basic bank information

Bank Mandiri is the largest commercial bank in Indonesia, ranking first in the country in terms of assets, loans, and deposits. It is a state-controlled commercial bank committed to providing comprehensive financial services to individual and corporate customers, while occupying an important position in the regional financial market.

name and background

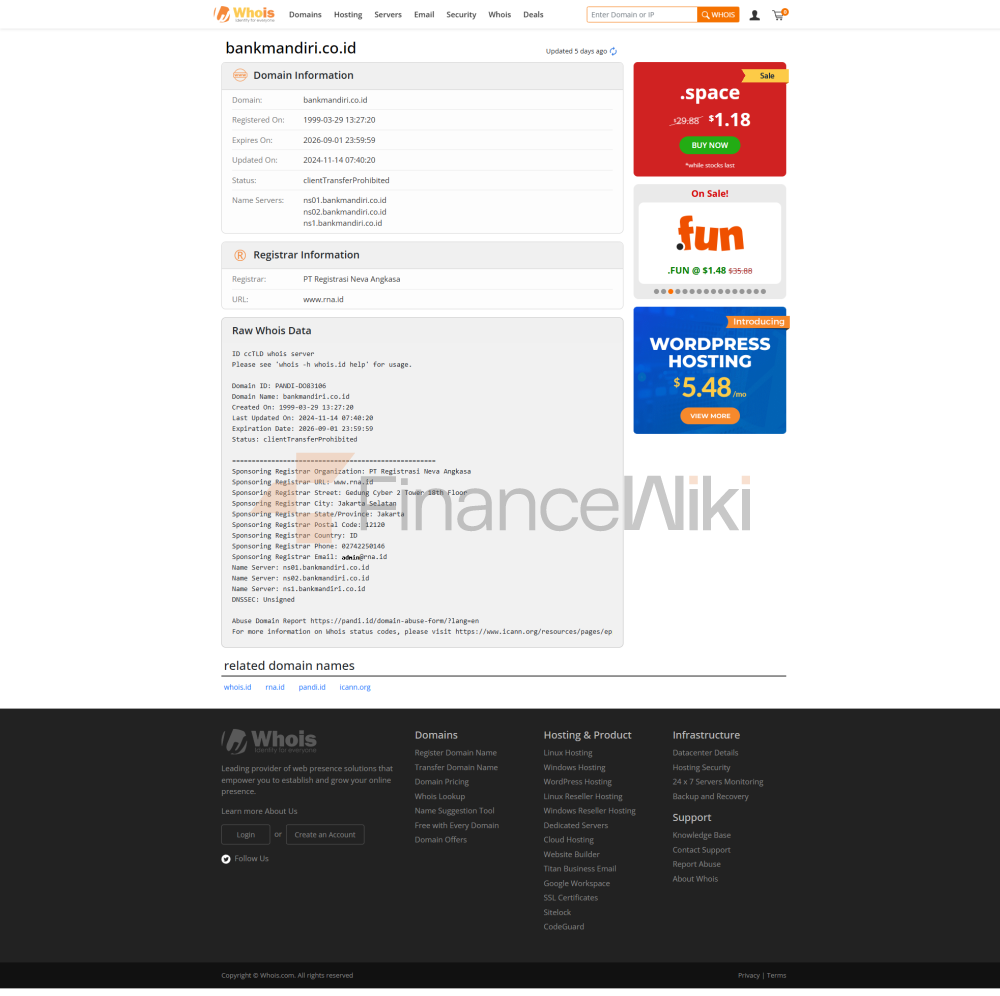

full name: PT Bank Mandiri (Persero) Tbk

was established on October 2, 1998 by the Indonesian government merging four state-owned banks (Bank Bumi Daya, Bank Dagang Negara, Bank Ekspor Impor Indonesia, Bank Pembangunan Indonesia). The merger entered into force on 31 July 1999.

