Central Bank of India, one of the pillars of India's financial system, has been the benchmark for public banks in India since its inception in 1911 with its long history, extensive service network and commitment to social responsibility. As India's first fully Indian-owned and managed commercial bank, the Central Bank of India serves both urban and rural residents as well as international customers through its innovative financial products, robust digital platform and focus on customer service. This article will provide insights into the characteristics and strengths of the Central Bank of India (CBB) in terms of institutional profile, financial health, products and services, fee structure, digital experience, customer service quality, security measures, unique services and market position.

Institutional Overview and BackgroundThe

Central Bank of India was established on 21 December 1911 and is headquartered at Chander Mukhi, Nariman Point, Mumbai. Founded by Sir Sorabji Pochkhanawala and chaired by Sir Pherozeshah Mehta, the bank aims to provide financial support to local businesses and individuals in India and fill the gap in local financial institutions during the British colonial period. In 1921, banks were nationalized and became an important tool for the Indian government to promote financial inclusion. In 1969, the bank was formally nationalized along with 13 other major banks, further cementing its position in the Indian financial system.

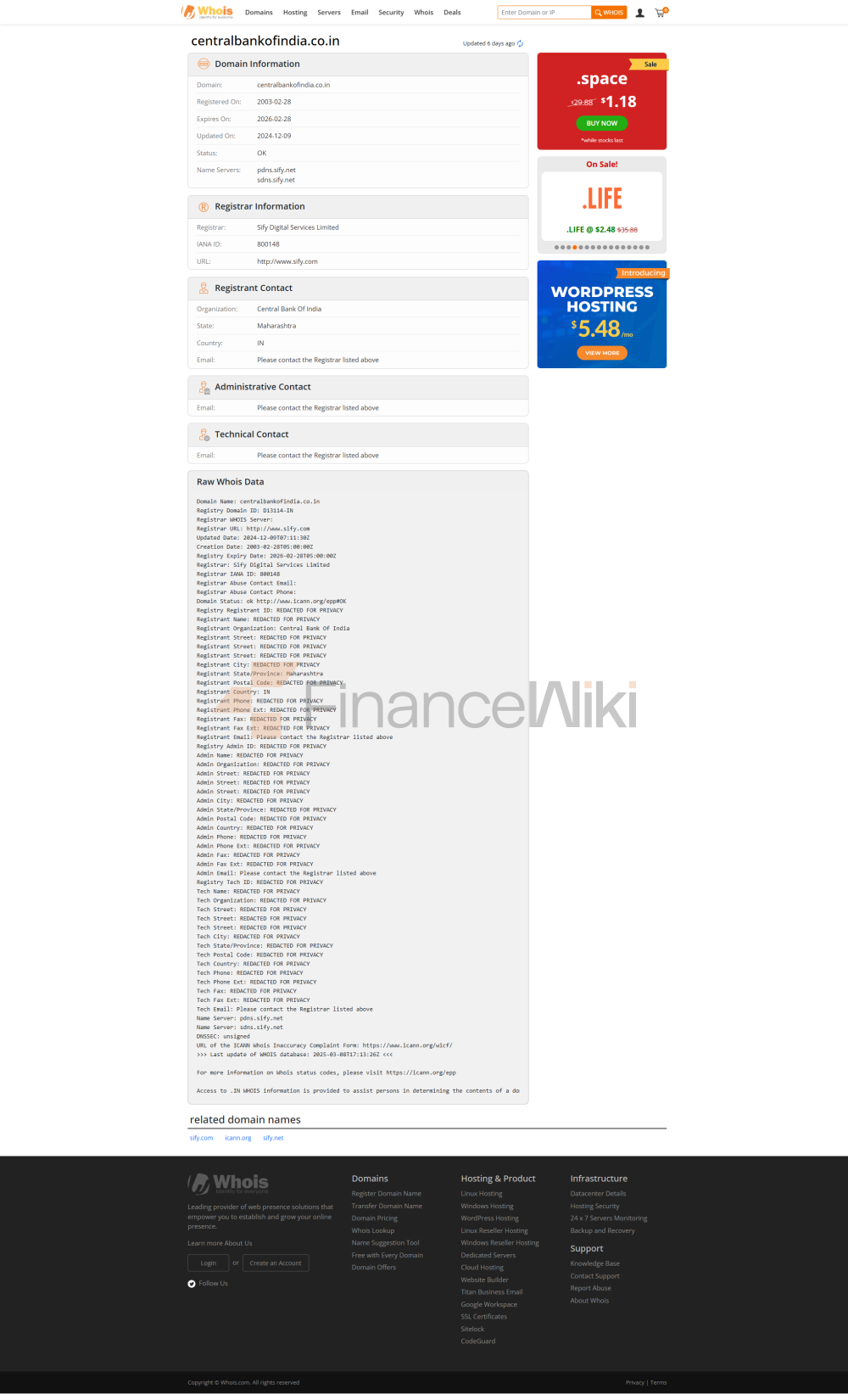

As of 2024, the Central Bank of India is wholly owned by the Government of India and is listed on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) under the ticker code 532885. Major shareholders include the Government of India, institutional investors, and public shareholders. The Bank's services cover all 28 states and 7 Union Territories of India with about 5,100 branches spread across both urban and rural areas. The bank also offers more than 5,500 ATMs through the LankaPay network, ensuring easy access to deposits and withdrawals across the country. In addition, the bank has branches in more than 20 countries, including the United States, the United Kingdom, Singapore, Japan, and Hong Kong, serving non-resident Indian (NRI) and international customers.

The Central Bank of India has further expanded its financial product portfolio through its subsidiaries such as Central Bank of India Financial Services Ltd. and Centbank Home Finance Ltd., which provide asset management, insurance and housing finance services. Banks are regulated by the Reserve Bank of India (RBI) and are subject to the Banking Act and related regulations. Its deposits are protected by the Deposit Insurance and Credit Guarantee Corporation (DICGC) and each depositor is compensated up to Rs 500,000. As of 2025, banks have not reported significant compliance issues, demonstrating their robust performance in regulatory compliance.

