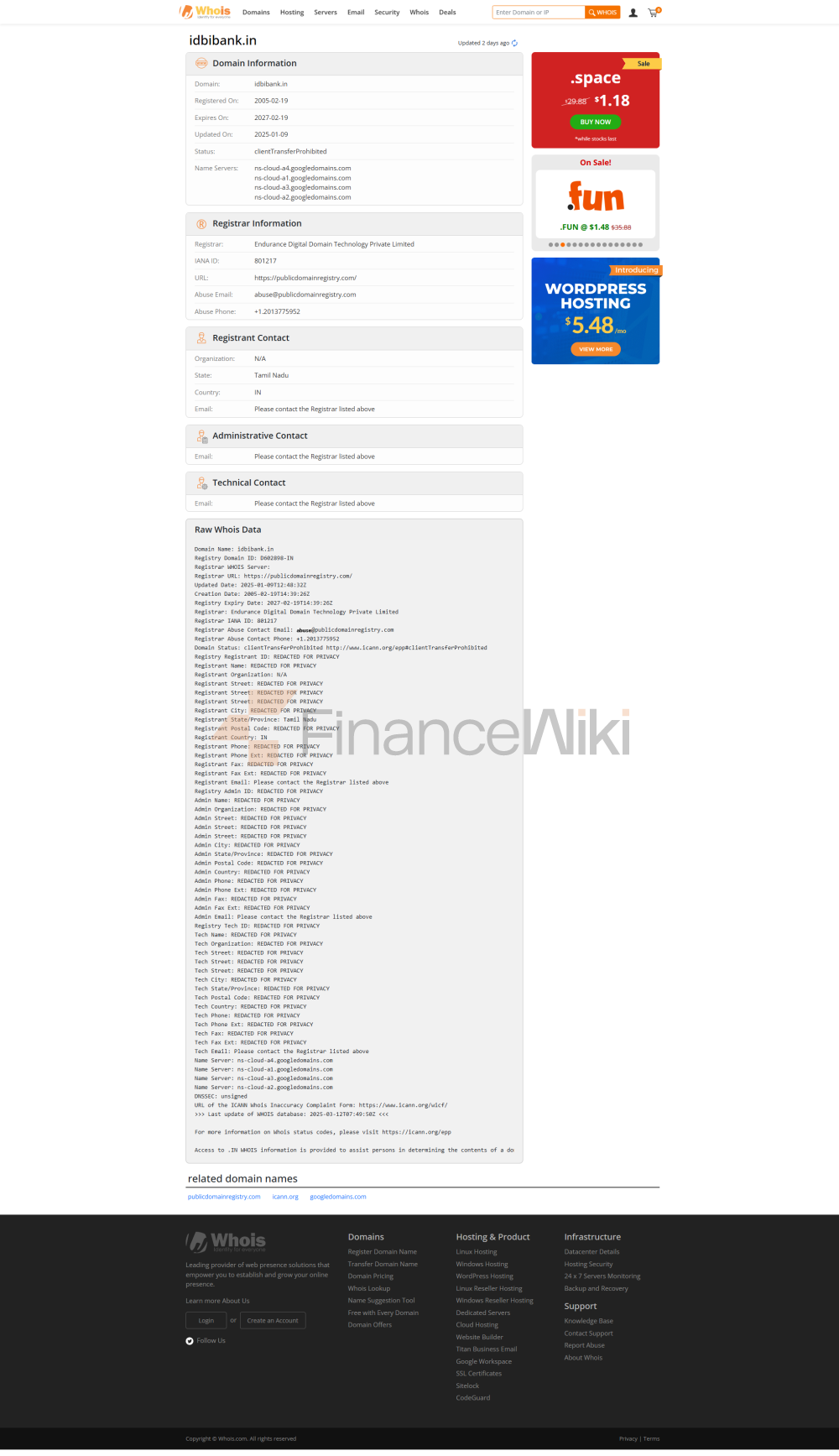

IDBI Bank Limited (IDBI Bank Or IDBI) Is A Designated Commercial Bank Owned By The Life Insurance Corporation Of India (LIC) And The Government Of India. It Was Established By The Government Of India In 1964 As A Wholly Owned Subsidiary Of The Reserve Bank Of India, Then The Industrial Development Bank Of India, As A Development Financial Institution Group Providing Financial Services To The Industrial Sector. In 2005, The Institution Merged With Its Subsidiary, The Commercial Arm IDBI Bank, And Was Categorized As "Other Development Financial Institution Group". In Late March 2019, Due To High Non-performing Asset And Capital Adequacy Issues, The Government Of India Asked LIC To Inject Capital Into The Bank And Required LIC To Manage The Bank To Meet Regulatory Norms. Following LIC's Acquisition Of 51% Of The Total Paid-up Share Capital, The Bank Was Classified As A "private Sector Bank" By The Reserve Bank Of India With Effect From January 21, 2019. IDBI Was Placed Under Timely Corrective Action By The Reserve Bank Of India And Exited IDBI On March 10, 2021. Currently, The Government Of India Has A Direct And Indirect Shareholding Ratio Of About 95% In IDBI Bank. The Government Of India (GoI) In Its F.No Letter 8/2/2019-BO-II Dated December 17, 2019 Clarified And Directed All Central/state Government Departments To Consider IDBI Bank's Allocation Of Government Business. Many State Institutions Originated From IDBI Such As SIDBI, EXIM, National Stock Exchange Of India, SEBI, National Securities Depository Limited. At Present, IDBI Bank Is One Of The Largest Commercial Banks In India.

History

Overview Of The Development Bank Of India

Development Banking Emerged After The Second World War And The Great Depression Of The 1930s. Due To The Need To Provide Reconstruction Funds To The Affected Countries, A National Reconstruction Agency Had To Be Established. At Independence In 1947, India Had A Fairly Developed Banking System. Adopting A Bank-led Financial Development Strategy Aimed At Meeting The Credit Needs Of The Sector, Especially In Agriculture And Industry. To This End, The Reserve Bank Concentrated Its Efforts On Regulating And Developing Institution-building Mechanisms. The Network Of Commercial Banks Was Expanded To Meet The Needs Of General Banking Operations And To Meet The Short-term Liquidity Needs Of Industry And Agriculture. To Meet The Long-term Financing Needs Of Industry And Agriculture, Specialised Development Financial Institution Groups Such As IDBI, NABARDs, NHB And SIDBI