Head office location: Jakarta, Indonesia, Jenderal Gatot Subroto Street, Kav. 36-38

Shareholder Background: Bank Mandiri is a public company listed on the Indonesia Stock Exchange (IDX) on July 14, 2003 under the ticker symbol BMRI. The Indonesian government holds 52% of the shares, the Indonesia Investment Authority (INA) holds 8%, and the remaining 40% is held by public and institutional investors, including domestic and foreign investors. Its state-owned holding background ensures that it is closely integrated with national economic policies, and at the same time, it achieves partial market-oriented operation through listing.

service scope

Coverage Areas: Bank Mandiri mainly serves the whole of Indonesia, covering all major islands and three time zones, and has 7 branches overseas, including Singapore, Hong Kong, London, Cayman Islands, Shanghai, Dili (Timor-Leste) and Kuala Lumpur. The bank supports Indonesian businesses in their business expansion in regional and global markets through cross-border services.

Number of offline outlets: As of 2022, Bank Mandiri has 2,364 branches in Indonesia, including branches and cash outlets, which are widely distributed in urban and rural areas.

ATM distribution: The bank operates about 13,027 ATMs throughout Indonesia, providing convenient withdrawals, transfers and payment services.

services & products

Bank Mandiri provides a diverse range of financial products and services to individual, corporate and institutional clients, covering the following key areas:

Corporate Banking: provides investment loans, working capital loans, trade finance, cash management and supply chain financial services for large and medium-sized enterprises. The Kopra Cash Management platform provides online financial management tools to corporate clients.

Retail financing: including home loans, car loans, personal consumption loans, and micro-business loans, supporting financial inclusion.

Islamic Bank: Through its subsidiary, Mandiri Syariah, it provides Shariah-compliant banking services and occupies a leading position in Indonesia's Islamic financial market.

Investment & Insurance: Provision of investment banking and asset management services through its subsidiary, Mandiri Sekuritas; AXA Mandiri Financial Services provides bancassurance products; Mandiri AXA General Insurance is engaged in the non-life insurance business.

Other services: Car loans through Mandiri Tunas Finance, Bank Sinar Harapan Bali focusing on micro-loans, Mandiri Taspen supporting financial services for retirees.

> Personal Banking: Savings Accounts (Mandiri Tabungan), Current Accounts, Fixed Deposits (Mandiri Deposito), US Dollar Accounts, Foreign Exchange Services, Home Loans, Personal Loans, Credit Cards and Wealth Management Services. Launched Mandiri Private for high-net-worth clients, providing asset management and succession planning.

Bank Mandiri has strengthened its integrated financial services capabilities through cross-departmental synergies and the integration of subsidiaries, especially in the areas of corporate banking and retail deposits.

regulatory and compliance<

span style="font-family: sans-serif; color: black" > regulator: Bank Mandiri is regulated by the Indonesian Financial Services Authority (OJK) and Bank Indonesia (BI) and is subject to the Banking Law and related prudential requirements.

Deposit Insurance Program: Bank Mandiri is a member of the Indonesian Deposit Insurance Institution (LPS), where depositors' deposits are protected up to IDR 2 billion (approximately US$130,000).

Recent Compliance Record: Bank Mandiri has a strong compliance record with no major breaches recorded. It ensures financial transparency through strict anti-money laundering (AML) and counter-terrorism financing (CFT) measures. The bank has also publicly committed to gender equality and anti-corruption policies, and was ranked 16th in Southeast Asia in the 2022 World Benchmarking Alliance (WBA) Financial System Benchmark, demonstrating its social responsibility and compliance efforts.

financial health

Bank Mandiri's financial performance reflects its solid operating capabilities and market leadership position, as shown by the following key metrics (as of December 2024):

non-performing loan ratio (NPL): The net NPL ratio was approximately 1.5%, a significant decrease from 15.34% in 2005, reflecting effective risk management and improved asset quality.

Liquidity Coverage Ratio (LCR): The specific data is not disclosed, but the bank's loan-to-deposit ratio (LDR) is 98%, indicating that liquidity management is tight but still manageable. Banks plan to reduce LDR to around 90% by 2025 through digital channels.

