Since Its Establishment In 1988 Through The Acquisition Of An Established Canadian Bank, The Bahamas Bank Limited's Assets Have Grown From $90 Million To More Than $900 Million As Of June 30, 2021; From Three Locations To 12; From Serving Two Islands To Serving Eight; And From Providing The Most Basic Retail Banking Services To The Most Comprehensive Range Of Financial Products. Total Equity Surged From $19 Million In 2000 To $158.50 Million As Of June 30, 2021. The Bahamas Bank Limited Was Incorporated In The Commonwealth Of The Bahamas On April 17 And In 1970 The Bank Of Montreal (Bahamas And Caribbean) Limited Was Established. In 1983 It Was Renamed The Bahamas Bank Of Montreal Limited. Five Years Later In September 1988, The Government, The Bahamas Formed A Joint Venture With The European Bank Of Canada Limited And Purchased 100% Of The Company's Shares. Shares In The Bahamas Bank Of Montreal Limited And Renamed It 51% Controlling Stake In The Bahamas Bank Limited. In The Second Half Of 1990, The Government Purchased All Of The Shares Held In Euros And The Bank Of Canada Limited Issued An Additional 7,000,000 Shares, Bringing The Total To, Issued To 10,000,000 Shares. In September 1994, The Government Sold 20% Of The Shares, Holding 2,000,000 Shares To The Bahamian Public. In October 1995, The Government, Issued An Additional 3,000,000 Shares Of The Bank To The Bahamian Public. Both Products, Significantly Oversubscribed. In 2005, The Bank Conducted A $25 Oversubscribed Rights Issue And In 2006, A Million And Subsequent $15 Million Private Placement Preference Share Issue. Later Named BOB, Solution Bank, Bank Of The Bahamas Became, Pioneering Local Retail Banking First: Pioneered VISA Gift Cards And Prepaid Cards, The First Local Bank To Have Full Online Banking Services, And The First To Offer Email And, SMS Alerts To Notify Customers Of Deposits, Withdrawals, Loan Payments Or Other Activities To Their Accounts. Its ATMS Became The First In The Bahamas To Offer, A Number Of Features, Including Braille Instructions And Non-envelope Deposit Capability, Cash Deposits With Immediate Value. Although Relatively Young, The Bank Of The Bahamas Has Grown Through Acquisitions, Including Assets, Of The Mortgage Portfolios Of Workers Bank Limited (2001) And Citibank (2007). In September 2016, The Bank's $40,000,000 Rights Issue Was Fully Subscribed And Acquired In December. In The Same Year, The Bank Issued $30,000,000 In Perpetuity At A Fixed Rate Of 3.125%. Contingent Convertible Bonds ("Convertible Bonds") Are Only Available To Accredited Investors. This Private Placement, Issued In Three Tranches Of $10,000,000 Each. The Subscribers For The First Tranche Of The Bonds Were, And Issued To The Government As Of December 31, 2016. The Offering Closed On February 28, 2017, And As Of June 30, 2017, The Bonds Were Converted Into 6,756,756 Ordinary Shares With Voting Rights. As Of June 30, 2021, The Bank's Total Assets Were $903 Million And Total Equity Was $158.50 Million

