Basic information

about the Bank of Mauritius is the central bank of the Republic of Mauritius and not a commercial bank in the traditional sense. It is wholly owned by the government and is a state-owned institution that sets monetary policy, issues currency (Mauritian rupees) and maintains financial stability. The Bank of Mauritius does not aim to make a profit, but rather to make a mission to stabilize the country's economy and sound financial system.

Name & Background

Full Name: Bank of Mauritius (French: Banque de Maurice)

Established: September 1967 under the Banking of Mauritius Act 1966, succeeding the previous Board of Monetary Commissioners. It was born thanks to the assistance of the Bank of England, with a strong British central bank DNA.

Headquarters location: Sir William Newton Street, Port Louis, Republic of Mauritius. Opened in December 2006, the new headquarters building is located in the heart of Porterwis, symbolizing its centrality in the country's economy.

Shareholder Background: 100% owned by the Government of Mauritius, unlisted, fully nationalised. As a central bank, it has no private or joint venture components, a simple and transparent shareholder structure, and its goal is to serve the national economy, not to pursue market-based returns.

Scope of Services

As a central bank, the Bank of Mauritius does not directly provide retail banking services to individual or corporate customers, but indirectly influences financial activities throughout the country through monetary policy, interest rate regulation and payment system management. Its services cover the whole of Mauritius and are mainly allocated through the supervision of 19 commercial banks (including 5 local banks, 12 foreign banks, 1 joint venture bank and 1 private bank).

Number of offline outlets: The central bank itself does not have a retail outlet for the public, and only has office space at Port's Louis headquarters.

ATM distribution: does not operate ATMs directly, but ensures the efficient operation of commercial banks' ATM networks throughout Mauritius and Rodrigues by regulating national payment systems, including real-time settlement systems supported by the National Payment Systems Act 2018.

Regulatory & Compliance

Regulator: The Bank of Mauritius is the highest regulatory authority for the banking sector in Mauritius and is empowered by the Banking of Mauritius Act 2004 and the Banking Act 2004. It is responsible for licensing, supervising and regulating all banks and non-bank depository institutions, while working with the Financial Services Commission (FSC) to maintain the stability of the financial system.

Deposit Insurance Scheme: Mauritius has established a deposit insurance scheme, supported by section 100 of the Banking Act 2004. The Deposit Insurance Fund requires financial institutions to pay a premium (20 cents per 100 MYRs) on the amount of their deposits, which is used to protect depositors' funds.

Recent Compliance Record: The Bank of Mauritius, known for its strict supervision, has in recent years pushed for the Basel III framework (phased in since 2014), which requires banks to maintain a minimum capital adequacy ratio of 10% (including 5% Tier 1 capital and 5% Tier 2 capital). Its regulatory measures include additional risk weighting and loan-to-value ratio restrictions to ensure the bank's sound operations. No major compliance scandals have been recorded, showing good performance in anti-money laundering (AML) and counter-terrorist financing (CFT).

Financial health

As a central bank, the Bank of Mauritius does not measure its health by the financial indicators of traditional commercial banks, but by its control over the country's financial system and policy execution. The following indicators are based on the overall performance of the banking sector under its supervision:

Capital adequacy ratio: According to the Basel III Guidance for June 2021, the average capital adequacy ratio of the banking sector in Mauritius is approximately 18%, well above the minimum requirement of 10%, indicating that the industry as a whole is resilient.

Non-performing loan ratio: The non-performing loan ratio (NPL) of the banking sector as a whole, which was around 3.5% in the Financial Stability Report in December 2020, increased slightly after the pandemic, but remained manageable and reflected better asset quality.

Liquidity Coverage Ratio: The liquidity coverage ratio (LCR) of the banking sector in Mauritius is generally above the regulatory requirement of 100%, with the average LCR of around 150% in 2020, indicating that banks have sufficient high-quality liquid assets to cope with short-term stresses.

Deposits & Loans

Deposits: The Bank of Mauritius does not directly provide deposit products, but indirectly influences the deposit rates of commercial banks by issuing currencies and setting benchmark interest rates (such as the key repo rate, which is about 4.5% in May 2025). The interest rate on demand deposits in commercial banks is usually 0.5%-1.5%, and the interest rate on time deposits (1-5 years) is about 2%-4%, depending on market competition and central bank policies.

