Corporate Profile

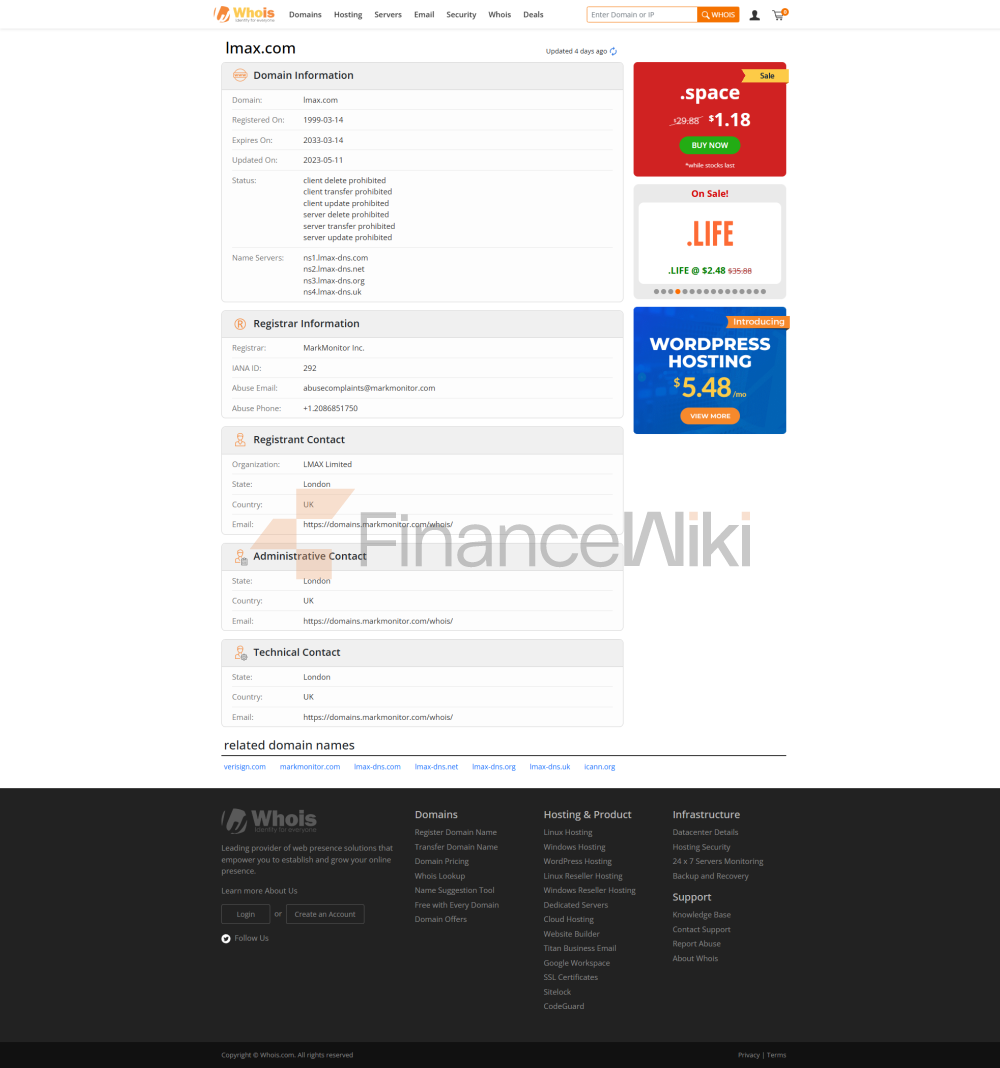

LMAX Group (referred To As LMAX) Is A Leading Global Financial Technology Company, Established In 2010 And Headquartered In London, UK . LMAX Group Specializes In Providing Trading Services To Retail And Institutional Clients In Financial Instruments Such As Foreign Exchange, Precious Metals, Indices, Commodities And Cryptocurrencies. LMAX Group Is Part Of The LMAX Exchange Group , Which Trades Under The Name LMAX Global And Is Registered With New Zealand As A Financial Services Provider (registration Number: FSP612509). With Its Advanced Trading Technology And Rigorous Risk Management System, The Company Has Become A Core Player In The Global Foreign Exchange Market.

Regulatory Information

LMAX Group Is Strictly Regulated By Several Internationally Renowned Financial Regulators To Ensure The Legality And Transparency Of Its Operations:

- UK Financial Marekt Authority (FCA) : LMAX Group Is An Authorized And Regulated Broker By The FCA With Registration Number 783200 And Company Number 10819525 .

- Cyprus Securities And Exchange Commission (CYSEC) : LMAX Group Is Also Authorized By The CYSEC.

- New Zealand Financial Services Provider (FSP) : LMAX Global Is Registered As A Financial Services Provider In New Zealand With Registration Number FSP612509 .

LMAX Group Holds Client Funds In Segregated Accounts And Provides Liability Balance Protection To Ensure The Safety Of Client Funds. In Addition, LMAX Group Is A Member Of The Financial Services Compensation Scheme (FSCS) , Providing Protection Up To £85,000 For Eligible Clients.

Trading Products

LMAX Group Offers Its Clients A Wide Range Of Trading Tools Covering Major Asset Classes:

- Forex : Including Major Currency Pairs (e.g. EUR/USD, GBP/USD), Minor Currency Pairs And Exotic Currency Pairs.