Active

Bank of The Bahamas Limited

Official Certification Bahamas

Bahamas20 Year

Official Website

Updated On 2025-04-10 12:00:10

Current Enterprise Rating

5.00

Industry Rating

Basic Information

Full Name Of The Enterprise

Bank of The Bahamas Limited

Country

Bahamas

Enterprise Classification

Registration Time

1988

Business Status

Active

Regulatory Information

Enterprise Evaluation/Exposure

Write Comments/Exposure

5.00

0Evaluate/

0Exposure

Write Comments/Exposure

Bank of The Bahamas Limited Enterprise Introduction

Bank of The Bahamas Limited Enterprise Security

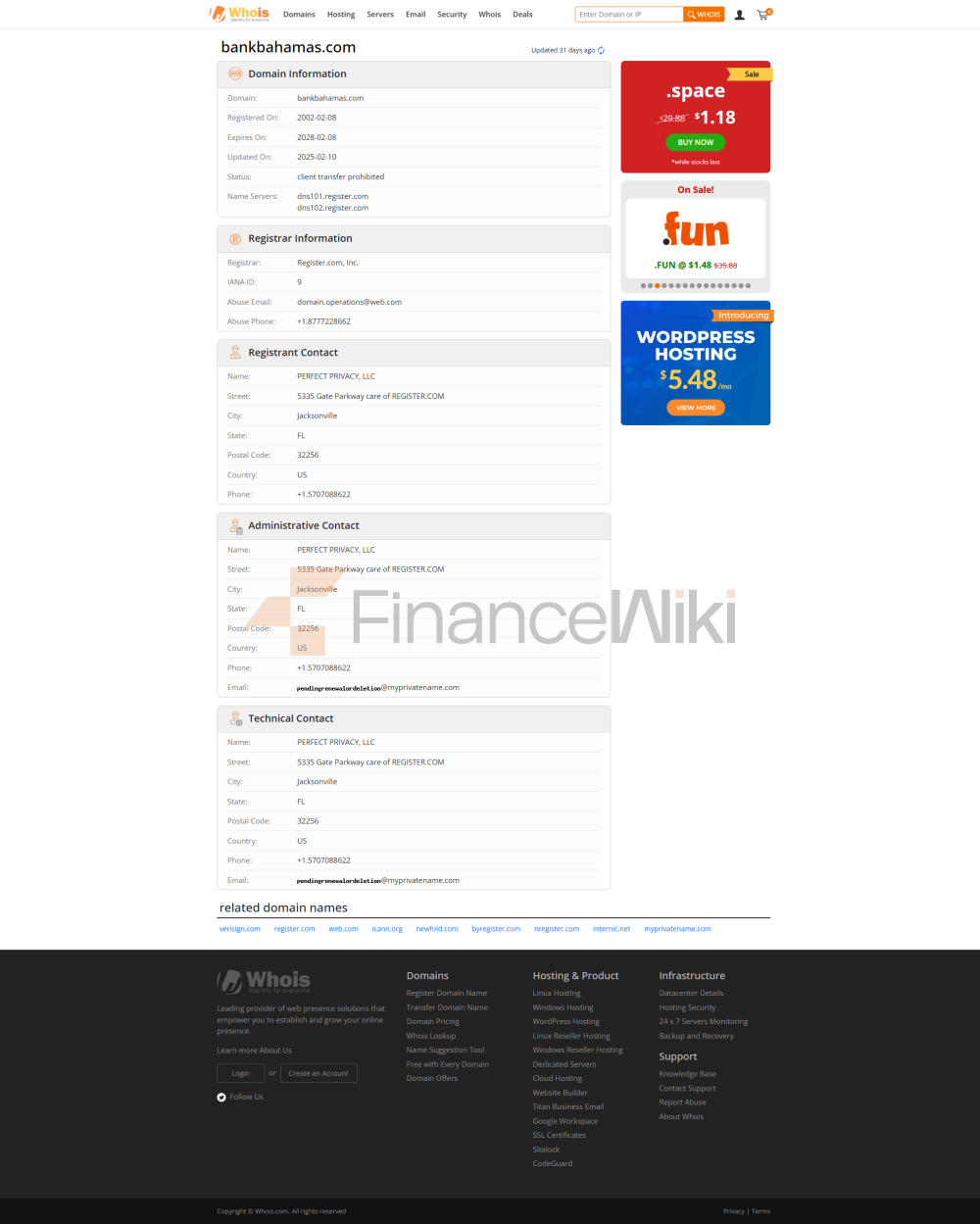

https://www.bankbahamas.com/

Bank of The Bahamas Limited Q & A

Ask a Question

Social Media

News And Information

Risk Statement

Finance.Wiki reminds you that the data contained in this website may not be real-time or accurate. The data and prices on this website may not be provided by the market or exchange, but may be provided by market makers, so the prices may not be accurate and may differ from the actual market prices. That is, the prices are only indicative prices, reflecting market trends, and are not suitable for trading purposes. Finance.Wiki and the providers of the data contained in this website are not responsible for any losses caused by your trading behavior or reliance on the information contained in this website.