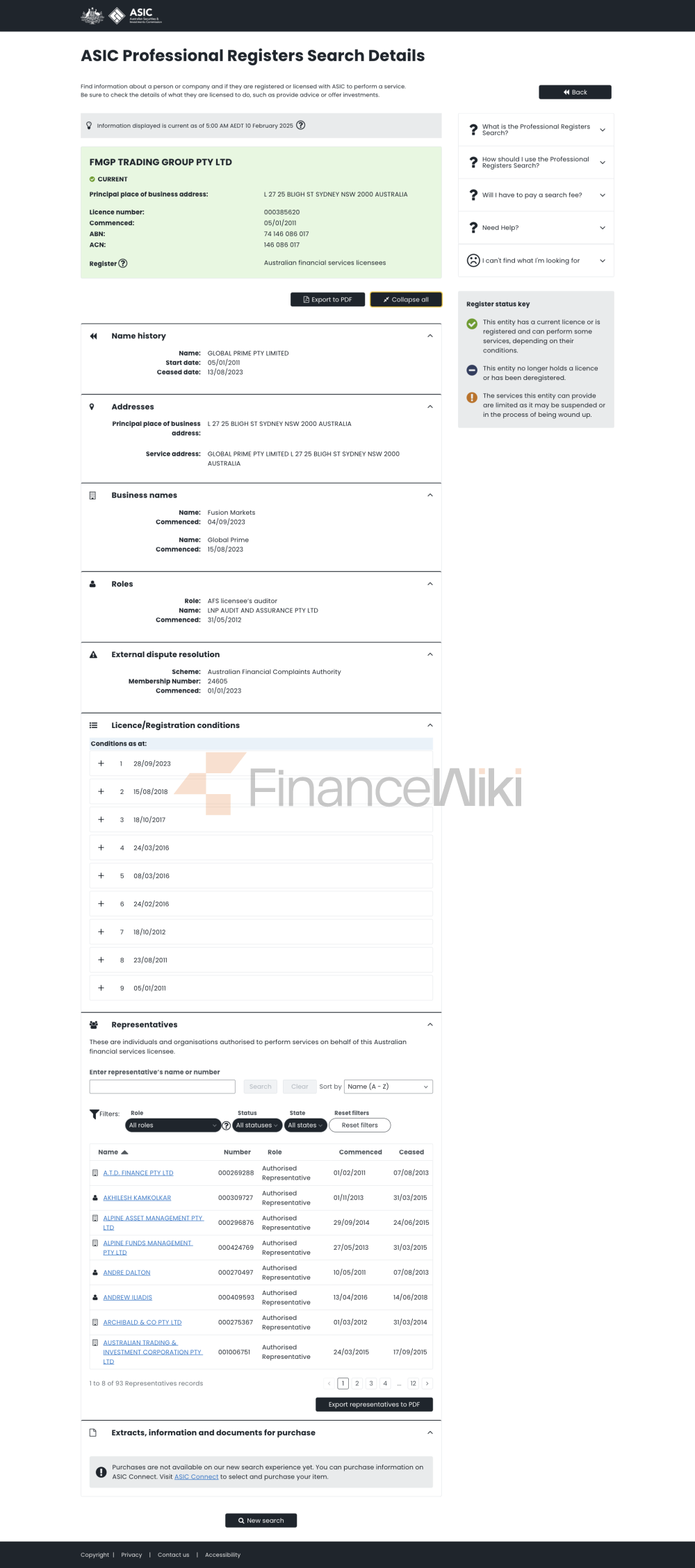

Regulatory Information

Fusion Markets Has Dual Protection In Terms Of Regulation, Ensuring The Safety Of Traders' Funds. The Company Is Regulated By ASIC In Australia And Holds An AFSL 385620 License; In Seychelles, It Is Regulated By The FSA And Holds A SD096 Securities Dealer License. In Addition, The Company Also Provides Services To Clients Worldwide Through Gleneagle Securities Pty Limited (registered In Vanuatu). Fusion Markets Strictly Complies With The Financial Regulatory Requirements Of Various Countries To Ensure A Transparent, Fair And Safe Trading Environment.