The Industrial Development Bank Of India (IDBI) Was Established In 1964 By An Act Of Parliament As A Wholly Owned Subsidiary Of The Reserve Bank Of India. In 1976, Ownership Of IDBI Was Transferred To The Federal Government And Became The Principal Financial Institution Group For Coordinating The Activities Of Institutions Engaged In Finance, Promotion And Development Of Industry In India. IDBI Provides Financial Assistance In Rupees And Foreign Currencies For Greenfield Projects And For Expansion, Modernization And Diversification Purposes. ITDA Has Also Provided Indirect Financial Assistance Since 1992 Through The Refinancing Of Loans Provided By The National Level Financial Institution Groups And Banks, And Through The Rediscounting Of Bills Of Exchange Arising From The Sale Of Domestic Machinery On Deferred Payment Terms, Following The Government's Financial Sector Reforms.

Following The Public Offering Of IDBI In July 1995, The Government's Stake In The Bank Fell From 100% To 75%.

IDBI Played A Pioneering Role, Especially In Promoting Broad-based Industrial Development In India Before The Reforms (1964-91) Under The "Development Bank" Charter Established By The Government Of India. Some Of The Institutions Established With The Support Of IDBI Include The Securities And Exchange Board Of India (SEBI), National Stock Exchange Of India (NSE), National Securities Depository Limited (NSDL), Equity Holdings Of India Limited (SHCIL), Credit Analysis And Research Limited, Export-Import Bank (India), Small Industries Development Bank Of India (SIDBI) And Entrepreneurship Development Institute Of India.

Transforming IDBI Into A Commercial Bank

A Committee Set Up By The Reserve Bank Of India Has Recommended That The Development Financial Institution Group (IDBI) Move Away From The Traditional Distinction Between Commercial And Development Banks, Diversify Its Activities And Coordinate The Roles Of Development Finance And Banking Activities. In Order To Keep Pace With The Reform Of The Financial Sector, IDBI Transformed Its Role From Development Financial Institution Group To Commercial Institution. Under The Industrial Development Bank (Transfer And Abolition Of Enterprises) Act, 2003, IDBI Was Granted The Status Of Limited Company, I.e. IDBI Ltd.

