A General Understanding Of Trading 212

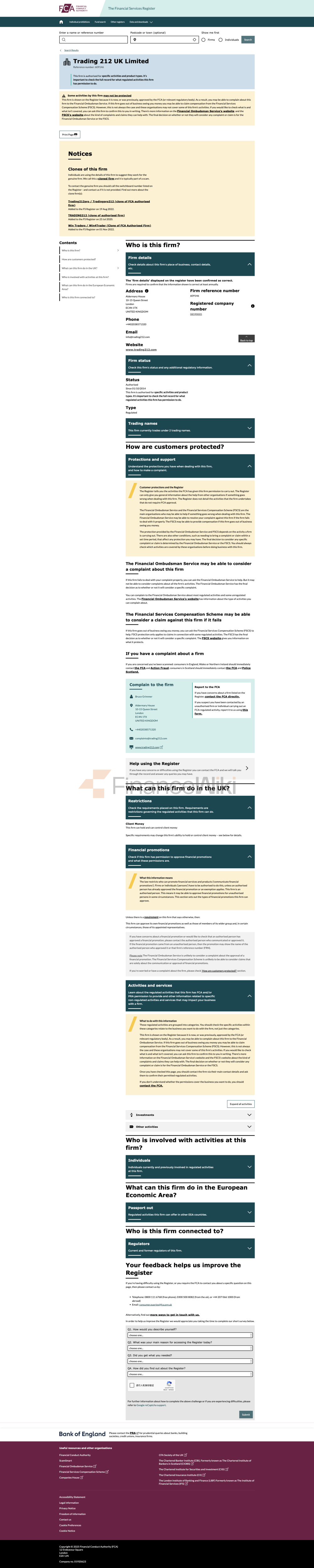

Trading 212 Is A UK-based Forex Broker That Offers A Wide Range Of Financial Instruments For Trading, Including Forex Currencies, Indices, Commodities, Stocks And Cryptocurrencies. The Company Is Regulated By The Financial Conduct Authority (FCA) And The Cyprus Securities And Exchange Commission (CSI), Providing Additional Security For Its Clients.

Traders Can Enjoy Trading From As Low As 1 Dollar/R16 And Up To 1:300. Minimum Spreads From, EUR/USD 1.2 Pips Ensure Competitive Prices For Traders. Trading 212 Offers Clients Advanced Trading Tools And Features Through A Proprietary Trading Platform And Web-based Versions, Both Of Which Provide Traders With A Demo Account To Practice Their Strategies Before Investing In Real Money. In Terms Of Payment Methods, Trading 212 Offers A Variety Of Options, Including, Credit Cards, Debit Cards, Skrill, Dotpay, Giropay, Carte Bleue, Direct E-banking, And Bank Telegraphic Transfer.

These Multiple Payment Options Provide Traders With Flexibility And Convenience In Managing Their Trading Accounts. Finally, Trading 212 Offers 7/24 Customer Support Through Multiple Channels, Ensuring That Clients Are Able To Ask For Help And Receive Timely Assistance When They Need It. Comprehensive, Trading 212 Is A Reputable And Regulated Trading Platform That Offers Clients A Diverse Range Of Financial Instruments And Advanced Trading Tools.

Pros And Cons

Trading 212, An Online Trading Platform, Has Both Pros And Cons. On The Positive Side, The Company Is Regulated By Well-known Financial Institution Groups Such As The Financial Conduct Authority (FCA) And The Cyprus Securities And Exchange Commission (cysec), Ensuring A Certain Level Of Trust And Security For Users. In Addition, Trading 212 Offers Demo Accounts That Allow Users To Practice Trading Without Risking Real Money. They Also Offer 24/7 Customer Support, Ensuring That Help Is Always Available.

