Access Bank Plc, Commonly Known As Access Bank, Is A Nigerian Multinational Commercial Bank Affiliated With Access Bank Group. It Is Licensed By The Central Bank Of Nigeria, The National Banking Regulator.

Originally A Corporate Bank, They Expanded Into Personal And Commercial Banking In 2012. Access Bank And Diamond Bank Merged On April 1, 2019. Following Its Merger With Diamond Bank, Access Bank Unveiled Its New Logo, Marking The Start Of A New Expanded Banking Entity. The Bank Has Over 28,000 Employees In 2021.

After The Merger, Access Bank Has More Than 42 Million Customers, Making It The Bank With The Largest Customer Base In Africa And The Largest Bank By Assets In Nigeria.

Access Bank Group

Main Entry: Access Bank Group

As Of September 2021, Access Bank Plc Has Subsidiaries In Mozambique, Zambia, Congo, Sierra Leone, Rwanda, Gambia, Ghana, Kenya, South Africa And The United Kingdom, In Addition To Nigeria. Access Bank Group Also Has Representative Offices In China, India, Lebanon And The United Arab Emirates.

Africa Expansion

In Early 2021, Access Bank Announced That It Has Identified Eight New African Countries For Potential Expansion, Seeking To Benefit From Free Trade Agreements Across The Continent. Target Markets Are Morocco, Algeria, Egypt, Côte D'Ivoire, Senegal, Angola, Namibia And Ethiopia, Which Will Expand The Bank's International Reach To 18 Countries. Access Bank Is Expected To Establish Offices In Some Countries And Partner With Existing Banks In Others, As Well As Leverage Its Digital Platform To Serve Clients.

Expansion In France And Europe

In July 2021, The French Government Expressed Its Willingness To Strengthen Ties With Nigerian Industrial Leaders, Including Access Bank Group Managing Director Herbert Wigwe, And Announced That An Agreement Had Been Signed To Allow The Group To Settle In France. The Agreement Confirms The Group's Vision And Desire To Extend Its Influence And Activities Throughout France And Gradually Across Europe.

The Opening Of Access Bank In Paris Will Be Managed By The Group's London Branch, Which Is Headed By Jamie Simmonds Of The United Kingdom. The New Office Set Up In France Will Focus On Trade Finance. The Nigerian Bank Is Also Considering Launching Investment And Wealth Management Services.

Access Bank Plc Is A Large Financial Services Provider. In June 2021, The Bank Had An Asset Base Of Over $25.5 Billion (NGN: 10,055 Trillion) And The Value Of Shareholders' Equity Was Approximately $1.87 Billion (NGN: 775 Billion). (Note That On November 1, 2021 It Was $1.00 = 413 Nigerian Naira.

Customers Of Access Bank Plc Withdraw Money In Nigeria.

