Corporate Profile

IIFL Has Been A Full Suite Of Financial Services Broker In India Since 1995, Offering Clients A Wide Range Of Loan Products Through The IIFL LOANS APP. Backed By An Advanced Technology Platform And A Professional Management Team, The Company Is Committed To Ensuring Resilience And Continuity Of Operations.

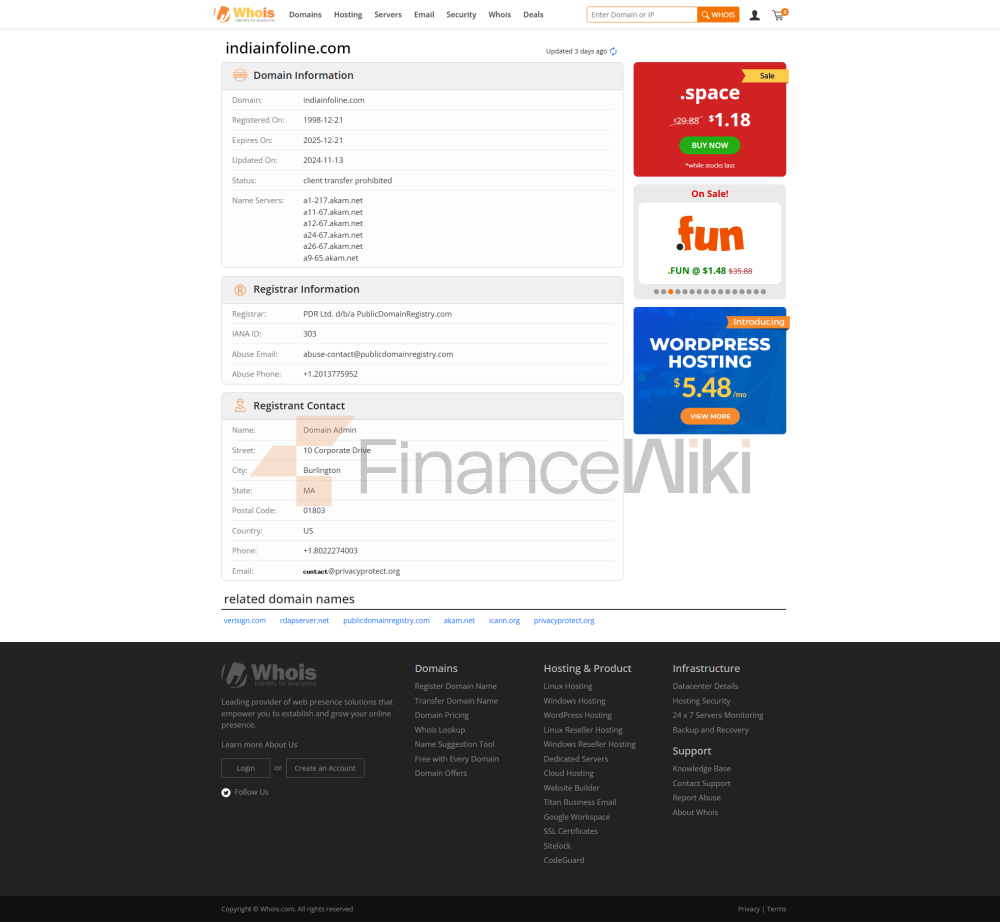

Regulatory Information

IIFL Is Regulated By The Securities And Exchange Board Of India (SEBI) With Regulatory Number INP000002213 . The Company Strictly Complies With Regulatory Requirements To Ensure The Safety Of Client Funds And Transparency Of Transactions.

Trading Products

IIFL Offers The Following Types Of Loan Products:

- Housing Loans

- Gold Loans

- Commercial Loans

- Real Estate Mortgage

- SME Financing

- Microfinance

- Developer And Construction Loans Capital Markets Financing

Trading Software

The Company Provides Convenient Loan Services Through Its Self-developed IIFL LOANS APP . Users Can Perform Account Management, Equal Installment Payment, Account Reconciliation And Inquiry Submission Anytime, Anywhere.

Deposit And Withdrawal Methods

Deposit And Withdrawal Methods Include Bank Transfer, Check And Electronic Payment And Other Methods To Ensure Customer Convenience And Liquidity.

Customer Support

IIFL Provides Comprehensive Customer Support Services, Including:

- Telephone Consultation Contact Number: 1860-267-3000 Or 7039-050-000 Business Hours: Monday To Friday 09:30 Am To 06:00 Pm, Saturday 09:30 Am To 04:00 Pm, Excluding Sundays And Public Holidays.

- Email Select The Corresponding Email Address According To The Loan Type.

- Headquarters Visit Headquartered In N.S. Phadke Marg , Andheri East, Mumbai, Vijay Nagar, Hubtown Solaris, 8th Floor, No. 802, Zip Code: 400 069.

Meanwhile, The Company Has Official Accounts On Social Media Platforms (Facebook, Instagram, Twitter, YouTube) To Provide Customers With Instant Information And Online Support.

Core Business And Services

IIFL's Core Business Focuses On Loan Services, Covering Three Areas Of Home Loans, Gold Loans And Commercial Loans, To Meet The Financing Needs Of Different Customer Groups.

Technical Infrastructure

The Company Adopts An Advanced Technology Platform Combined With The AIoT (AIoT) Risk Control System To Monitor And Manage Loan Risks In Real Time To Ensure The Safety And Efficiency Of Transactions.

Compliance And Risk Control System

IIFL Strictly Complies With The Regulatory Regulations Of The Securities And Exchange Board Of India (SEBI), Implements Strict Internal Control System And Risk Management System To Ensure The Safety Of Customer Funds And Transaction Transparency.

Market Positioning And Competitive Advantage

As A Leading Financial Services Provider In India, IIFL Has Established A Unique Advantage In The Market With Its Diverse Product Line, Convenient Trading Software, And Comprehensive Customer Support.

Customer Support And Empowerment

IIFL Helps Clients Make Informed Financial Decisions By Providing Multi-channel Support And Rich Educational Resources. Educational Resources Include Loan Calculators, Blogs, And News Feeds To Help Clients Gain A Comprehensive Understanding Of Their Loan Options.

Social Responsibility And ESG

IIFL Actively Participates In Social Welfare Activities, Supports The Development Of SMEs And Community Building, And Practices Corporate Social Responsibility. The Company Continues To Make Efforts In Environmental Protection, Social Responsibility And Corporate Governance (ESG) To Promote Sustainable Development.

Strategic Cooperation Ecology

IIFL Has Established Close Strategic Partnerships With A Number Of Industry Associations And Financial Institution Groups To Jointly Develop Innovative Products And Services And Enhance Market Competitiveness.

Financial Health

As Of 2023Q3 , The Company's Management Scale Exceeded $10 Billion , Demonstrating Its Solid Financial Position And Market Recognition.

Future Roadmap

IIFL Plans To Further Expand Its Product Line, Introduce More Innovative Financial Services, And Deepen Its Relationship With Technology Partners To Enhance The Client Server Experience In The Next Three Years.

Through The Above, IIFL Has Demonstrated To Its Customers Its Comprehensive Financial Services Capabilities, Robust Compliance System And Strong Market Competitiveness, Laying A Solid Foundation For Its Continued Development In The Indian Financial Services Market.