Historical BackgroundThe

establishment of the Central Bank of India is an important milestone in the modernization of India's banking sector. In 1911, the bank was founded by business leaders in Mumbai to provide financial support to local businesses and individuals. In 1918, the bank opened its first branch in Hyderabad and subsequently expanded to Secunderabad in 1925. In 1923, the bank acquired the troubled Tata Industrial Bank, further expanding its operations in South India. In 1936, the bank facilitated the establishment of India's first foreign exchange bank, the Central Exchange Bank of India, in London, although it was acquired by Barclays in 1938.

Before World War II, the bank opened a branch in Yangon, focusing on trade and wire transfers between India and Myanmar. In 1963, the Burmese Revolutionary Government nationalized the bank's operations in the region and renamed it the People's Bank No. 1. In 1969, the Indian government nationalized the bank, along with 13 other major banks, marking it as a core component of the country's financial system. In 1980, the bank partnered with Visa to become one of the first banks in India to issue credit cards. In 2019, the bank celebrated its 108th anniversary with the launch of its robo-banking service "MEDHA", taking an important step in its digital transformation.

Financial HealthThe

Bank of India's financial position is solid with the following key indicators for 2024:

- Capital Adequacy Ratio: Approximately 14.8%, in line with Basel III requirements, indicating that it has sufficient capital to address potential risks.

- Non-Performing Loan Ratio: The gross non-performing loan ratio was approximately 4.5% and the net non-performing loan ratio was approximately 1.2%, which was lower than the industry average and reflected improved asset quality.

- Liquidity Coverage Ratio: Around 120%, indicating that banks have sufficient liquidity to meet short-term needs.

- Total assets: Approximately Rs.3.7 trillion, up about 8% YoY.

- Net profit: Approximately Rs.647 crore in Q1 2024, up approximately 66% YoY.

- Total revenue: Approximately Rs.830 crore in Q1 2024, up about 15 per cent YoY.

Banks maintain profitability through strict cost control and revenue diversification, such as retail lending, agricultural lending, and SME financing. In 2024, the bank raised funds through a Qualified Institutional Placement (QIP), further strengthening its capital base.

Deposits &

LoansDeposit Products

The Central Bank of India offers a wide range of deposit products to meet the needs of individuals, businesses and special groups:

- Demand deposits: Includes regular savings accounts, Cent Savings accounts and electronic savings accounts (Cent E-Save), which support unlimited deposits and withdrawals, SMS alerts and mobile banking services. The minimum deposit requirement is INR 1000 and the interest rate is around 3.0%-3.5% (subject to bank confirmation).

