Corporate Profile

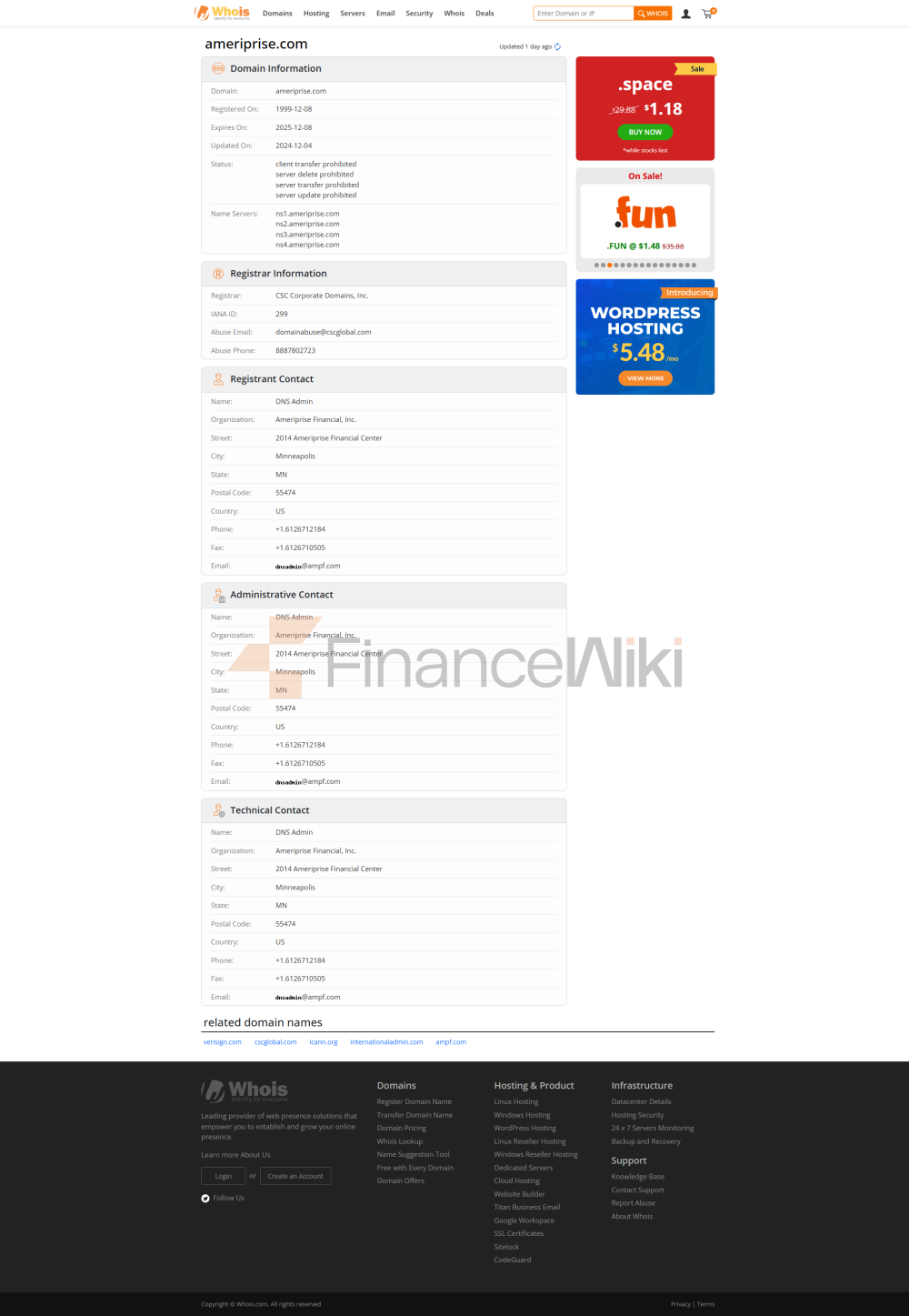

Ameriprise Financial, Inc. Ameriprise Financial, Inc., Is A Diversified Financial Services Company And Bank Holding Company Headquartered In Minneapolis, Minnesota, USA, And Incorporated In Delaware. It Provides Financial Planning Products And Services, Including Wealth Management, Asset Management, Insurance, Annuities, And Estate Planning

.History Ameriprise Financial, Inc., Formerly The Financial Advisory Division Of American Express, Was Spun Off As An Independent Company In September 2005. As Of April 2022, More Than 80% Of The Company's Revenue Comes From Wealth Management. According To The 2022 Fortune 500 Rankings, Mitsu Financial Is Ranked 245th. It Is The Ninth Largest Independent Broker-dealer By Assets Under Management And One Of The 25 Largest Asset Managers In The World. It Is Ranked 8th In US Long-term Mutual Fund Assets, 4th In UK Retail Funds And 27th In Global Assets Under Management.

