Corporate Profile

AC Capital Market Was Established In 2006 And Is A Foreign Exchange Brokerage Headquartered In Sydney, Australia. The Registered Entity Of The Company Is AC CAPITAL MARKET PTY LTD, Which Provides Investors With Trading Services In Financial Derivatives Such As Foreign Exchange, Precious Metals, Indices And Commodities On A Global Scale. AC Capital Market Has Established A Place In The Industry With Its Diverse Trading Products, Flexible Leverage Ratios And Wide Range Of Payment Methods.

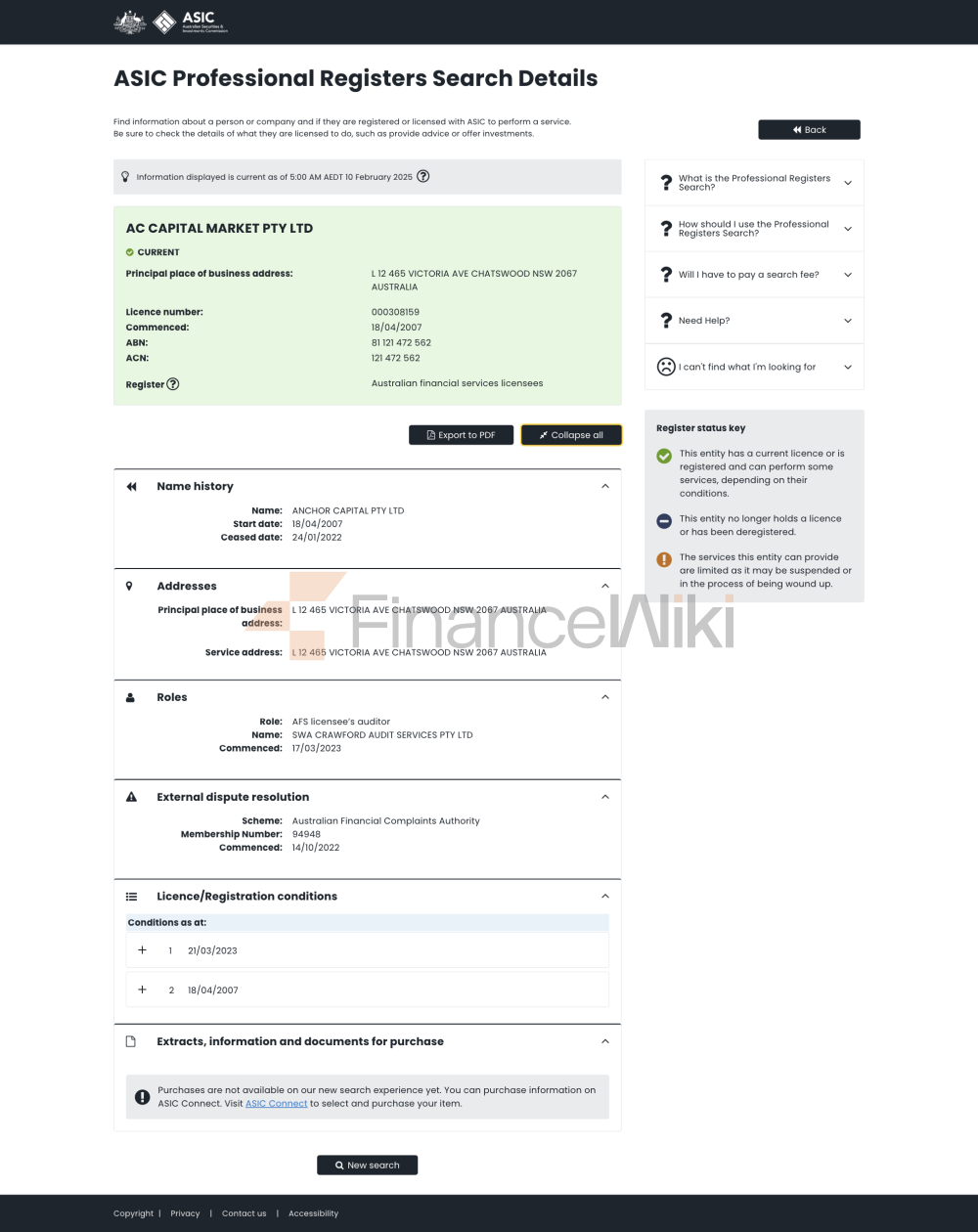

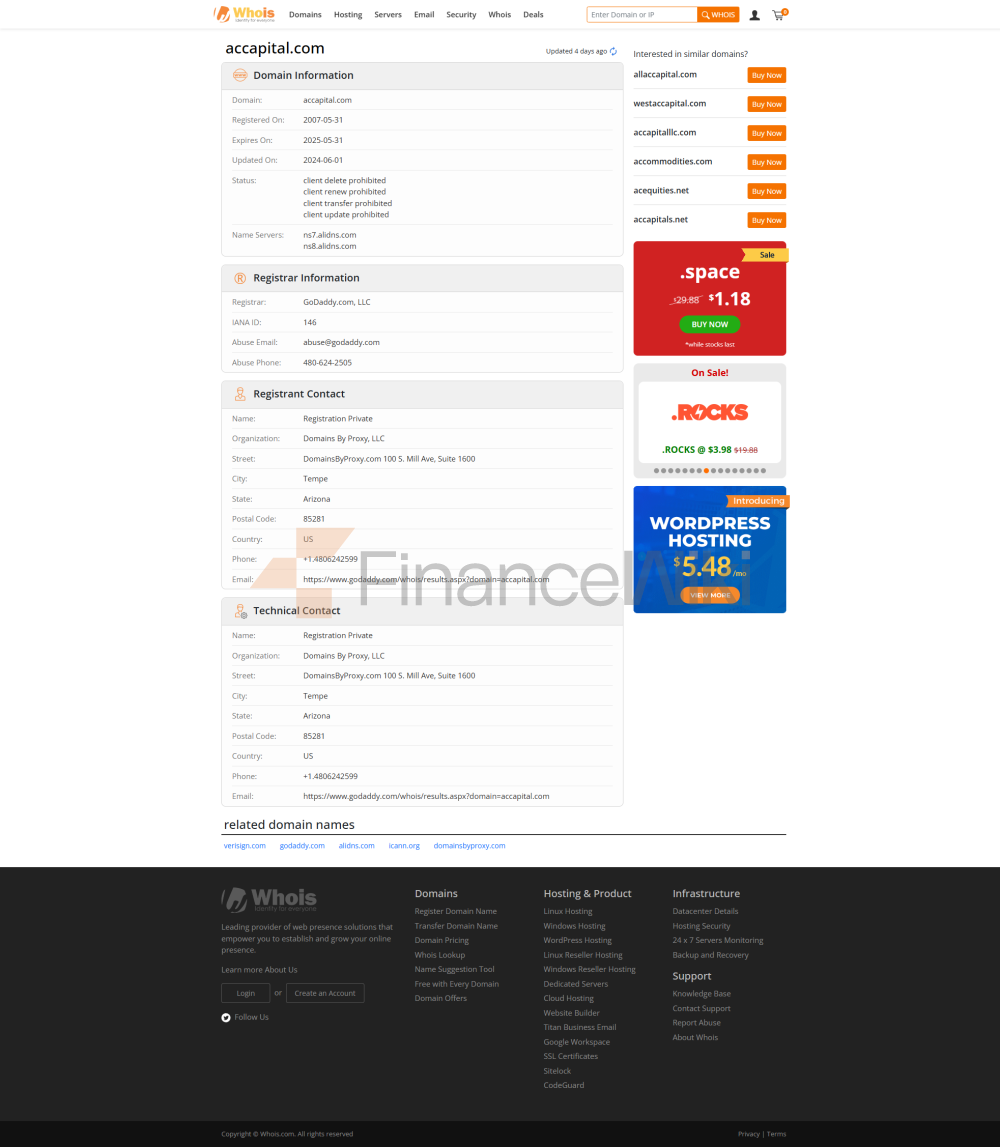

Regulatory Information

AC Capital Markets Is A Regulated Forex Broker Whose Business Is Strictly Regulated By The Australian Securities And Investments Commission (ASIC) And The Vanuatu Financial Services Commission (VFSC). The Australian Regulatory License Number Is 8121472562 And The Vanuatu Regulatory License Number Is 700597 . These Regulators Ensure The Company's High Standards In Terms Of Transaction Transparency, Safety Of Client Funds, And Compliant Operations.

Trading Products

AC Capital Market Offers A Wide Range Of Financial Products, Including:

- Forex Trading : Offers Over 40 Currency Pairs, Such As EUR/USD, GBP/USD, Etc.