However, There Are Some Limitations To Consider. Trading 212 Has A Limited Product Portfolio, Which May Limit The Diversity Of Investment Options Available To Users. In Addition, The Platform Does Not Allow Scalp Trading (a Trading Strategy) Or The Use Of Expert Advisors (EAs), Which May Disappoint Users Who Prefer These Technologies. In Addition, Trading 212 Charges An Inactivity Fee, Which Means That If A User's Account Is Left Inactive For An Extended Period Of Time, A Fee May Be Incurred. Finally, While They Offer A Zero Commission Trading Environment, Their Research Options Are Limited.

Market Tools

Tradable Financial Instruments That Can Be Traded Online Trading 212 Includes, Currency Pairs, Commodities, Stocks And Indices.

Inventory: Trading 212 Offers The Opportunity To Trade A Wide Range Of Stocks, Allowing Users To Take Long And Short Positions. This Includes Popular And Well-known Stocks Such As Tesla, Stop Game And Amc, Providing Users With Ample Investment Options.

Indices: Users Can Also Trade On Various Global Indices By Trading 212. This Includes Well-known Indices Such As The Standard & Poor's 500, Dow Jones And FTSE 100, Enabling Users To Participate In The Performance Of Major Stock Market Indices.

Commodities: Trading 212 Provides A Commodities Trading Channel That Allows Users To Invest In Precious Metals, Oil And Niche Agricultural Products. This Diverse Range Of Commodities Includes Assets Such As Gold, Silver, Oil, As Well As Unique Options Such As Timber And Cattle.

Forex: With Over 180 Currency Pairs Available For Trading, Users Can Participate In The Forex Market Trading 212 In The Following Ways. The Platform Offers 24/5 Trading Hours, Enabling Users To Participate In Currency Trading 24/7, Providing Forex Traders With The Opportunity To Take Full Advantage Of Global Market Movements.

Account Types

Trading 212 Offers Investors Three Different Investment Options On Its Platform, Including Trading 212 Investment Account, Trading 212 Is An Account, And Trading 212 CFD Account. However, It Is Important To Note That Each Account Type Has Its Own Unique Features And Advantages That Cater To Different Trading Styles And Preferences. Investors Are Advised To Thoroughly Research And Understand The Details Of Each Account Type Before Deciding Which Account To Choose.

How Do I Open An Account?

Opening An Account Trading 212 Is A Simple Process That Can Be Completed In A Few Simple Steps:

1. Visit The Trading 212 Website And Click On The "Open Account" Button.

2. Fill In The Required Personal Information Such As Your Name, Email Address And Date Of Birth.

3. Verify Your Identity By Providing A Copy Of Your Passport Or Other Acceptable Identification Document.

4. Once Your Account Has Been Verified, Please Inject A Minimum Deposit Of $1/R16 Into Your Account. Choose Your Preferred Payment Method, Such As Credit Card, Debit Card, Skrill Or Bank Telegraphic Transfer.

5. After Funding Your Account, You Can Start Trading By Selecting The Financial Instrument You Want To Trade And Through The Trading 212 Platform.

6. If You Encounter Any Problems Or Need Assistance During The Account Opening Process, Trading 212 Provides 24/7 Customer Support Via Various Communication Channels Such As Phone, Email, Live Chat Or Web Forms.

Demo Account

Trading 212 Offers Traders, Especially Novice Traders, Access To Demo Accounts. These Accounts Can Be Used In A Number Of Ways. It Is Considered A Practice Account For Beginners Who Wish To Improve Their Trading Skills And Experience In A Risk-free Environment Using Virtual Funds.

Demo Accounts Are Also Beneficial For Traders Who Wish To Test Their Trading Strategies In A Simulated Real Trading Environment Without Risking Their Money.

Minimum Deposit

One Of The Most Attractive Features Of These Accounts Is That They All Require A Minimum Initial Deposit Of $1, Which Makes It Easy For Most Average Traders To Get Started.