Basic Information - Full Name Of The Company: Ameriprise Financial Joint Stock Company - Established: September 2005 - Headquarters Location: Minneapolis, Minnesota, USA - Registered Capital: Undisclosed - Regulatory License: National Futures Association (NFA) Regulation, License Number 0558308 - Executive Background: Undisclosed - Advisory Team: Undisclosed - Industry Association Members: Undisclosed - Compliance Statement: The Company Operates In Strict Accordance With The Requirements Of The US Financial Regulators To Ensure That All Business Activities Comply With Laws And Regulations - Corporate Structure: Adopts A Diversified Financial Service Structure, Covering Multiple Business Areas Such As Wealth Management, Asset Management, Insurance, Etc. - Equity Structure: Undisclosed

Core Business The Core Business Of Metone Financial Covers The Following Areas: 1. Wealth Management: Provide Customized Wealth Management Services For High Net Worth Individuals And Institutions, Including Asset Allocation, Portfolio Management And Risk Control 2. Asset Management: Manage A Diverse Portfolio Of Assets, Including Stocks, Bonds, Funds And Other Financial Products 3. Insurance And Annuities: Provide Life Insurance, Health Insurance And Annuity Products To Help Clients Achieve Long-term Financial Goals 4. Estate Planning: Assisting Clients In Planning And Managing Their Estates To Ensure A Smooth Succession Of Assets

Technical Infrastructure - Trading Software: Offline Mode, Real-time Data Access, Advanced Mapping Tools And More Than 30 Market Analysis Indicators Are Supported With Trading Applications IOS And Android Devices - Operating System: A Stable And Reliable Operating System Is Adopted To Ensure The Smooth Operation Of The Trading Process - Data Security: Protect Customer Data From Unauthorized Access Through Encryption Technology And Other Security Measures

Compliance And Risk Control System Metronome Financial Has Established A Strict Compliance And Risk Control System, Including: 1. Compliance Statement: The Company Strictly Complies With The Laws And Regulations Of The US Financial Regulators To Ensure That All Business Activities Are Legal Compliance 2. Risk Control Team: Composed Of Professional Risk Managers, Responsible For Monitoring And Managing Various Financial Risks 3. Risk Management Tools: Adopt Advanced Risk Management Tools And Technologies To Monitor Market Fluctuations And Latent Risks In Real Time 4. Compliance Audits: Conduct Regular Internal And External Audits To Ensure The Effectiveness Of The Risk Control System

Market Positioning And Competitive Advantage - Market Positioning: As A Diversified Financial Services Company, Metone Financial Mainly Serves High Net Worth Individuals And Institutional Clients - Competitive Advantage: 1. Diversified Business: Covering Multiple Fields Such As Wealth Management, Asset Management, Insurance, Etc., To Provide Customers With Comprehensive Financial Services 2. Professional Team: Have An Experienced Financial Services Team That Can Provide Customers With Personalized Solutions 3. Technological Innovation: Enhance Customer Trading Experience And Fund Safety Through Advanced Trading Technology And Risk Control System

Customer Support And Empower - Customer Support: Provide 24/7 Customer Support Services, Including Telephone, Online Chat And Other Methods - Educational Resources: Provide A Wealth Of Investment Education Tools And Resources To Help Customers Improve Their Financial Knowledge And Investment Skills - Account Management: Provide Professional Account Management And Investment Advice To Customers To Ensure The Optimal Allocation Of Assets

Social Responsibility And ESG Metronome Financial Actively Fulfills Social Responsibility, Pays Attention To The Performance Of Environmental, Social And Corporate Governance, And Is Committed To Promoting Social Progress And Environmental Protection Through Sustainable Investment And Financial Services

>Development Strategy And Future Roadmap 1. Business Expansion: Plans To Further Expand Its Business Presence In Asian And European Markets And Enhance Its Global Influence 2. Technological Innovation: Continuously Invest In Fintech To Improve Transaction Efficiency And Customer Experience 3. Client Server: Further Optimize Client Server And Launch More Personalized Financial Services 4. Sustainable Development: Strengthen Investment In ESG To Promote Sustainable Development Of The Company And Society