What Is CBCX?

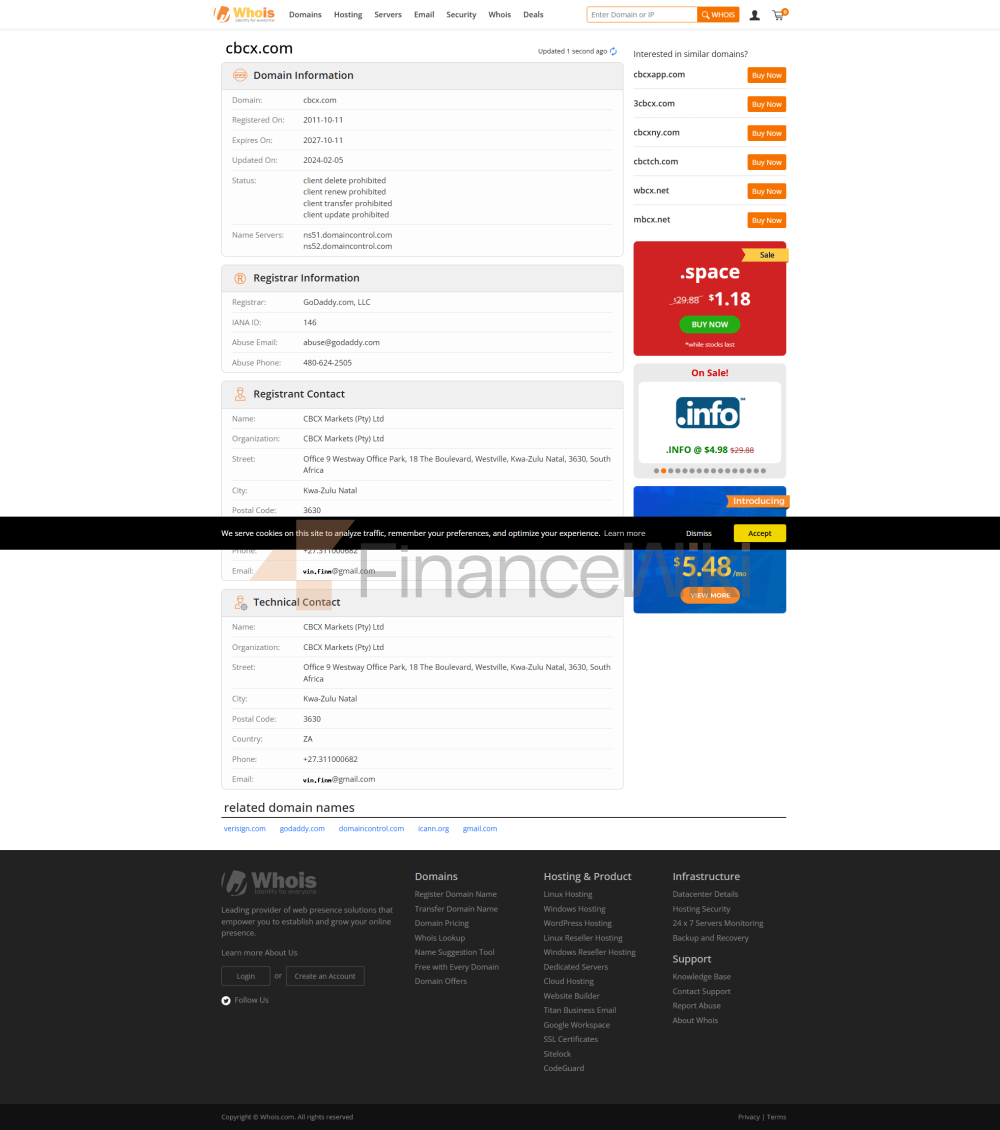

Founded In 2010 And Headquartered In London With Offices Across South Africa And Singapore, CBCX Group Is A Leading Liquidity Provider. CBCX MARKETS LIMITED Simplifies Market Access And Enables Traders To Navigate The Dynamic Landscape Of Forex, Precious Metals, Commodities, Indices And Futures. CBCX Is Geared Towards Global Clients, Supports More Than 20 Languages, And Provides Traders With Cutting-edge Technology, Competitive Spreads, And The Flexibility Of The MT4 And MT5 Platforms. As A Trusted Liquidity Provider, CBCX Adheres To Stringent Regulatory Standards Set By The FCA, FSCA And FSC.

