basic information

of the bankState-owned, joint venture or commercial bank: Saitama Resona Bank is a metropolitan bank in Japan, which is a joint venture commercial bank, wholly owned by Resona Holdings, and not independently listed.

Name & Background:

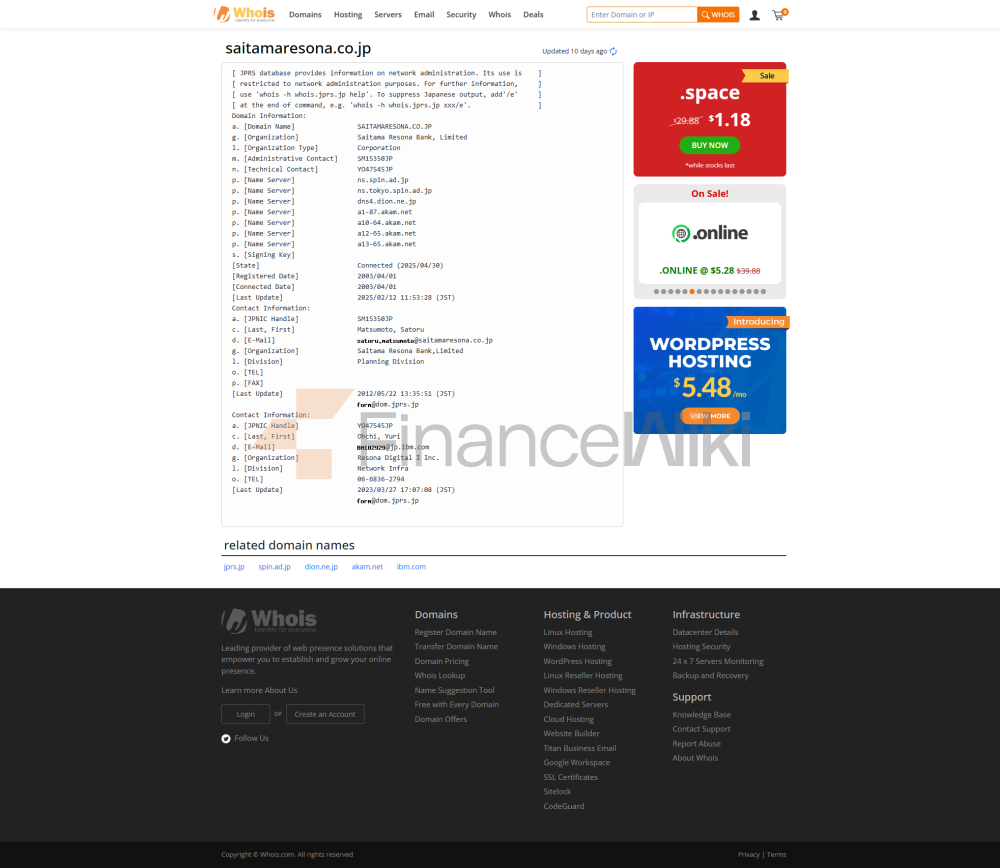

full name: Saitama Resona Bank, Limited, Co., Ltd.

Founded: August 27, 2002, by the merger of the former Saitama Bank and the Rising Sun Bank.

Headquarters location: No. 1, Tokiwa 7-chome, Urawa District, Saitama City, Saitama Prefecture, Japan.

Shareholder background: The parent company is Resona Holdings, which has received capital injections from the Japanese government, but Saitama Risona Bank itself is financially sound and has a low non-performing debt rate.

Scope of Services:

Coverage area: The main business is concentrated in Saitama Prefecture, with the largest market share of deposits and loans in the prefecture, and a small number of branches in Tokyo and Gunma Prefecture.

Offline outlets: 132 manned stores, 127 of which are located in Saitama Prefecture.

ATM distribution: It is widely distributed in government offices and business districts in Saitama Prefecture, and supports the sharing of deposit and withdrawal services with Risona Bank ATMs.

Regulation & Compliance:

Regulator: Regulated by the Kanto Finance Bureau under the Financial Services Agency (FSA) of Japan, which is different from the direct financial agency of other metropolitan banks.

Deposit Insurance: Participation in the Japan Deposit Insurance System, with a maximum coverage of 10 million yen per depositor.

Recent compliance record: No major violations made public, affected by the nationalization of the Risona Group in 2003, but the bank's own asset quality is good.

key indicators

of financial health:capital adequacy ratio: no specific data disclosed, However, the overall capital adequacy ratio of the Resona Group is stable, with an average capital adequacy ratio of 15.74% in the banking sector in 2024.

Non-performing loan ratio: Historically, it has outperformed its peers, with the 2018 financial report showing solid asset quality, with the average NPL ratio of the Japanese banking sector of about 1.5% in recent years.

Liquidity Coverage Ratio: In line with Japanese regulatory requirements, the liquidity indicators of the Risona Group remained stable.

Deposit & Loan

ProductsDeposit class:

Current/Term Rate: No specific data disclosed, However, in the Japanese market, fixed deposit rates are generally lower (0.15%-0.7%), and some savings insurance plans offer higher returns.

Featured products: Preferential housing loans for Saitama residents and support foreign currency savings (e.g., USD, RMB).

Loans:

Mortgages: Partnered with Fujitsu to launch a digital home purchase service to support couples to make decisions and match preferences, with undisclosed interest rates and thresholds.

Car Loans/Line of Credit: Focusing on local SMEs and personal financing, the product line includes flexible repayment options.

list of common expenses

account management fee: not disclosed, but the Bank of Japan generally waives the monthly fee for the basic account.

Transfer fee: Domestic transfers are usually charged, and inter-bank ATM withdrawals may incur third-party fees.

Hidden fees: Some loan products may have a prepayment penalty, so please read the terms carefully.

Digital Service Experience

APP & Online Banking:

- User

rating: undisclosed, However, Fujitsu has helped develop a decision-making tool for home purchases, which has been well received.

Core functions: Support online mortgage application and bill management, and AI customer service or robo-advisors have not yet been widely used.

customer service quality

service channels: telephone and offline branch support available, limited multi-language service (Japanese only).

Complaint handling: No publicly available data, but as a leading local bank, customer satisfaction is high.

security measures

security of funds: protected by Japan deposit insurance, using a standard anti-fraud system.

Data security: The certification information is not publicly available, but the parent company, Resona Group, complies with the data specifications of the financial industry.

Featured Services & Differentiation

- market

segment: Launched "Saitama Risona TODAY" local information magazine to strengthen community ties.

High Net Worth Services: There is no independent private bank, but it provides customized SME financing.

market position and honors

industry ranking: Saitama Prefecture has the largest share of deposits and loans, and the national ranking has not entered the Top 50.

Awards: Recent awards are not disclosed, but in 2004 the headquarters building was awarded the BCS Award (Architectural Award).