- Fixed Deposits: Deposit tenors of 7 days to 10 years are available, and the interest rate varies depending on the amount and term, e.g. 3.0% for 7 days to 45 days, 6.0%-6.75% for 1 to 3 years, and 7.0% for more than 3 years (2024 data, to be confirmed).

- Featured Products:

- Cent Bal Bhavishya: A savings account designed for children that encourages savings habits, offers free ATM withdrawals, and financial education.

- Cent Senior Citizen Savings: Additional 0.5%-0.75% interest rates, priority services, and medical insurance benefits for customers over the age of 60.

- Sukanya Samriddhi Yojana: A government-supported savings program designed for girls with an interest rate of around 8.0% and tax incentives.

- Public Provident Fund (PPF): A long-term savings plan backed by the central government with an interest rate of around 7.1% and is suitable for retirement planning.

Loan Products

The bank offers a variety of loan products to meet the needs of retail and corporate customers:

- Cent Home Loan: supports the purchase of a house, construction or renovation of a house for a period of up to 30 years, with an interest rate of approximately 8.35%-9.35% (variable rate, subject to confirmation). The loan-to-value (LTV) ratio is up to 90% and applicants are required to provide proof of identity (e.g. Aadhaar card or passport) and proof of income.

- Cent Vehicle Loan: Used for the purchase of a new or used car for up to 7 years, with an interest rate of about 7.25%-8.55% (to be confirmed).

- Cent Personal Loan: For consumer needs such as education, medical care or weddings, with a term of up to 7 years and an interest rate of about 10.85%-11.25% (to be confirmed).

- Corporate loans: including lines of credit, short-term and medium-term loans, with interest rates determined based on market conditions and corporate credit ratings, for agricultural, SME and large industrial projects.

- Flexible repayment options: The bank supports early repayment and partial early repayment, allowing customers to adjust their repayment plans according to their financial situation and reduce interest expenses.

Proof of identity and proof of income are required for loan approval, and compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

List of Common FeesThe

Bank of India's fee structure is transparent, but specific fees need to be consulted by phone (1800 22 1911) or branches. Common fees include:

- Account Management Fee: A minimum balance (e.g. Rs.1,000) is required for a regular savings account, and a monthly fee of Rs.50-100 may be charged if the standard is not met. Cent E-Save accounts may be exempt from the administration fee and need to be confirmed.

- Transfer fee: Domestic transfers are usually free of charge through NEFT/RTGS, and cross-border transfer fees are about 0.5%-1% (to be confirmed).

- Overdraft Fees: Overdrawn accounts may incur interest charges, the exact amount of which is subject to the Account Terms.

- ATM Interbank Withdrawal Fee: A fee of INR 20-25 per withdrawal may be charged at non-RBI ATMs, which may be waived for some accounts such as children's accounts.

Digital Service ExperienceThe

Central Bank of India (RBI) provides modern financial services through the "Cent Mobile" mobile app (available for iOS and Android) and the online banking platform "Centeez". Core features include:

- Account Management: View balances, transaction history, credit cards, and loan information.

- Real-time transfers: Support domestic and cross-border transfers in rupees and other currencies (SWIFT code: CBININBB).

- Bill Payment: Pay phone bills, electricity bills, water bills, and more online.

- Investment Instrument Integration: Support for fixed deposits, mutual funds, and National Pension System (NPS) administration.

Technological innovations include biometric logins (such as fingerprint and facial recognition), one-time password (OTP) authentication, and UPI (Unified Payment Interface) integration. Banks interact with customers through Platform X ([@CentralBankIND](https://x.com/CentralBankIND)) and WhatsApp interact with customers, providing real-time updates and financial education content. However, user feedback shows that the "Cent Mobile" app has technical issues, such as difficult logins, a complicated interface, and slow response times, with an App Store and Google Play rating of around 3.8/5 (to be confirmed). The bank did not explicitly mention AI customer service or open banking API support, but its digital platform is in the middle of the pack among Indian public banks, with the launch of its robo-banking service 'MEDHA' in 2024 signaling further exploration in the fintech space.