History

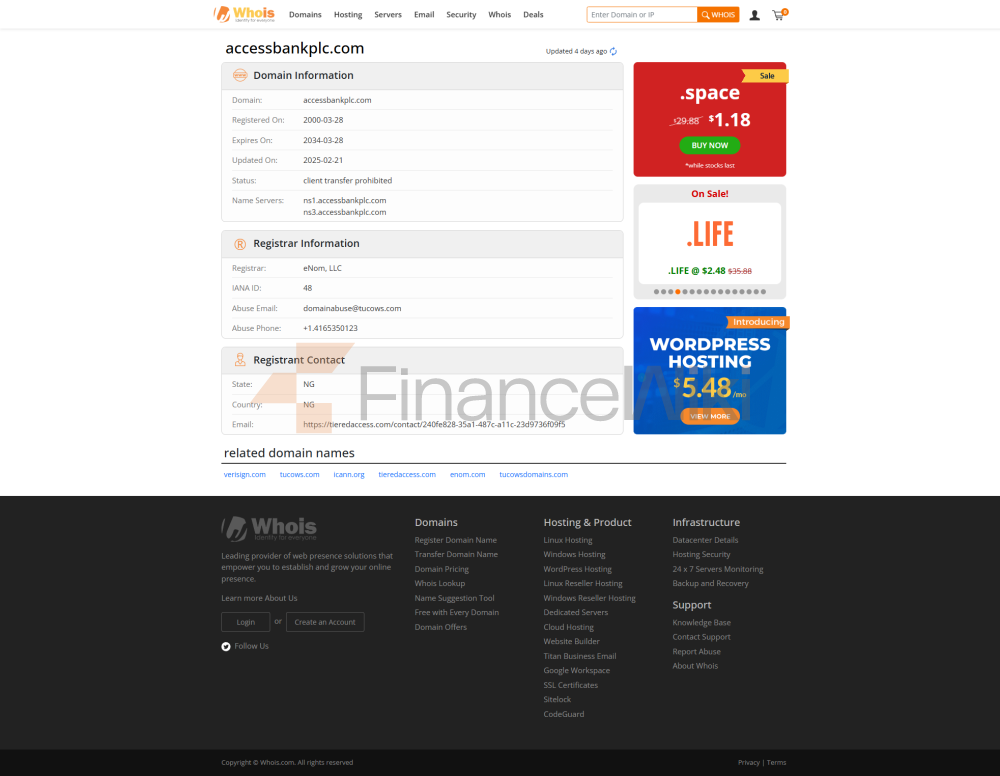

The Bank Was Licensed By The Central Bank Of Nigeria In 1989 And Listed On The Nigerian Stock Exchange In 1998.

- 2002: Access Bank Was Taken Over By A New Core Of Management Led By Aigboje Aig-Imoukhuede And Herbert Wigwe.

- 2005: Access Bank Acquired Marina Bank And Capital Bank (formerly Credit Lyon Bank Nigeria) Through A Merger.

- 2007: Access Bank Established A Subsidiary In Banjul, Gambia. The Bank Now Has A Head Office And Four Branches, And The Bank Has Committed To Opening Four More Branches.

- 2008: Access Bank Acquired An 88% Stake In Omnifinance Bank, Founded In 1996. It Also Acquired A 90% Stake In Congo Private Bank, Founded In 2002 By South African Investors. Access Bank Acquired A 75% Stake In Bancor SA In Rwanda. Bancor Was Founded In 1995 And Restructured In 2001. In September, Access Bank Opened A Subsidiary In Freetown, Sierra Leone, And In October, The Bank Opened Subsidiaries In Lusaka, Zambia, And London, United Kingdom.

- 2008: Finbank (Burundi) Joined The Access Bank Network, But Exited The Group In 2014.

- 2011: Access Bank Entered Into Talks With The Central Bank Of Nigeria To Acquire Intercontinental Bank Limited.

- Intercontinental Bank Became A Subsidiary Of Access Bank Plc, Which Recapitalized The Former And Acquired A Majority Stake Of 75% Of Its Shares.

- The Combined Effect Of AMCON's Restoration Of Net Asset Value (NAV) To Zero And Access Bank Plc's Injection Of 50 Billion Naira Is That Intercontinental Bank Is Now A Well-capitalized Bank With 50 Billion Naira In Shareholder Capital And A Capital Adequacy Ratio (CAR) Of 24%, Well Above The 10% Regulatory Threshold.

January 2012: Access Bank Announces Completion Of Acquisition Of Former Intercontinental Bank, Creating The Expanded Access Bank, One Of The Four Largest Commercial Banks In Nigeria With Over 5.70 Million Customers, 309 Branches And Over 1,600 Automated Teller Machines (ATMs).

- 2012: The High Court In London Sued Erastus Akingbola, Former Managing Director Of Intercontinental Bank, For Returning More Than $1 Billion To Access Bank.

- 2018: In December 2018, Access Bank Plc Acquired Diamond Bank, And The Diamond Bank Board Announced That The Merger With Access Bank Plc Is Expected To Be Completed In The First Half Of 2019.

- 2020: Access Bank Acquired A Multinational Bank In Kenya, Including 100% Equity And 28 Branches Across Kenya.

- 2020: In October, Access Bank Received Regulatory Approval To Form Access Bank Mozambique. In Addition, It Also Announced Plans To Transform The Group Into A Holding Company And Enter South Africa.