Verified: Tokio Marine & Nichido Fire Insurance Co., Ltd. Is One Of The Largest Non-mutual Private Insurance Groups In Japan, A Subsidiary Of Tokyo Marine Holdings, Established In 2004 And Regulated By Japan's Financial Services Agency (FSA).

According To The Company's Official Website Display And Multi-faceted Detailed Inquiry, The Following Is The Specific Introduction:

Historical Development

The Company Was Formed By The Merger Of Tokyo Marine Fire Insurance And Nikko Fire Marine Insurance. Tokyo Marine Insurance Was Established In 1879 And Was The First Marine Insurance Company In Japan. The History Of Nikko Fire Marine Insurance Can Be Traced Back To 1898.

1879: Tokyo Marine Insurance Was Established.

1944: Tokyo Marine Fire Insurance Merged Meiji Fire Insurance And Mitsubishi Marine Fire Insurance.

2004: Tokio Marine & Nichido Merged With Tokio Marine & Nichido To Form Tokio Marine & Nichido Fire Insurance Company.

2008: The Company Experienced A Major Scandal Involving Unpaid Insurance Claims And Overcharged Insurance Premiums, Resulting In A Change In Management Of The Company.

Products & Services

Tokio Marine & Nichido Offers A Wide Range Of Insurance Products And Services Covering The Following Areas:

Property Insurance: Provides Insurance For Residential, Commercial Real Estate And Other Property.

Marine Insurance: Includes Cargo Transportation Insurance And Marine Insurance.

Motor Insurance: Provides Insurance Services For Personal And Commercial Vehicles.

Life Insurance: Provides Life Insurance Products Through Its Subsidiaries.

Liability Insurance: Covers Corporate Liability, Product Liability, And More.

Health Insurance: Provides Individual And Group Health Insurance Plans.

Tools And Technologies

Although Specific Trading Platforms And Instrument Information Are Not Disclosed In Detail, Tokio Marine & Nichido May Use Advanced Insurance Management Systems And Technology Platforms To Support Its Business Operations, Including:

Customer Management System: Used To Manage Customer Relationships And Policy Information.

Threat And Risk Assessment Tools: Used To Assess And Manage Insurance Risks.

Online Service Platform: Provides Online Policy Management And Claims Services.

International Business And Subsidiaries

Tokio Marine & Nichido Has Subsidiaries In Many Countries And Regions Around The World, Including:

China: Tokyo Marine Insurance (Hong Kong), Etc.

Singapore: Tokyo Marine Malaya Insurance Company, Etc.

Thailand: Sri Muang Insurance Co., Ltd., Etc.

United States: Tokio Marine HCC, Philadelphia Insurance Companies, Etc.

Other Regions: Such As Australia, United Arab Emirates, And The United Kingdom.

Tokio Marine & Nichido Fire Insurance Is Known For Its Long History And Global Business Layout, Dedicated To Providing Comprehensive Insurance Solutions To Its Customers. If You Need More Information, You Can Visit Its Official Website Or Contact Its Client Server.

Regulatory Situation

Tokio Marine & Nichido Fire Insurance Co., Ltd. Is An Insurance Company Operating On A Global Scale And Is Therefore Regulated By Multinational Financial Regulators.

Here Is How It Is Regulated In Key Markets:

JapanJapan Financial Services Agency (FSA): As A Japan-based Insurance Company, Tokio Marine & Nichido Is Regulated By The FSA. The FSA Oversees All Financial Institution Groups, Including Banks, Securities Firms And Insurance Companies, To Ensure Compliance And Stability Of Their Operations.

US Market

Subsidiaries Of Tokio Marine Such As Tokio Marine HCC And Philadelphia Insurance Companies Are Regulated By The Insurance Regulators Of The Various States In The United States. Each State Has Its Own Insurance Regulator, Which Oversees The Financial Health, Business Practices And Consumer Protection Of Insurance Companies.

European Market

Tokio Marine Is Regulated By The Financial Conduct Authority (FCA) And The Prudenberg Regulatory Authority (PRA) In The United Kingdom. These Agencies Are Responsible For Ensuring The Integrity Of Financial Marekts And The Safety Of Consumers.