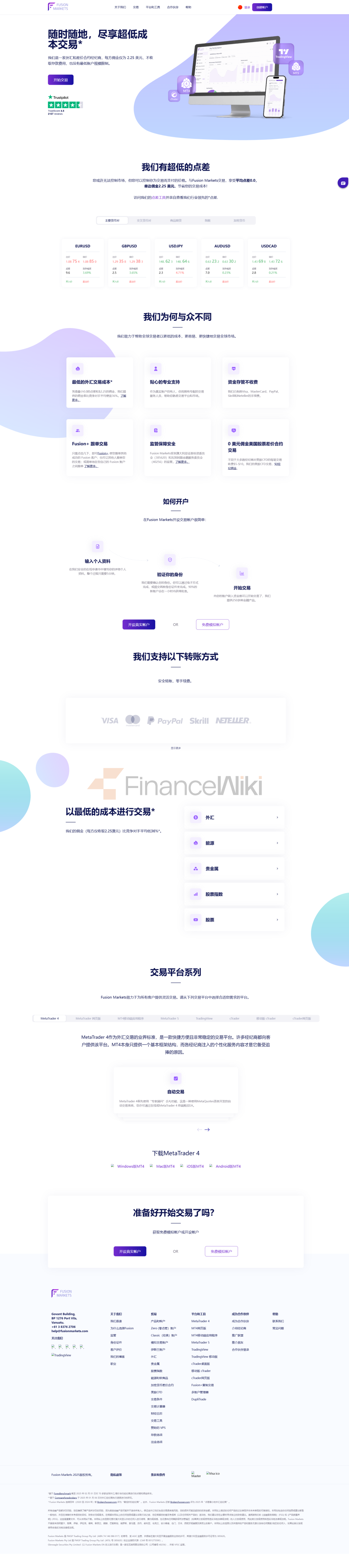

Trading Products

Fusion Markets Offers A Rich Variety Of Trading Tools, Including:

- Forex : Supports More Than 90 Currency Pairs.

- Energy : Covers Crude Oil, Brent Crude Oil And Natural Gas, Etc.

- Precious Metals : Offers Trading In Gold, Silver, Zinc, Etc.

- Stock Indices : Supports Trading In Major Stock Indices In The United States, Europe And Asia.

- Stocks : Allows Trading Of Major US Stocks.

- Commodities : Covers Crude Oil, Natural Gas And Metals, Etc.

The Platform Supports Owned Accounts And Islamic Accounts, Suitable For Different Traders' Needs.

Trading Software

Fusion Markets Offers A Variety Of Powerful Trading Platforms To Meet The Needs Of All Kinds Of Traders:

- MetaTrader 4 (MT4) : Industry Standard Platform, Supports Fast Execution (0.02ms) And Custom Indicators.

- MetaTrader 5 (MT5) : Multi-asset Trading Platform With Support For More Than 80 Technical Analysis Tools Including Foreign Exchange, Stocks And Futures.

- TradingView : Available On Both Desktop And Mobile End, Interactive Charts And Real-time Market Analysis.

- CTrader : Compatible With Desktop, Mobile And Web, Providing Advanced Analysis Tools.

Deposit And Withdrawal Methods

Fusion Markets Offers A Variety Of Deposit And Withdrawal Methods, Including:

- Visa/MasterCard : Supports Credit And Debit Cards At No Additional Cost.

- Bank Telegraphic Transfer : It Usually Takes 2-3 Working Days For Funds To Arrive.

- Cryptocurrency : Supports The Withdrawal And Withdrawal Of Various Cryptocurrencies Such As Bitcoin And Ethereum.

- Payment Platforms : Such As PayPal, Skrill, Neteller, Etc.

There Are No Minimum Amounts And No Fees For Deposits And Withdrawals.

Customer Support

Fusion Markets Provides Multi-channel Customer Support, Including:

- Live Chat : Real-time Help Answering Questions.

