Company

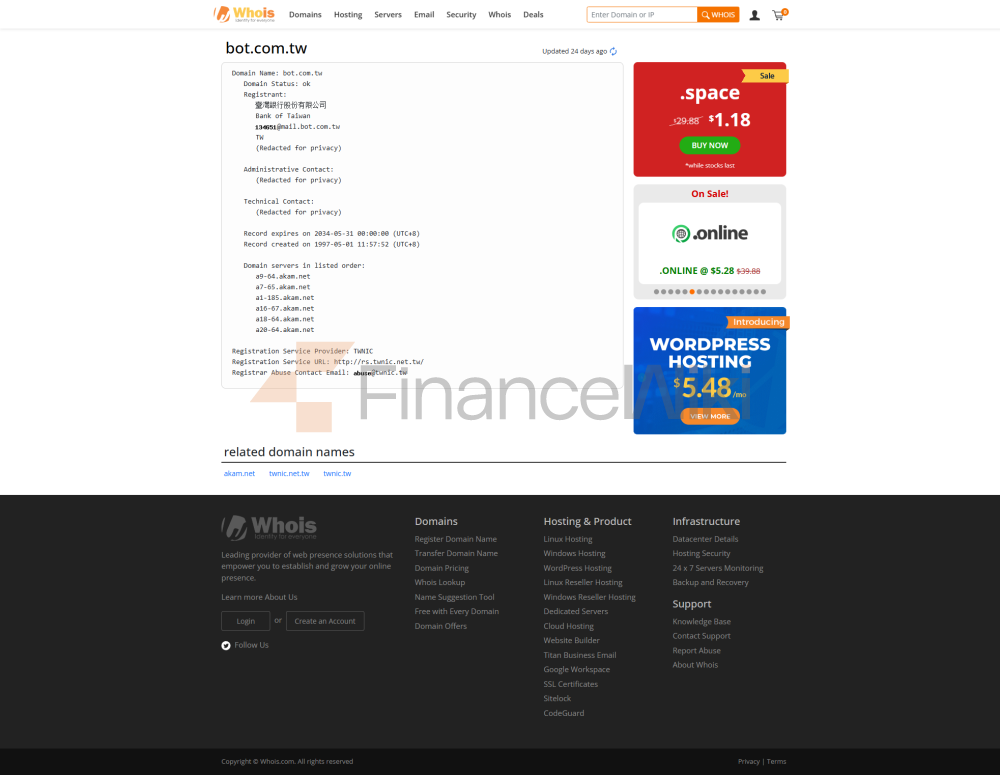

ProfileBank of Taiwan (BoT) is the oldest bank in Taiwan, founded in 1899. As the first bank in Taiwan, its history can be traced back to the Bank of Taiwan during the Japanese colonial period. With 188 branches worldwide and 169 branches in Taiwan, BoT is one of the largest banks in Taiwan in terms of asset size, net worth, deposit and loan balance, and one of the "Eight Largest Banks" in Taiwan.

After the merger with Central Trust of China in 2007, BoT became a major subsidiary of Taiwan Financial Holdings Co., Ltd. In 2003, the bank completed its corporate restructuring and gradually increased its capital to New Taiwan Dollar 95 billion yuan (as of 2014), making it the largest domestic bank in Taiwan.

regulatory information

Bank of Taiwan is a highly regulated financial institution in Taiwan, and its operations are strictly governed by laws and regulations such as the Banking Act and the Central Bank Act. In addition, BoT is under the supervision and direction of the Central Bank of the Republic of China (Taiwan) in the areas of currency issuance, foreign exchange transactions and acting as a central bank.

trading productsBank

of Taiwan offers a wide range of financial services, including but not limited to:

deposit products: Demand deposits, time deposits, foreign currency deposits, etc.

Loan products: personal loans, housing mortgages, corporate loans, etc.

Foreign exchange transactions: foreign currency cash trading, foreign exchange spot trading, international trade financing, etc.

Precious metal trading: buying, selling and custody services for precious metals such as gold and silver.

Wealth management: including portfolio management, fund escrow, etc.

In addition, BoT also acts as an agent for government-related businesses, such as veterans' Save savings and public education insurance underwriting.

trading softwareBank

of Taiwan provides a variety of trading channels, including:

online banking: support deposits and withdrawals, Transfers, foreign exchange transactions and other services.

Mobile payment: "Taiwan Pay" supports QR code scanning payment, and customers can complete transactions through mainstream mobile payment methods such as Apple Pay, Google Pay, and Samsung Pay.