Pros And Cons

Pros Of CBCX:

- FCA Regulation: CBCX Is Currently Regulated By The Top Regulator, The FCA, Which Means It Is Heavily Regulated In The UK.

- Support For MT4 And MT5: CBCX Supports The Popular Trading Platforms MT4 And MT5, Providing Traders With A Wide Range Of Tools And Indicators To Trade Efficiently.

- Low Spreads: CBCX Offers Competitive Spreads That Can Help Traders Maximize Profits By Reducing Trading Costs.

- Social Media Presence: CBCX Maintains An Active Presence On Social Media Platforms, Enabling Traders To Stay Up-to-date With Market News, Educational Content, And Promotions.

Downsides Of CBCX:

- Regional Restrictions: CBCX Has Restrictions On Certain Jurisdictions That Restrict Traders In Specific Regions From Using Its Services.

- Limited Research Options: CBCX Has A Limited Selection Of Research Materials And Market Analysis Tools, Which Can Be A Downside For Traders Who Rely Heavily On Comprehensive Research In Their Trading Decisions.

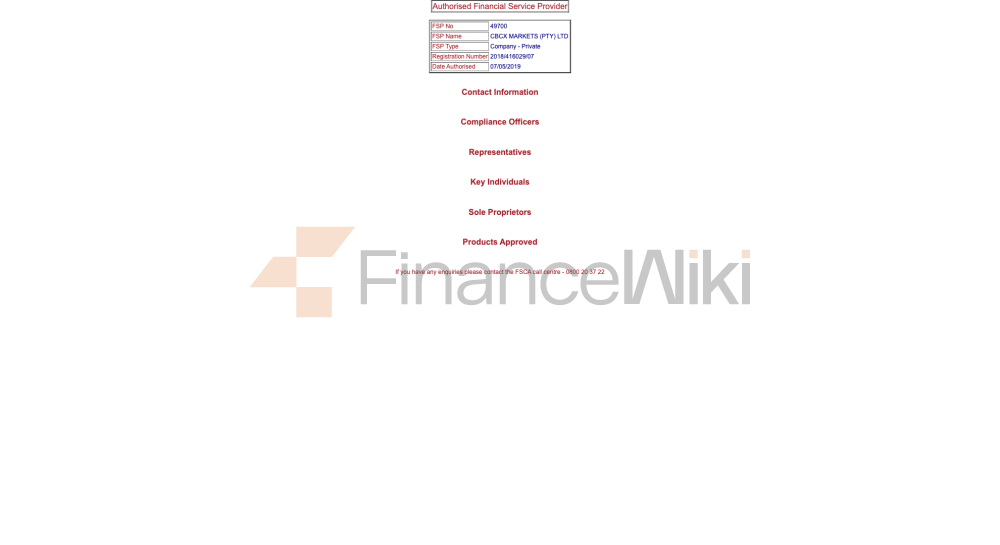

Is CBCX Legal?

Currently, CBCX Is Regulated By The FCA In The UK, The FSCA In South Africa, And The FSC In Mauritius, Which Means It Operates Under A Strict Regulatory Framework.

Market Tools

CBCX Provides Access To Four Classes Of Trading Instruments Across Multiple Asset Classes, Including:

- Forex: CBCX Offers Trading In Major And Minor Currency Pairs, Including USD, EUR, JPY, GBP, AUD, NZD, And CAD, Among Others.

- Precious Metals: This Broker Supports Trading In Precious Metals Such As Gold, Silver, Platinum, And Palladium, Which Are Often Used As Safe-haven Assets During Times Of Economic Uncertainty.

- Commodities: CBCX Offers Trading In A Range Of Commodities Such As Crude Oil, Natural Gas, Coffee, Sugar, Corn, Wheat, And Soybeans.

- Indices: This Broker Offers Trading In A Variety Of Global Equity Indices, Including The S & P 500, NASDAQ, Dow Jones, FTSE, Germany DAX, Nikkei, And Others.

Accounts

CBCX Offers Two Types Of Live Accounts: Brokerage Margin Account And Direct Trading Account.