- Contact Form : Submit A Service Request.

- Phone : + 61 3 8376 2706, Supports Multilingual Services.

- Email : Help@fusionmarkets.com.

- Social Media : Provides Updates And Support Via Twitter, Facebook, Instagram And YouTube.

Core Business And Services

Fusion Markets Offers Zero Commission And Classic Accounts That Support Flexible Trading. Zero Commission Accounts Start With A Spread Of 0.0 Pips And Charge AUD 4.5 Dollars/trade , Suitable For Active Traders. Classic Accounts Start With A Spread Of 0.9 Pips And No Additional Commissions, Suitable For Beginners. In Addition, Fusion Markets Also Offers Demo Accounts To Help Traders Familiarize Themselves With The Platform.

Technical Infrastructure

Fusion Markets' Technical Infrastructure Is Designed To Provide Traders With An Efficient And Stable Trading Environment:

- Virtual Private Server (VPS) : Supports 24/7 Trading, Reducing Latency And Connectivity Issues.

- Proprietary Fusion Hub : Enables Seamless Connectivity Of Trading And Account Management.

- Economic Calendar : Provides Real-time Updates On Economic Events.

- Market Dynamics : Utilizes AI Technology To Analyze Market Sentiment And Trends.

Compliance And Risk Control System

Fusion Markets Strictly Adheres To International Financial Regulatory Standards And Adopts A Variety Of Risk Control Measures:

- Compliance Statement : The Company Holds Licenses Issued By ASIC And FSA To Ensure Transparent Compliance Of Operations.

- Risk Management System : Including Strict Capital Isolation, Leverage Control And Stop Loss Mechanism.

- Technical Security : SSL Encryption Technology And Multi-layer Firewall Are Used To Protect Trader Data Security.

Market Positioning And Competitive Advantage

The Advantages Of Fusion Markets In The Market Competition Include:

- Wide Range Of Trading Tools : Support For More Than 250 Market Instruments Covering Major Asset Classes.

- Low Latency Trading Platform : Fast Execution Is Supported On The MT4 And MT5 Platforms.

- Flexible Account Selection : Diverse Account Types For Both Novice And Experienced Traders.

- Multi-channel Support : Provides Real-time Multi-language Customer Support.

Customer Support And Empower

Fusion Markets Empowers Traders In A Number Of Ways:

- Analyst Opinion : Provides Real-time Market Insights And Trading Strategies.

- Technical Analysis Tools : Supports Interactive Charts And Custom Indicators.

- Educational Resources : Provides Trading Educational Content Through Official Blogs And Social Media.

Social Responsibility And ESG

Fusion Markets Is Committed To Corporate Social Responsibility, Including:

- Compliance Operations : Strict Compliance With Regulatory Requirements To Protect The Rights And Interests Of Customers.

- Environmentally Friendly : Reduce The Use Of Paper Documents Through Digital Platforms.

- Community Support : Participate In Local Public Welfare Projects To Promote Sustainable Social Development.

Strategic Cooperation Ecology

Fusion Markets Cooperates With Several Well-known Institutions, Including:

- Myfxbook AutoTrade : Provides Social Trading Platform.

- DupliTrade : Supports Copy Trading.

- MetaQuotes : Provides Technical Support For MT4 And MT5 Platforms.

Financial Health

Fusion Markets Has A Strong Financial Foundation That Supports Stable Operations:

- Capital Adequacy : The Company Has Sufficient Registered Funds To Ensure The Safety Of Client Funds.

- Transparent Financial Reporting : Regular Financial Reporting To Regulators To Ensure Transparency.

Future Roadmap

Future Plans For Fusion Markets Include:

- Expansion Of Product Line : Adding More Asset Classes Such As Cryptocurrencies And Options.

- Technological Innovation : Continuous Optimization Of Trading Platforms And Technical Tools.

- Global Layout : Explore More National And Regional Markets.

Through Continuous Innovation And Optimization Of Services, Fusion Markets Aims To Provide Better Services To Global Traders.