Mobile banking: provides real-time account inquiry, transfer, financial consultation and other functions.

Deposit and withdrawal methodsBank

of Taiwan Deposit and withdrawal methods include:

cash deposit and withdrawal: Done through a branch or ATM.

Transfer service: support real-time inter-bank transfer, international transfer, etc.

Electronic payments: Cashless deposits and withdrawals via mobile payments and online banking.

customer supportBank

of Taiwan provides a variety of customer support channels:

online customer service : Through the real-time online chat function on the official website, customers can communicate directly with customer service.

Phone Support: Customers can contact the customer service team at (02) 2545-1788.

Social Media: BoT provides customer service and product information updates on platforms such as Facebook and Line.

Physical Branches: Customers can visit one of BoT's 169 branches for face-to-face consultations.

Core Business & ServicesAs

one of the largest banks in Taiwan, Bank of Taiwan's core business includes:

Retail banking: Provide individual customers with deposits, loans, investment and wealth management services.

International business: including foreign exchange transactions, international trade financing, cross-border payments, etc.

Wealth Management: Provide customized asset allocation and investment management services for high-net-worth clients.

Corporate Banking: Provide a full range of financing solutions for corporate clients, including trade finance, project finance, etc.

Technical InfrastructureBank

of Taiwan has invested heavily in technical infrastructure to ensure the stability and security of services. Its technical highlights include:

AIoT risk control system: through artificial intelligence and Internet of Things technology, real-time monitoring of transaction risks and prevention of fraud.

Cloud computing platform: supports the efficient operation of multi-business systems, improves service efficiency and customer experience.

Biometrics: Enhance the security of customer authentication through fingerprint, facial recognition and other technologies.

Compliance and Risk Control SystemBank

of Taiwan strictly abides by relevant laws and regulations, and its compliance and risk control system mainly includes:

Anti-Money Laundering (AML): Prevent money laundering and terrorist financing through well-established customer identification (KYC) procedures.

Risk management: Adopt the TIL (Threat, Impact, Likelihood) model to assess and prevent various risks.

Internal control audits: Conduct regular internal audits to ensure compliance and risk control.

Market Positioning and Competitive AdvantageAs

one of the largest banks in Taiwan, Bank of Taiwan's competitive advantage is reflected in:

Network coverage: Extensive branch and ATM network to provide customers with convenient financial services.

Technology-driven: Improve customer experience and operational efficiency through technological innovation.

Government support: As a subsidiary of Taiwan Financial Holdings, the BoT has advantages in terms of policy support and access to resources.

> Customer Support & EnablementIn

addition to traditional financial services, Bank of Taiwan empowers customers by:

Educational support: Provide students with study abroad loans to support education.

Innovation Capacity Training: Through the "Youth Entrepreneurship Loan" program, we will help small and medium-sized enterprises and individual entrepreneurs.

Social Responsibility: BoT actively participates in public welfare activities and supports social welfare and environmental protection projects.

Social Responsibility and ESG

Bank of Taiwan has demonstrated outstanding performance in fulfilling corporate social responsibility, including:

Social Responsibility: BoT continues to participate in public welfare projects in the fields of education, healthcare, and culture.

Corporate Governance: The BoT has established a robust governance structure to ensure transparent decision-making and the protection of stakeholders' rights.

Environmental protection: Support the development of renewable energy and a low-carbon economy through the "Green Finance" program.

Strategic Cooperation EcologyBank

of Taiwan has established long-term strategic cooperative relations with various institutions, including:

International Financial Institutions: BoT has branches in international financial centers such as New York, London, and Singapore, and has established close cooperative relationships with major financial institutions around the world.

Tech companies: BoT partners with tech companies to develop smart banking solutions.

Government Agencies: The BoT acts as an agent for central banking operations and supports the implementation of the country's monetary policy.

Financial HealthBank

of Taiwan has a solid financial performance, with total assets of 6.79 trillion New Taiwan Dollar and a capital adequacy ratio of 16.11% as of 2023Q3, well above regulatory requirements.

future roadmap

Bank of Taiwan Future strategic priorities include:

Digital transformation: Continuing to invest in AI, Big data and blockchain technology improve the intelligent level of financial services.

International layout: deepen financial cooperation with Southeast Asia and countries along the "Belt and Road".

ESG development: Strengthen investment in green finance and sustainable development, and fulfill corporate social responsibility.