Loans: Similarly, the central bank does not issue loans directly, but its monetary policy determines the cost of lending for commercial banks. Currently, the interest rate on a home loan in Mauritius is around 5%-7%, the interest rate on a car loan is around 6%-8%, and the interest rate on a personal line of credit is between 8% and 12%. Commercial banks often offer flexible repayment options, such as early repayment or adjustment of repayment terms, but the exact terms vary from bank to bank.

Featured Products: Bank of Mauritius encourages commercial banks to launch green loans and SME financing programs through policies to support sustainable development, but does not directly design products.

List of Common Fees

Since the Bank of Mauritius does not provide retail services, the issue of fees is mainly decided by the commercial banks it regulates. The following is a common fee structure in the banking sector in Mauritius (based on industry practice):

Account Management Fee: The monthly fee for a current account is usually 0-50 (about 0-1.2 USD), with some banks charging additional fees for insufficient minimum balances (e.g. Rs 5,000).

Transfer fees: Free or as low as Rs 10 for domestic transfers and around Rs 200-500 ($5-$12) for Cross-border Transfers (SWIFT).

Overdraft Fee: The overdraft rate is usually the base rate plus 5%-10%, depending on the bank's policy.

ATM interbank withdrawal fee: Each interbank withdrawal is about INR 10-20 and is usually free of charge at our ATM.

Hidden Fee Alert: Some banks charge a dormancy fee (around Rs. 50-100/year) for accounts that are inactive for a long period of time (6-12 months). Users are advised to read the bank's terms carefully to avoid additional costs due to minimum balances or unused accounts.