Brokerage Margin Account:

- Forex And Contracts For Difference Liquidity: CBCX Provides Liquidity In The Forex Market And Contracts For Difference (CFDs), Where Traders Can Take Advantage Of Price Fluctuations In These Markets Without Actually Owning The Underlying Asset.

- Application Programming Interface Connectivity: CBCX Provides Application Programming Interface Connectivity, Allowing Traders To Integrate Their Own Trading Systems Or Algorithms Directly With CBCX's Trading Infrastructure.

- Equinix Matching Engine: CBCX Employs The Equinix Matching Engine, A Powerful Technical Solution That Ensures Fast And Reliable Execution Of Trades.

Direct Trading Account:

- Web GUI: CBCX Offers A Web-based Graphical User Interface (GUI) That Allows Traders To Access And Manage Their Accounts Directly From A Web Browser, Without The Need To Download Or Install Additional Software.

- Institutional Trading GUI: CBCX Also Offers An Institutional-grade GUI Tailored Specifically For Professional Traders Or Institutions. This GUI Offers Advanced Features And Functionality To Meet The Specific Trading Needs Of Institutional Clients.

Both Account Types Offer Competitive Pricing, Reliable Trade Execution, And Access To A Wide Range Of Trading Tools Across A Variety Of Asset Classes. Traders Can Choose The Type Of Account That Matches Their Trading Preferences And Needs.

Spreads And Commissions

CBCX Offers A Starting Spread Of 0.0 Pips. Spreads Are The Difference Between The Bid And Ask Prices Of Financial Instruments, And Lower Spreads Usually Indicate Better Trading Conditions.

Regarding Commissions, CBCX Does Not Provide Specific Commission Information On Its Website. This Suggests That They May Have Adopted A Spread-only Pricing Model, With Transaction Costs Embedded In The Spread And No Separate Commission Charged Per Trade. This Pricing Model Benefits Traders As It Simplifies The Cost Structure And Provides More Transparency Of Trading Fees.

Trading Platform

CBCX Offers Its Clients The Opportunity To Access The MetaTrader 4 (MT4) And MetaTrader 5 (MT5) Platforms. Both Platforms Are Widely Used Throughout The Industry And Offer A Range Of Features Designed To Support Traders' Strategies.

MT4

The MT4 Platform Is A Popular Choice For Forex Traders As It Offers Advanced Charting And Analysis Tools, As Well As An Intuitive User Interface. Traders Can Customize And Save Chart Templates, Set Alerts For Specific Price Levels, And Access A Range Of Technical Indicators. In Addition, The Platform Supports Automated Trading Through The Use Of Expert Advisors, Allowing Traders To Trade Automatically Based On Specific Conditions.

MT5

On The Other Hand, The MT5 Platform Offers More Features And Functionalities Than Its Predecessor. In Addition To The Charting Tools And Technical Indicators Available On MT4, MT5 Offers More Advanced Market Analysis Tools, More Time Frame Options, And Support For Traditional Netting And Hedging Order Accounting Systems. In Addition, MT5 Supports Trading In A Wider Range Of Asset Classes, Including Stocks And Futures, Making It A More Functional Platform.

Client Server

Customers Can Visit Their Office Or Contact The Client Server Department Using The Information Provided Below:

Tel: + 44 (0) 2037288999, + 27 (0) 311000682 (24/7)

Email: Support@cbcx.com, Primeservices@cbcx.com

Physical Address:

20 Victoria St, London, SW1H 0NB, England, UK.

AMR Building 3, 9 Concorde East Road, Bedfordview, 2007, South Africa.

In Addition, Clients Can Also Connect With The Broker Via Social Media, Such As Twitter, Facebook, Instagram, And LinkedIn.

CBCX Offers An Online Messaging Feature Within Its Trading Platform, Allowing Traders To Communicate Directly With Customer Support Or Other Traders. This Feature Provides A Convenient Way To Receive Live Help Or To Have Discussions With Other Traders.

Conclusion

In Conclusion, CBCX Is A Reputable Liquidity Provider Regulated By The FCA, FSCA And FSC, Offering A Diverse Range Of Trading Options And Services To Clients Worldwide. CBCX Provides Easy Access To A Wide Variety Of Markets. The Brokerage Supports Popular Trading Platforms Such As MT4 And MT5, Catering To The Needs Of Traders At All Levels.