Rest Of Asia

In Other Countries And Regions In Asia, Such As China, Singapore, And Thailand, Tokio Marine's Branches And Subsidiaries Are Regulated By Local Insurance Regulators. These Agencies Are Responsible For Managing And Overseeing The Operation Of The Insurance Market.

Regulatory Compliance

Tokio Marine & Nichido Fire Insurance Must Comply With National And Regional Laws And Regulations, Including Capital Adequacy, Financial Reporting, Risk Management, And Consumer Protection Requirements. The Company Is Committed To Maintaining Its Good Reputation And Market Position Through Compliance Management And Internal Controls.

In Summary, Tokio Marine & Nichido Fire Insurance Ensures That Insurance Operations In Various Markets Comply With Local Laws, Regulations And Regulatory Requirements Through Its Global Compliance Framework. This Multi-layered Regulatory Structure Helps The Company Maintain High Standards Of Operations And Client Server Worldwide.

Contact Information]

To Contact Tokio Marine & Nichido Fire Insurance Co., Ltd., You Can Contact The Following Methods:

Headquarters Contact Information

Address: 1-2-1 Marunouchi, Chiyoda-ku, Tokyo 100-0005, Japan

Tel: + 81-3-6212 -3333

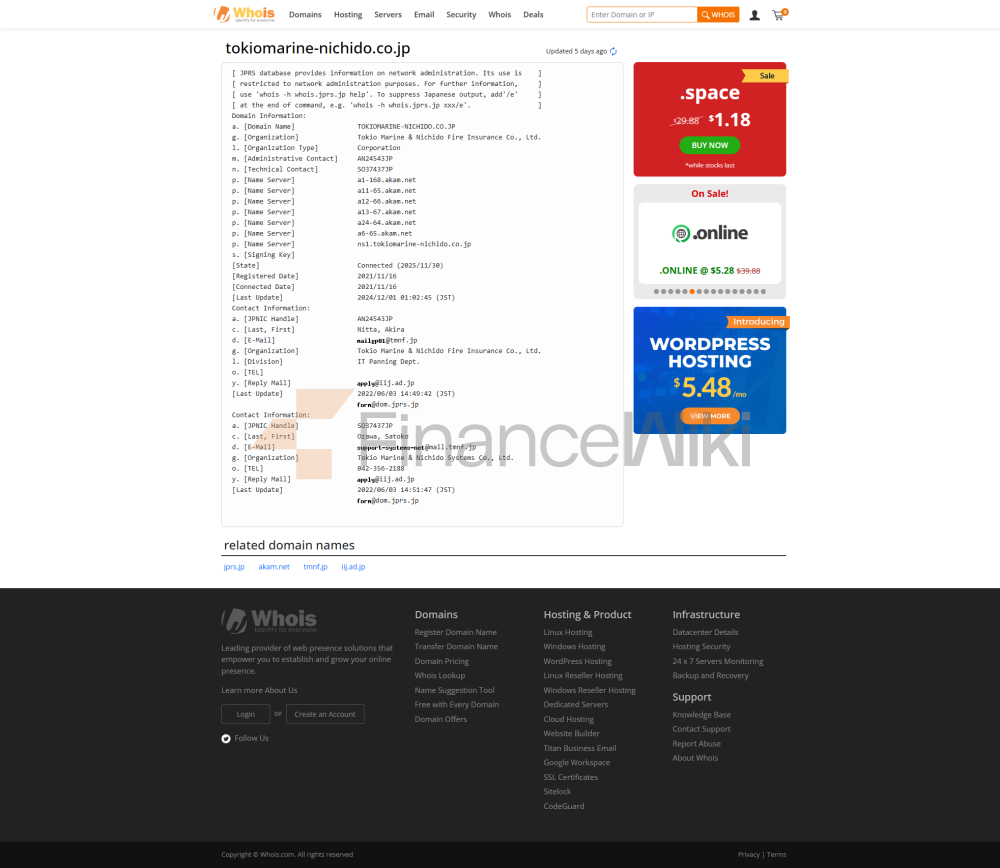

Official Website: Https://www.tokiomarine-nichido.co.jp/