> Capital Adequacy Ratio (CAR): 20.9%, well above the 8% required by Indonesian regulators, indicating a strong capital buffer.

As of 2023, Bank Mandiri has total assets of IDR 2,174 trillion (about USD 143 billion), total loans of IDR 1,398 trillion, and third-party funds of IDR 1,577 trillion, demonstrating its scale and financial soundness.

digital service experience<

span style="font-family: sans-serif; color: black" > APP & Online Banking: Bank Mandiri offers the Livin' by Mandiri mobile app and Mandiri Online online banking platform for both personal and corporate customers. Livin' by Mandiri has a user rating of around 4.5 out of 5 stars on Google Play and App Store, and it has received rave reviews for its user-friendly interface and rich features.

Core Features:

Real-time transfers: Support domestic and international real-time transfers through BI-FAST and RTGS systems.

bill management: supports bill payment such as utility bills and telephone bills, as well as recurring payment settings.

investment tool integration: Stocks, bonds, and mutual fund investments are available through Mandiri Sekuritas.

technical innovation:AI customer service: via Livin' by Mandiri integrates an AI-powered chatbot to handle frequently asked questions and account queries.

Open Banking API: The Mandiri API platform allows third-party developers to integrate banking services and support corporate customers to customize financial solutions.

Digital Ecosystem: Banks provide corporate cash management services, including financial dashboards and multi-level authorized transactions, through the Kopra Portal.

> face recognition: supports account login and transaction verification.

Bank Mandiri's digital transformation has enabled it to maintain its leading position in the Indonesian banking sector, especially in the areas of retail deposits and corporate finance digitalization.

customer service

Bank Mandiri provides multi-channel customer service to meet the needs of individual and corporate customers:

phone: Customer Hotline 14000 (domestic) or +62-21-52997777 (international) for 24/7 support.

Email: Email support is provided through the official website (www.bankmandiri.co.id) to handle account and product inquiries.

Live chat: The Livin' by Mandiri app and the Mandiri Online platform offer a live chat feature to quickly respond to customer questions.

Smart Branch: Launched Smart Branch, which provides self-service kiosks and face-to-face consultation to optimize the customer experience.

security measures

Bank Mandiri uses multiple layers of security measures to protect customer assets and data:

Cybersecurity: Secure online transactions with SSL encryption and multi-factor authentication, including facial recognition and mobile tokens.

Anti-Money Laundering & Anti-Fraud: Strict compliance with OJK's AML/CFT requirements, monitoring for suspicious transactions, and partnering with Yandex to launch anti-phishing certification.

Transaction security: Corporate customers reduce the risk of unauthorized transactions through Kopra Cash Management's multi-level authorization mechanism.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel to prevent theft and fraud.

featured services and differentiation

Bank Mandiri is unique among Indonesian banks due to its size, state-owned background and innovative capabilities:

Wealth Management Expansion: Partnered with Lombard Odier in Singapore to launch high-end wealth management services, targeting high-net-worth individuals and family offices, with a compound annual growth rate of 43.55% since 2019.

Financial Inclusion: Promoting financial inclusion in remote areas of Indonesia by supporting Islamic finance and microenterprise lending through Mandiri Syariah and Bank Sinar Harapan Bali.

Sustainability commitment: Invest IDR 205.4 billion in sustainable business activities to support ESG (Environmental, Social and Governance) goals, such as green financing and community development.

Cultural Transformation: Implement the five corporate culture values of "TIPCE" (trust, integrity, professionalism, customer first, excellence) to improve employee behavior and service quality.

>Corporate Banking Expertise: With corporate banking as its core competitiveness, it provides integrated financial solutions, with loan growth of 19.5% in 2024, higher than the industry average.

summary

Bank Mandiri, Indonesia's largest commercial bank, is the backbone of Indonesia's financial system with its state-controlled background, extensive service network and strong digital capabilities. The bank meets the diverse needs of individuals to large corporations through integrated retail and corporate banking services, solid financial performance, and continuous innovation. Its unique services in the areas of wealth management, Islamic finance and financial inclusion further strengthen its market leadership.