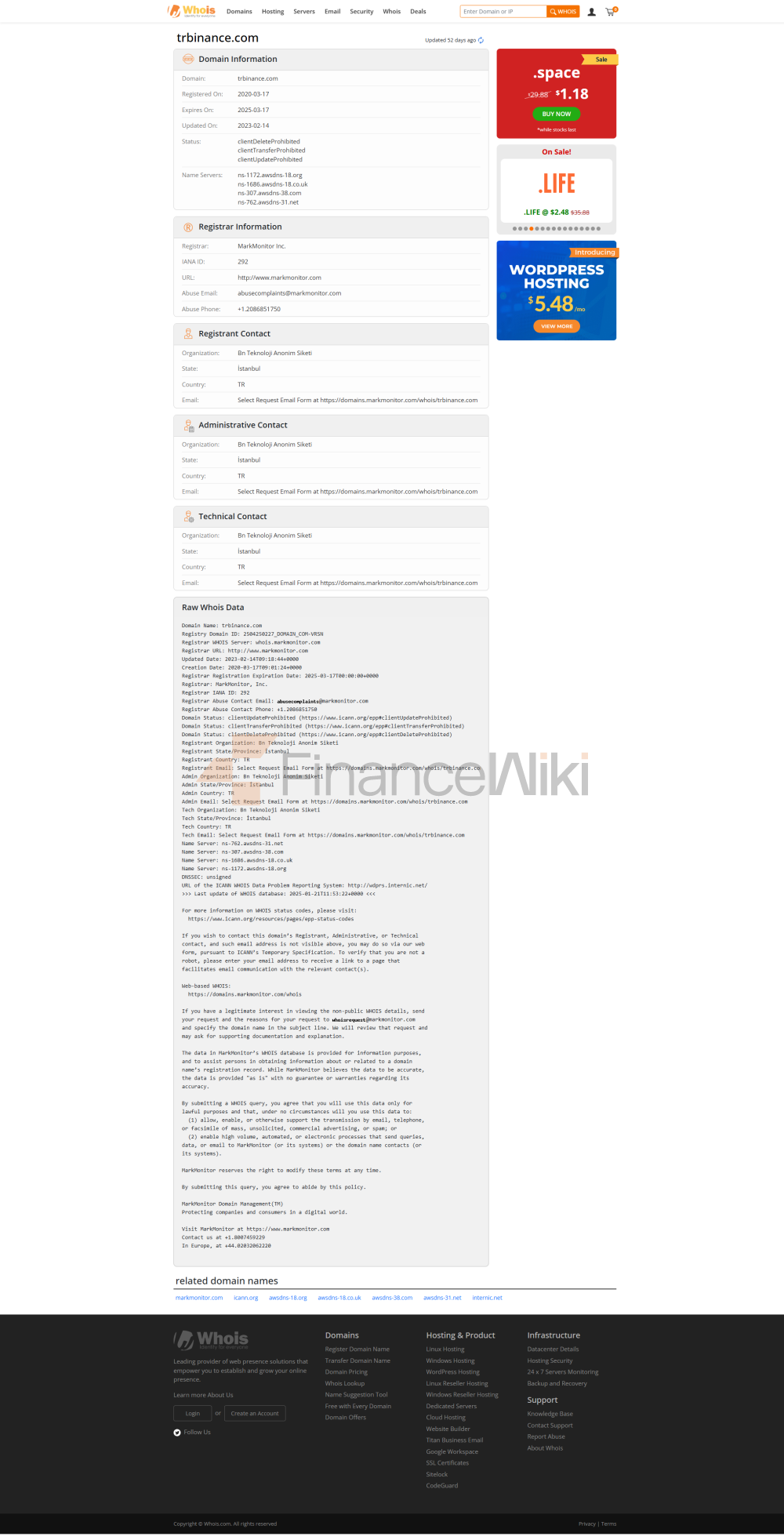

Launched In September 2020, Binance TR Is A Digital Asset Market. It Is Licensed By The Binance Cryptocurrency Exchange To Use Binance's Matching Engine And Wallet Technology. Binance TR Is Operated By BN Teknoloji In Istanbul, Turkey, And Aims To Provide A Fast, Secure And Reliable Platform For Trading Cryptocurrencies Within Turkey. The Exchange Supports The TRY Fiat Trading Pair.

The Platform Uses Technologies And Mechanisms Licensed To The Binance Exchange And Complies With Local Legal Norms And Anti-money Laundering Regulations.

Technical Support For Binance TR Is Provided By Binance's Core Functions. The Exchange Gives The Community In Turkey Access To Industry-leading Technology, Spot Trading Liquidity, Robust Matching Mechanisms, And Cutting-edge Security Technology, And Allows Users To Buy And Sell Digital Currencies Using Local Currencies.

Who Is The Founder Of Binance TR?

Binance TR Is Owned By Binance And Guaranteed By Binance SAFU Funds.

When Was Binance TR Founded?

The Centralized Exchange (CEX) Was Launched In September 2020.

Where Is Binance TR Located?

Binance TR Is Operated By BN Teknoloji, A Fintech Company Headquartered In Istanbul, Turkey.

Countries Where Binance TR Is Restricted

Customers In Canada, Japan, And The United States Are Not Allowed To Use The Platform.

What Currencies Can Binance TR Support?

Binance TR Is A Fiat-to-cryptocurrency And Cryptocurrency-to-cryptocurrency Exchange. Popular Digital Assets Listed On Its Shelves Include BTC, ETH, AVAX, DOGE, USDT, BUSD, XRP, SOL, ATOM, ADA, MANA, LTC, MATIC, And More.

What Is The Handling Fee For Binance TR?

Generally Speaking, Binance TR Has A Transaction Fee Of 0.1%. The System Uses A Pending Order And Eating Order Mode And Charges According To Different Levels (up To 0.1%). There Is No Handling Fee For Deposits And Withdrawals Of TRY. In Addition, There Is No Handling Fee For The Cryptocurrency Withdrawal Process Between Binance And Binance TR.

Can Leverage Or Margin Trading Be Used On Binance TR?

Users Can Trade Cryptocurrencies And Futures. The Maximum Leverage Available On The Platform Is 10:1.