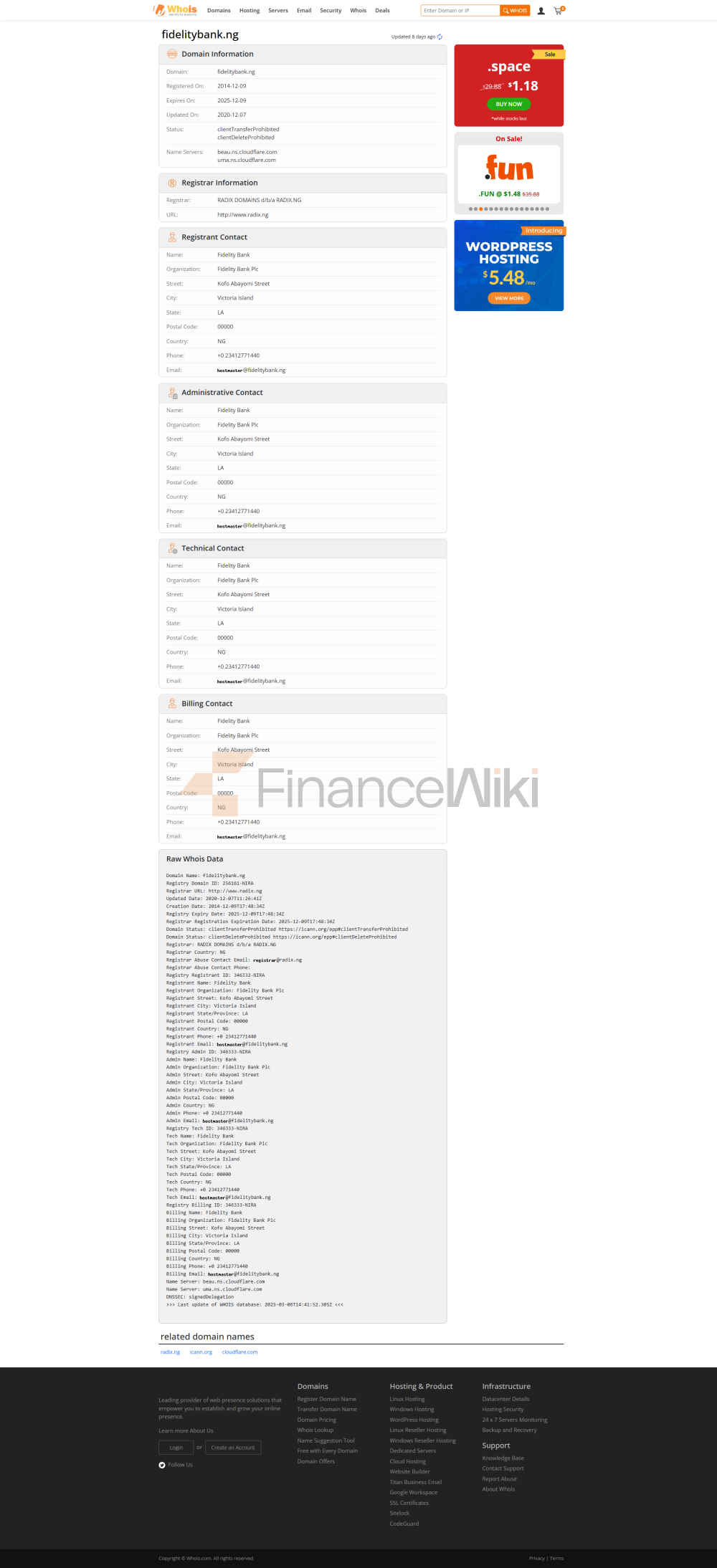

Fidelity Bank, Also Known As Fidelity Bank, Is A Commercial Bank In Nigeria, Headquartered On Victoria Island, Lagos. It Is An Internationally Licensed Commercial Bank By The Central Bank Of Nigeria (CBN), The Central Bank And The National Banking Supervisory Authority.

Fidelity Bank Has Grown From A Fringe Player In 1987 To A Stable And Respected Banking Institution. Notably, In 2005, Fidelity Bank Acquired FSB International Bank ("FSB") And Manny Bank ("Manny") To Become One Of The Top 10 Banks In Nigeria. In 2011, The Bank Was Ranked 7th Among The Most Capitalized Banks In Nigeria And 25th Among The Most Capitalized Banks On The African Continent. In Addition, Following A Renewed Push Into Retail And Digital Banking, Fidelity Bank Ranked Fourth In The Retail Market Segment In The 2017 KPMG Banking Customer Satisfaction Survey (BICSS).

As Of December 2017, Fidelity Bank's Total Assets Are Estimated At Over $4.20 Billion (NGN: 1.4 + Trillion) And Shareholders' Equity At Over $610 Million (NGN: 203 Billion). The Bank Serves Its 4 + Million Customers Through Its Multiple Distribution Channels, Including 240 Business Offices, 775 ATMs And 4,346 POS. It Was Listed On The Nigerian Stock Exchange In May 2005 And Has Been Paying Dividends Annually For The Past 12 Years, Even During The Most Turbulent Times In The Nigerian Banking Industry. According To BGL Plc, Fidelity Bank Has A Market Capitalization Of NGN: 37,072,109,685.76

History

Fidelity Bank Nigeria Was Established In 1987 And Began Operations In 1988. It Initially Started With A Commercial Banking License.

Fidelity Bank Converted Into A Commercial Bank In 1999 In An Attempt To Grow Into A Private Limited Company And Became A Public Limited Company In August 1999. That Year, It Changed Its Name To Fidelity Bank Plc.

It Was Granted A Universal Banking License In February 2001 And An International Banking License In 2011. Fidelity Bank Nigeria Has Developed Into A Stable Banking Institution. During The Merger Of The Nigerian Banking Industry In 2005, Fidelity Bank Acquired FSB International Banking Limited ("FSB") And Manny Bank Plc To Become One Of The Top Banks For Financial Stability In Nigeria. Fidelity Bank Currently Has Operations In All States And Major Cities In Nigeria. Over The Years, The Bank Has Been Known For Its Financial Stability And Integrity. Fidelity Continues To Rank Among The Most Well-capitalized Banks In Nigeria, With Tier 1 Capital Of Nearly $1 Billion ($1 Billion).

Branch Network

The Bank Has A Vast Network Of Interconnected Branches In All States Of Nigeria And Major Nigerian Cities. It Currently Has 240 Branches Of Business And 774 ATMs.

Partnerships

Fidelity Bank Works With School Management And Learning Management Solutions; SchoolTry And Provides Digital Payment Options To Schools Across Nigeria. Fidelity Bank Also Provides Access To The Bank Account Monitoring System (BAMS), Which Helps Subscribing Schools Monitor Their Bank Account Activities In Real Time.