Quality of Customer

ServiceThe Bank of India offers a diverse range of customer service channels to ensure that customers receive timely support:

- Service channels: 24/7 contact centre (1800 22 1911, international customers dial +91 22 6164 8720), email ( headoffice.csd@centralbank.co.in), Live Chat (via the official website), X platform ([ @CentralBankIND] (https://x.com/CentralBankIND)) and about 5,100 branches.

- Complaint handling: Customers can submit complaints through the contact form on the official website, and unresolved issues can be escalated to the Customer Service Department or the Financial Ombudsman at Central Bank of India, Central Office, Mumbai. Complaint rate, average resolution time, and satisfaction data are not publicly available, but the process is in line with RBI regulatory requirements. Customer feedback shows that banks are more responsive in urban areas and may experience slight delays in rural areas due to infrastructure constraints.

- Multi-language support: Services are primarily available in English and Hindi, with the possibility of supporting other Indian languages such as Tamil, Bengali, Marathi, etc., and cross-border customers can consult other language support.

Safety and Security

MeasuresFunds Security

Deposits are protected by DICGC with a maximum compensation of Rs 500,000. Banks use real-time transaction monitoring, multi-factor authentication (MFA) and biometrics to prevent fraud, emphasizing that customers will not be asked for passwords or PINs via phone calls, text messages or emails. The bank also posted anti-fraud tips through social media and its website to warn customers to be wary of phishing emails and unsecured public Wi-Fi.

Data security

Online banking and mobile applications employ SSL encryption, firewalls, and regular security audits. The bank is ISO 27001:2013 certified to ensure data security in line with international standards. As of 2025, no major data breaches have been reported, demonstrating that its data security measures are reliable.

Featured Services & DifferentiationThe

Bank of India differentiates itself through segmented services and community engagement:

- Student Account (Cent Bal Bhavishya): No fees, encourages young people to develop savings habits, offers free ATM withdrawals, digital banking services and financial education courses.

- Cent Senior Citizen Savings: Offers additional interest rates of 0.5%-0.75% for customers over the age of 60, priority services and health insurance benefits, such as health screening programs with insurance companies.

- Green financial products: Supporting renewable energy and energy efficiency projects, such as the Cent Solar Loan, with preferential interest rates in line with India's National Solar Mission and Sustainable Development Goals.

- High Net Worth Services: Cent Elite Banking offers a dedicated relationship manager, customised banking solutions and exclusive experiences such as priority loan approval and investment advisory with a minimum investment of Rs 50 million.

- Community involvement: The bank is actively involved in education grants, rural development, and environmental protection projects. For example, its commitment to social responsibility is demonstrated by providing scholarships to rural students through the "Cent Shiksha" program and supporting green agriculture and renewable energy projects through the "Cent Green" initiative.

Market Position & Accolades

TheCentral Bank of India is the leading public bank in India with total assets of about Rs.3.7 trillion in 2024, ranking among the top five public banks in India. Banks are prominent in retail banking, corporate banking and international banking, with retail loans accounting for about 40% of total loans in 2024, with agricultural loans and SME financing accounting for a significant proportion. The bank has won the "Best Public Bank" award several times and has been recognized for its contributions to financial inclusion, rural banking services and digital innovation, such as the "Best Financial Services Award" and the "Best Rural Banking Service Award". In 2024, the bank won the "Best Fintech Initiative" award for the launch of its robo-banking service "MEDHA", demonstrating its leadership in technological innovation.

Looking

ahead, the Central Bank of India (RBI) will continue to drive digital transformation and plan to address the challenge of 30% of India's population being unbanked through fintech. In 2025, the bank will further expand its service network, especially in rural areas, to enhance customer experience and strengthen its leadership in green finance and financial inclusion. The bank also plans to optimize the loan approval process and improve service efficiency through artificial intelligence and big data analytics.

SummaryThe

Central Bank of India has become one of the pillars of the Indian financial system with its century-old history, extensive service network, and commitment to social responsibility. Whether it is a retail customer, an SME or a high-net-worth customer, banks offer a wide range of financial solutions to meet different needs. Despite the technical issues with its mobile app, the central bank of India continues to improve the customer experience through strong customer service and market position. The bank's signature services, such as student accounts, wealth management for the elderly, and green financial products, combined with its community engagement in education and environmental protection, demonstrate its commitment to financial inclusion and sustainability. In the future, with its continued efforts in the areas of digitalization and sustainability, the RBI is expected to further consolidate its position as an industry leader.