General Information And Regulations

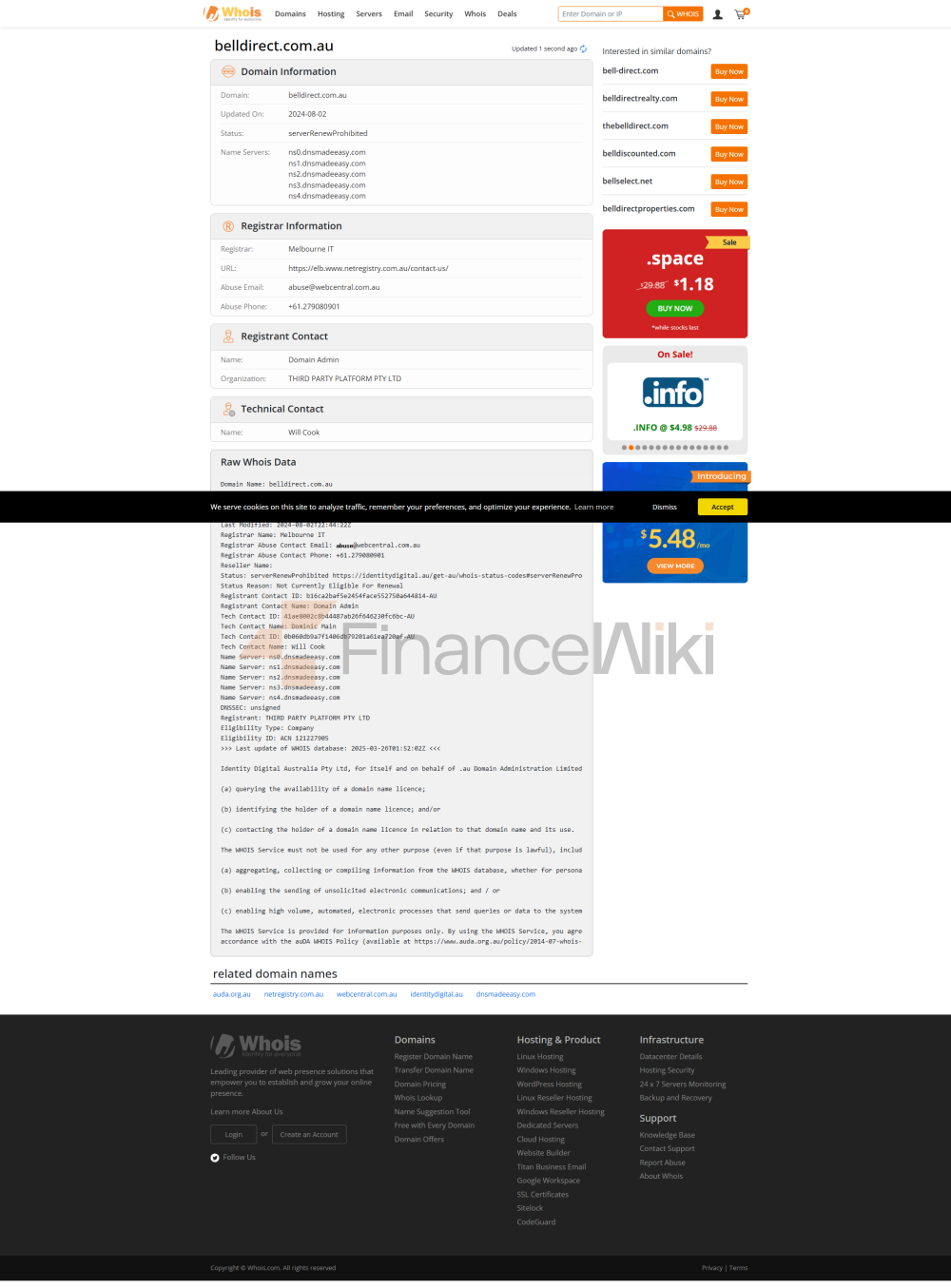

Bell Direct Is An Australian Registered Brokerage Company Whose Services Are Provided By "third Party Platform Pty Limited", Which Holds An Australian Asic Investment Advisory License (license Number 314341).

Market Instruments

Investors Can Trade ASX Shares, Exchange Traded Funds, Warrants, Interest Rate Securities, Options, Xtb (exchange Traded Bond Units), Ipos, Margin Loans, Exchange Traded Bonds On The Bell Direct Platform.

Bell Direct Fees

Bell Direct Has A Staggered Brokerage Fee Of $15 Per Transaction For The First 10 Transactions Per Month, Up To A Maximum Of $10,000, $25/transaction For Transactions Between $10,000 And $25,000, And 0.1% For Transactions Over $25,000. For Transactions Between The 11th And 30th Of The Month, A Fee Of $13 Or 0.08% (whichever Is Higher) Will Be Charged Per Transaction. A Fee Of $10 Or 0.08% (whichever Is Higher) Will Be Charged Per Transaction Beginning With The 31st Of The Month. Traders Pay $60 Or 0.2% (whichever Is Higher) For Stocks, Warrants And Funds When Trading Over The Phone.

Trading Platform Available

Bell Direct Offers Investors A Mobile Trading Platform Where Traders Can Access Accounts To Get Stock Quotes, Track Portfolios And View The Latest Research. Bell Direct's Mobile Trading Platform Is Available On Iphone And Android. It Is Web-based And Requires No Download Or Installation.

Deposits And Withdrawals

Bell Direct Supports Traders To Make Deposits And Withdrawals Via Bpay And Electronic Transfers. When A Trader Provides A Transfer Request Before 2:30 PM EST On A Business Day, The Transfer Will Be Processed The Same Day And The Funds Will Be Deposited Into The Investor's Account The Following Business Day.