Subsequently, In September 2004, The Reserve Bank Of India Registered IDBI As A "Designated Bank" Under The Reserve Bank Of India Act, 1934. The Commercial Banking Division IDBI Bank Was Incorporated Into IDBI In 2005.

Direct Government Intervention

The Merger Is Expected To Streamline The Operations Of The Bank. However, IDBI Continues To Base Its Policies On The Industrial Sector, As Previous IDBI Entities Did. This Has Resulted In The Bank's Retail Operations Being Capped At 13% Of Its Total Operations. Total Non-performing Assets (NPA) Rose To Rs 555.88 Billion (equivalent To Rs 740 Billion Or $8.90 Billion In 2023) As Of March 2018, Representing About 28% Of Its Total Lending. This Is The Highest Among Indian Banks. The Union Government Intervened And The Life Insurance Corporation Bailed Out The Bank By Injecting Rs 9,300 Crore.

On June 29, 2018, LIC Received Technical Approval From The Insurance Regulatory And Development Authority Of India (IRDAI) To Increase Its Stake In IDBI Bank To 51%. LIC Completed The Acquisition Of 51% Controlling Stake With A Total Investment Of Rs 2162.4 Crore On January 21, 2019.

Operation

Acquisition Of United Western Bank

In 2006, IDBI Bank Acquired United Western Bank (headquartered In Satara). By Acquiring UWB, IDBI Bank Doubled The Number Of Its Branches From 195 To 425.

Strategic Divestment From Low-income Countries

India's LIC Completed The Acquisition Of 51% Controlling Stake In The Bank In January 2019, Becoming The Majority Shareholder Of The Bank. Following The Increase In Equity Holdings By LIC Of India, The Reserve Bank Of India Clarified Through A Press Release On March 14, 2019 That IDBI Bank Will Be Reclassified As A Private Sector Bank With Effect From January 21, 2019. LIC Has Taken Over The Management Control Of The Bank While The Union Government Has Been Classified As A Promoter.

Listing And Shareholding

The Shares Of IDBI Bank Are Listed On The Bombay Stock Exchange And The National Stock Exchange Of India. As Of September 2021, The Union Government Holds A 45.48% Stake In IDBI Bank While LIC Holds A 49.24% Stake And The Rest Is Held By Non-promoters.

EMPLOYEES

The Bank Had 18,283 Employees As Of September 1, 2023, Of Which 197 Were Employees With Disabilities. The Average Age Of The Bank Employees On The Same Date Was 34 Years. The Bank Reported That In The Fiscal Year 2012-13, The Business Was Rs 2.564 Billion Per Employee And The Net Profit Per Employee Was Rs 121,700.

IDBI Intech Ltd. (IIL) Is A Wholly Owned Subsidiary Of IDBI Bank, Which Was Established In 2000.

It Provides IT-related Services In The Areas Of Consulting, System Integration, System Implementation And Support, Application And Server Hosting, And Other IT-related Managed Services And Professional Training.

IDBI Intech Has Been ISO 9001:2000 Certified For IT-related Services, Including Data Center Management And Call Centers, As Well As IT Security Audit Organization Certification By Computer Emergency Response Team Of India (CERT-In).

Awards And Honors

- IDBI Bank Was Ranked #1197 In The Forbes Global 2000 In May 2013.

- It Won The "Best Bank Overall" And "Best Public Sector Bank" Awards At The Dun & Bradstreet Bank Awards 2011.

- In 2011, It Received The Banking Technology Award From The Association Of Indian Banks For Best Business Intelligence Usage And Best Risk Management Company Type IT Solutions And Services In Affiliated Industrial Banking And Financial Services Established March 2000 Headquarters New Mumbai, India Service Industry IT Consulting IT Services Outsourcing Software Products Number Of Employees 1750 (as Of October 31, 2021) Parents IDBI Bank Website IDBI Intech Ltd