Leverage

Trading 212 Offers Different Maximum Leverage Ratios For Different Trading Instruments. For Retail Traders, The Maximum Leverage Is Set At 1:30. The Leverage Ratios Provided By Trading 212 Are Described Below:

1. Major Currency Pairs: Retail Traders Can Get A Maximum Leverage Of 1:30 When Trading Major Currency Pairs. This Leverage Allows Traders To Control Larger Positions With Less Money.

2. Secondary Currency Pairs: Trading 212 Offers A Maximum Leverage Of 1:20 When Trading Minor Currency Pairs. This Slightly Lower Leverage Still Offers Traders The Potential To Expand Their Trading Positions.

3. Gold: Retail Traders Can Use A Maximum Leverage Of 1:20 When Trading Gold. This Leverage Ratio Allows Traders To Speculate On The Price Movement Of Gold By Increasing Their Exposure.

4. Other Commodities: For Trading Other Commodities, Trading 212 Grants A Maximum Leverage Of 1:10. This Leverage Ratio Applies To Commodities Other Than Gold And Provides Traders With The Opportunity To Participate In The Commodity Market.

5. Stock CFDs: When Trading Stock CFDs (Contracts For Difference), Retail Traders Can Use A Maximum Leverage Of 1:5. The Lower Leverage Ratio Of Stock CFDs Reflects The Higher Latent Risk Associated With Trading Individual Stocks.

6. Index CFDs: Major Index CFDs Have A Maximum Leverage Of 1:20, Providing Traders With Access To A Wider Range Of Market Indices. Secondary Index CFDs Can Be Traded With A Maximum Leverage Of 1:10.

These Leverage Ratios Are Subject To Change By Trading 212 And May Vary Depending On Regulatory Requirements And Market Conditions. When Using Leverage In Trading Activities, Traders Must Carefully Consider The Risks Involved And Manage Their Positions Accordingly.

Spreads And Commissions

Trading 212 EUR/USD Spreads Start From 1.2 Pips. This Broker Does Not Charge Any Commission For Trade Execution, But Collects Brokerage Fees From His Spreads.

Trading Platform

Trading 212 Offers Investors Not The Most Popular Mt4/mt5 Trading Platform, But A Mobile App That Can Be Downloaded From The App Store Or Google Play.

Deposit And Withdrawal

Trading 212 Supports Traders To Deposit And Withdraw Funds To Their Investment Accounts Through Various Payment Methods, Such As Visa/mastercard/maestro Credit/debit Card, Paypal, Skrill, Telegraphic Transfer. It Is Possible To Deposit For Free By Bank Transfer, While Deposits Made By Card, Google Pay, Apple Pay And Other Methods Up To A Cumulative Amount Of €2000/$2000 Are Free. For A Cumulative Amount Over €2000/$2000, A 0.7% Fee Will Be Charged. On The Other Hand, Withdrawals On The Platform, Are Free, Providing Customers With A Worry-free Withdrawal Experience. Be Sure To Note That Payment Processing Times May Vary Depending On The Chosen Payment Method And Where The Individual Is Located.

Educational Resources

Trading 212 Has A Wide Variety Of Educational Videos, With More Than 170 On Its YouTube Channel. However, Detailed Articles And Advanced Material Are Limited To The Help Center, And There Are No Archived Webinars.

Educational At Trading 212 Consists Primarily Of Videos, Many Of Which Are Embedded In Its Web And Mobile Platforms. Trading 212 Does Not Offer Educational Articles, Except For Some Posts In Its Community Forums And FAQs In Its Help Section.

CUSTOMER SUPPORT

For Help Or Support, Traders Trading 212 Can Choose From A Variety Of Channels, Including Phone Calls, Emails Or Filling Out Web Forms Available On The Platform's Website. In Addition, Traders Can Also Use The Live Chat Feature To Get In Touch With A Customer Support Representative. While Support Hours Are Not Explicitly Mentioned, It Can Be Assumed That Normal Working Hours Are In Place. Regardless, Multi-channel Customer Support Ensures That Traders Can Ask For Help And Get It In A Timely Manner When Needed.