Digital Service Experience

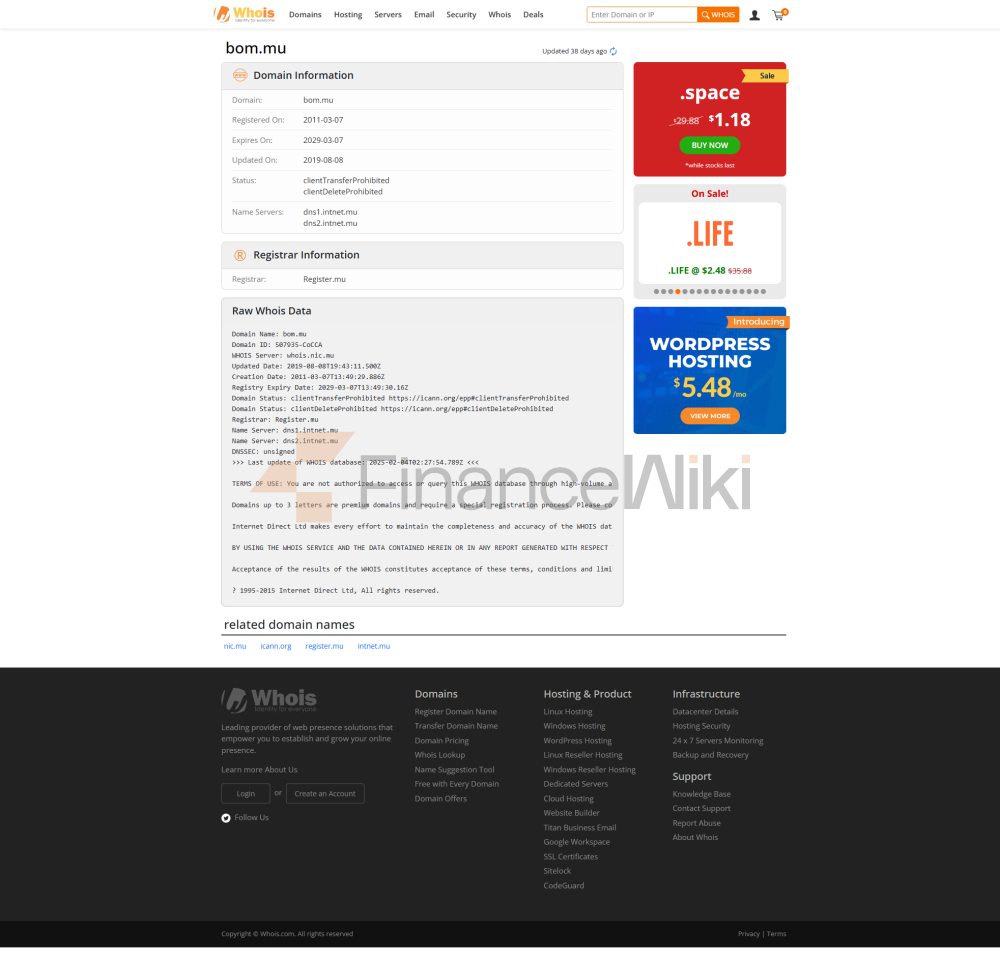

App & Online Banking: Bank of Mauritius does not provide a retail banking app for the general public, but it operates a national payment system that supports digital services (such as real-time transfers and mobile payments) for commercial banks. Its official website (www.bom.mu) provides foreign exchange rates, policy announcements, and regulatory guidance.

Core functions: The central bank does not directly develop facial recognition or bill management tools, but promotes the adoption of advanced technologies by commercial banks through regulation. For example, the apps of banks such as MauBank support OCR authentication and real-time transfers, reflecting the central bank's support for digitalization.

Technological innovation: Bank of Mauritius is actively promoting fintech, with plans to launch a digital and private banking framework by 2025. The Mauritius Credit Information Bureau (MCIB) database it oversees supports bank credit assessment, and some banks have integrated AI customer service and open banking APIs to improve the user experience.

Customer Service Quality Service

Channels: Bank of Mauritius mainly serves financial institutions and government departments, and non-retail customers. Its official website provides contact numbers and emails to support consultations during business hours, with no 24/7 hotline or live chat.

Complaint handling: The public can complain about banking issues through the Office of the Financial Services Ombudsman (under the Financial Services Act 2018), with an average processing time of about 1-2 months, and user satisfaction data is not publicly available.

Multi-language support: The official website is mainly in English and French, which is in line with the multilingual environment of Mauritius, and some regulatory documents are available in Creole for the convenience of local users.

Security Measures

Security of Funds: The Deposit Insurance Program covers the deposit accounts of all licensed banks, and the amount of insurance is determined by the Deposit Insurance Fund (the exact limit is not disclosed, but it is sufficient to protect small and medium-sized depositors). Bank of Mauritius protects against fraud and illicit money flows through real-time transaction monitoring and AML/CFT regulations.

Data security: The Central Bank's IT systems follow international standards and some operations (e.g. the MCIB database) are run through a secure network and comply with the confidentiality requirements of the Banking of Mauritius Act 2004. There is no public record of ISO 27001 certification, and there are no reports of major data breaches, indicating that its data protection capabilities are strong.

Featured Services & Differentiation

Market segments: Bank of Mauritius does not directly provide retail products, but supports commercial banks to launch student accounts (fee-free), senior savings plans and high-net-worth customer service through policies. For example, its green finance guidelines encourage banks to develop ESG investments and sustainability loans.

High-net-worth services: Central banks do not directly operate private banks, but regulated international banks (such as HSBC Mauritius) offer customised wealth management for high-net-worth clients, with thresholds starting at $500,000.

Other: The Bank of Mauritius promotes Mauritius as a regional financial centre, supports cross-border investments and double tax treaties to facilitate international investors.

Market Position & Accolades

Industry Rankings: As a central bank, the Bank of Mauritius does not participate in the ranking of commercial banks, but is known among the world's central banks for its prudent regulation and efficient monetary policy. The Mauritian banking sector is among the best in sub-Saharan Africa, thanks in part to its regulation.

Awards: There is no record of awards directly facing the Bank of Mauritius, but its fintech (e.g., MauBank's API Innovation Award) and regional financial center strategy have been recognized by institutions such as the International Monetary Fund (IMF).

Conclusion

As the central bank of Mauritius, the Bank of Mauritius plays the role of the "guardian" of the country's financial system with its prudent supervision and forward-looking policies. It does not provide retail services, but through monetary policy and strict regulation, it has shaped a healthy, digitally advanced, and international banking ecosystem.