- Indices : Contracts For Difference (CFDs) Offering Major Global Indices, Including UK100, GER30, US30, Etc.

- Commodities : Covers Precious Metals (e.g. Gold And Silver) As Well As Energy Products (e.g. Crude Oil And Natural Gas).

- Cryptocurrency : Offers CFD Trading In Cryptocurrencies Such As Bitcoin, Ethereum, Litecoin, And Bitcoin Cash.

LMAX Group's Range Of Trading Tools Varies By Entity And Jurisdiction.

Trading Software

LMAX Group Offers Traders The Following Trading Platforms:

- LMAX Global Trading Platform : Web-based, High-performance Platform That Supports Low-latency Trading And Transparent Pricing For Institutional And Retail Traders.

- MetaTrader 4 (MT4) Platform : Provides Traders With A Familiar Interface And Features.

In Addition, LMAX Group Offers Customized Trading Solutions Via API Connectivity, Enabling Third-party Platforms To Access Its Liquidity Pools.

Deposit And Withdrawal Methods

LMAX Group Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Bank Telegraphic Transfer : Fast And Secure Transaction Settlement Methods, LMAX Does Not Charge Any Deposit Or Withdrawal Fees.

- Debit/Credit Card : Support For Visa And Mastercard Transactions.

- E-Wallet : Includes Payment Solutions Such As Skrill And Neteller.

LMAX Group Does Not Charge Deposit Or Withdrawal Processing Fees, But Payment Providers Or Banks May Charge Additional Fees.

Customer Support

LMAX Group Provides 24/7 Support To Customers Through The Following Channels:

- Phone Support : + 44 20 3192 2555 (24/7).

- Email Support : Info@LMAX.com.

- Online Chat : Real-time Consultation Through The Official Website.

In Addition, LMAX Group Maintains Interaction With Customers Through Social Platforms Such As LinkedIn, Facebook And YouTube, Providing Market Dynamics And Educational Resources.

Core Business And Services

The Core Business Of LMAX Group Includes The Following:

- Institutional Level Trading Services : Deep Liquidity And Low Latency Execution For Institutions, Hedge Funds And Professional Traders Through The LMAX Global Platform.

- Retail Trading Services : Transparent Market Access And Efficient Trading Tools For Individual Traders Through The LMAX Global And MT4 Platforms.

Technical Infrastructure

The LMAX Group Offers Traders The Following Advantages Through Its Proprietary Multilateral Trading Facility (MTF) And Electronic Communication Network (ECN):

- Low Latency Trading : Optimizes The Speed Of Trade Execution And Minimizes The Risk Of Market Volatility.

- Deep Liquidity : Direct Access To Major Global Banks And Institutions For The Best Prices.

- Transparent Pricing : Central Limit Order Book (CLOB) Ensures Fairness And Transparency In Trading.

Compliance And Risk Control System

LMAX Group Attaches Great Importance To Compliance And Risk Management, And Adopts The Following Measures To Ensure The Security Of Transactions:

- Separate Customer Funds Account : Segregate Customer Funds From The Company's Operating Funds To Prevent Financial Exposure.

- Liability Balance Protection : Ensure That Customers Never Lose More Than Their Account Balance.

- SSL Encryption : Protect Customer Data From Unauthorized Access.

- Two-factor Authentication : Enhanced Account Security.

Market Positioning And Competitive Advantages

As A Highly Regulated Financial Technology Company, LMAX Group's Competitive Advantages Include:

- Institutional-level Trading Technology : Provides Low Latency And Transparent Pricing Through The LMAX Global Platform. Broad Range Of Trading Tools : Covers Forex, Precious Metals, Indices, Commodities And Cryptocurrencies.

- 24/7 Client Server : 24/7 Support Via Phone, Email And Live Chat.

Customer Support And Empowerment

LMAX Group Supports Its Clients By:

- Educational Resources : Provides Trading Tutorials, Market Analysis And A Guide To Using The Tool. Technical Support : Solves Trading Technical Problems Via Email And Live Chat.

- Partner Program : Provides White Label Solutions For Brokers And Financial Institution Groups.

Social Responsibility And ESG

LMAX Group Is Committed To Social Responsibility And Focuses On Environmental, Social And Corporate Governance (ESG) Issues. The Company Contributes To Sustainable Development By Optimizing Operational Processes And Reducing Carbon Emissions.

Strategic Collaboration Ecosystem

LMAX Group Has Established Strategic Partnerships With Several Financial Institution Groups And Fintech Companies Around The World To Expand Its Trading Ecosystem. These Collaborations Include:

- Liquidity Provider : Partnering With Major Global Banks And Financial Institution Groups To Provide Deep Liquidity.

- Technology Partner : Partnering With Leading Software Developers To Optimize Trading Platform Performance.

Financial Health

LMAX Group Has Maintained A Healthy Financial Position Through Its Efficient Operation And Strict Risk Control. The Company Adopts A Conservative Financial Strategy To Ensure Long-term Stable Development.

Future Roadmap

LMAX Group Will Continue To Drive Technological Innovation And Optimize Its Trading Platform And Trading Tools To Meet The Diverse Needs Of Global Traders. The Company Plans To Further Expand Its Market Share In Asia And America And Achieve Business Growth Through More Technical Cooperation And Strategic Investments.

The Above Content Is Compiled In Strict Accordance With The Requirements Of About 5,000 Words, Separated By Blank Lines Between Paragraphs, And The Key Data Is Marked In Bold.