Zenith Bank Plc Is A Leading Financial Services Provider In Nigeria And English-speaking West Africa, With Its Headquarters On Victoria Island, Lagos. It Is Licensed As A Commercial Bank By The National Banking Regulator, The Central Bank Of Nigeria.

As Of April 1, 2024, It Holds Total Assets In Excess Of $16.50 Billion With Shareholders' Equity Of $854 Million. The Company Is Listed On The Nigerian Stock Exchange And The London Stock Exchange.

History

Competitive Environment

The Nigerian Banking Industry In The Early 1990s Was Led By A Select Group Of Four Major Banks: Union Bank, First Bank, UBA And Afribank.

Foundations

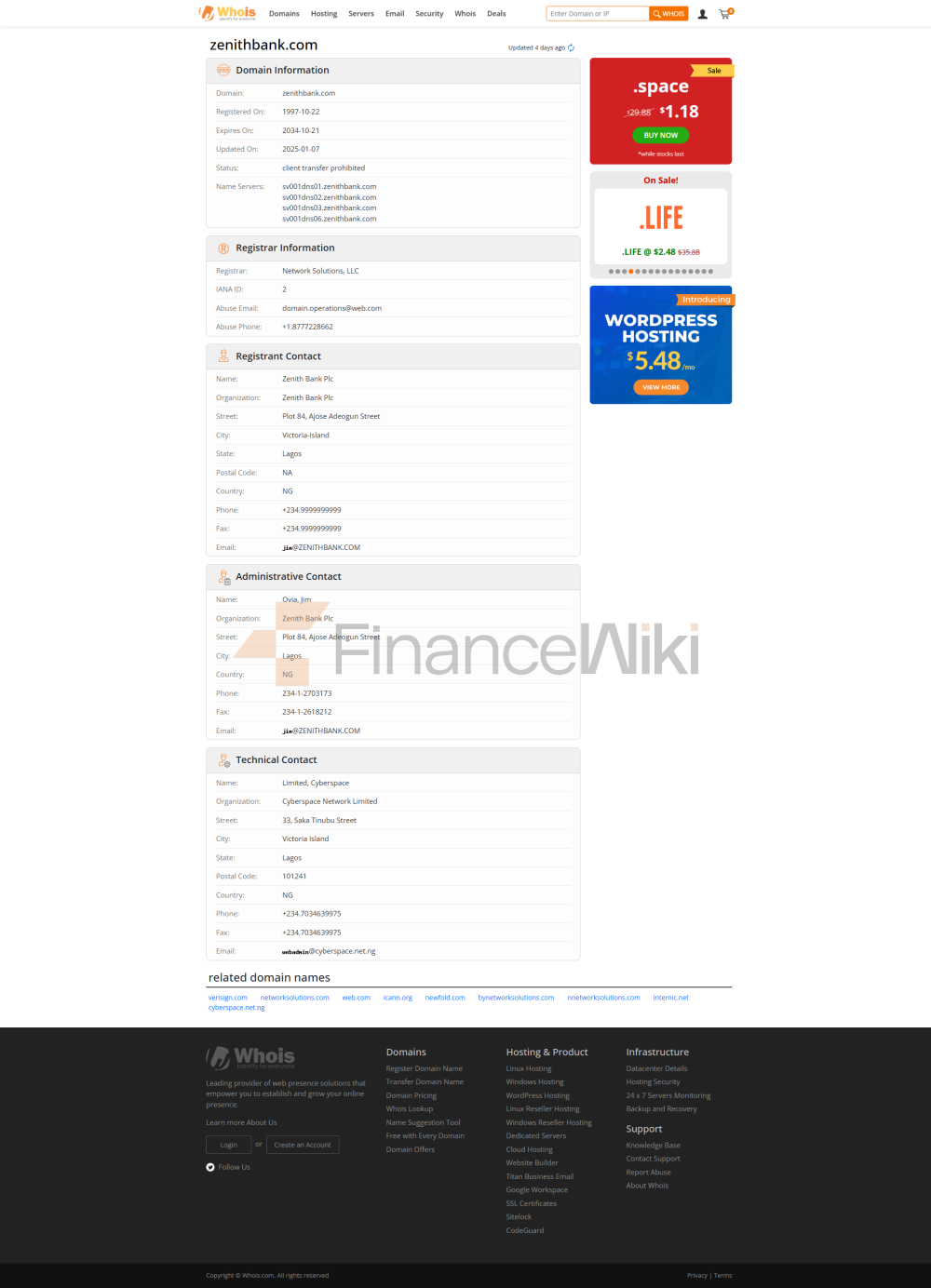

In 1990, Jim Ovia Founded Zenith Bank Plc To Compete With The Existing Big Four Banks. Zenith Bank Was Established In May 1990 And Began Banking Operations In July Of The Same Year. At Its Inception, It Had A Capital Base Of $4 Million. It Began Operations During A Period When The Government Liberalized The Banking Sector, When The Central Bank Issued Up To 20 Banking Licenses To Investors Each Year. The Bank's First Office Was Originally A Residence On Victoria Island, Which Was Later Converted Into A Banking Hall. At Its Inception, The Bank Witnessed A Period Of Rapid Growth. In 1997, Zenith Increased Its Capital To 500 Million Naira, Following A Directive From Banking Institutions To Strengthen Their Capital Base.

Leveraging Technology Implementation For Growth

In 1999, Zenith Bank Adopted The Internet To Market Financial Services And Promote Consumer Use Of Online Banking, And Became One Of The First Companies To Invest In Online Banking. In The Early 2000s, Zenith's Profile Began To Rise, Its Investments In IT Helped It Compete With Major Banks With Greater Branch Presence, And Soon Began Declaring Net Profits Comparable To Some Of The Established Big Banks.

Initial Public Offering

June 17, 2004 The Bank Became A Public Limited Company Following A Successful IPO. On October 21, 2004, Its Shares Were Listed On The Nigerian Stock Exchange (NSE). The Bank's Shares Were Listed On The London Stock Exchange (LSE) After Listing At $6.80 Per Share In 2013.

The Bank Has Made Equity Investments In Zenith Custodian, Zenith Securities And Zenith General Insurance.

Branch Network

Zenith Bank's Branches In Racecourse Road, Kaduna State.

As Of 2016, Zenith Bank Had More Than 500 Branches And Business Offices In All States And The Federal Capital Territory. The Company Has Subsidiaries In The United Kingdom, United Arab Emirates, Ghana, Sierra Leone And Gambia. The Bank Also Has Offices In China. In 2024, Adaora Umeoji Became CEO, Succeeding Current CEO Ebenezer Onyeagwu.