- Precious Metals Trading : Includes Gold (XAU/USD), Silver (XAG/USD), Palladium (PALL/USD), And Platinum (PT/USD).

- Index Trading : Covers Major Global Indices Such As The S & P 500 (SPX500), Nasdaq 100 (NAS100), Hong Kong Hang Seng Index (HKG50) And Australia's ASX200 Index (AUS200).

- Commodity Trading : Includes Crude Oil (WTI And Brent), Natural Gas And Agricultural Products, Among Others.

These Products Provide Investors With A Diverse Range Of Investment Options To Meet Different Trading Needs.

Trading Software

AC Capital Market Offers Investors The Following Two Trading Platforms:

- MetaTrader 5 (MT5) : This Is A Globally Popular Trading Platform That Offers Advanced Chart Analysis, Automated Trading, And A Variety Of Technical Indicators.

- AC Capital Market App : As A Mobile Trading Tool, The App Allows Investors To Trade Anytime, Anywhere, And Provides Real-time Market Updates And Personalized Tools.

Deposit And Withdrawal Methods

AC Capital Market Supports A Variety Of Deposit And Withdrawal Methods, Including:

- Payment Methods : WEBPAYS, Adyen, Online Banking, Instant Payment, E-wallet, Telegraphic Transfer, Kakao, FastPay, L Open Transaction Payments, Skrill, PayStack, Neteller, Webmoney And Paytm.

- Deposit And Withdrawal Fees : AC Capital Market Does Not Charge Any Deposit And Withdrawal Fees.

Deposit And Withdrawal Processing Hours:

- Withdrawal Requests Received Before 1pm GMT Time Will Be Processed On The Same Day.

- Withdrawal Requests Received After 1pm GMT Time Will Be Processed On The Next Business Day.

Customer Support

AC Capital Markets Provides Investors With Multi-language Customer Support In 12 Languages Including English, Chinese, Malay, Portuguese, Etc. Clients Can Contact The Customer Support Team At:

- Phone Support : Dial + 61 (02) 8056 9475.

- Email Support : Send Questions Or Requests To Cs@accapital.com.

- Live Chat Support : Communicate Directly Through The Online Customer Service Function On The Official Website.

Core Business And Services

AC Capital Market's Core Business Is To Provide Global Investors With Trading Services For Financial Derivatives Such As Foreign Exchange, Precious Metals, Indices And Commodities. Its Differentiating Advantages Include:

- Flexible Leverage Ratio : Provides Leverage Up To 800:1 To Meet The Risk Appetite Of Different Investors.

- Diversified Product Selection : Covering Multiple Asset Classes Such As Forex, Precious Metals, Indices And Commodities.

- Multi-platform Trading Support : Support MetaTrader 5 And AC Capital Market App To Meet The Needs Of Different Trading Habits.

Technical Infrastructure

AC Capital Market Employs Advanced Technical Infrastructure To Ensure The Stability And Security Of Trading. Its Trading Platform, MetaTrader 5, Is A Mature And Powerful Tool That Supports Multiple Trading Strategies And Automated Trading. In Addition, AC Capital Market's Mobile App Has Been Optimized To Provide A Smooth User Experience.

Compliance And Risk Control System

AC Capital Market Follows Strict Compliance Standards To Ensure The Safety Of Client Funds And The Transparency Of Trading. Its Compliance Measures Include:

- Segregated Accounts : Separation Of Client Funds From The Company's Operating Funds To Prevent The Risk Of Capital Mixing.

- Risk Management System : Provides Flexible Leverage And Rigorous Risk Control Tools To Help Investors Manage Latent Risks.

Market Positioning And Competitive Advantage

AC Capital Market Occupies An Important Position In The Global Foreign Exchange Market. Its Competitive Advantages Include:

- Regulated Operations : Holds Regulatory Licenses In Australia And Vanuatu To Ensure Compliance Operations.

- Diversified Product Selection : Covering Multiple Asset Classes To Meet The Needs Of Different Investors.

- Flexible Leverage : Provides Leverage Up To 800:1 To Suit Different Trading Strategies.

- Multilingual Customer Support : Supports 12 Languages For The Convenience Of Global Investors.

Customer Support & Empowerment

AC Capital Market Provides Comprehensive Customer Support Services, Including Professional Trading Guidance, Market Analysis, And Educational Resources To Help Investors Enhance Their Trading Skills And Market Understanding.

Social Responsibility & ESG

AC Capital Market Is Committed To Fulfilling Its Social Responsibility To Support Sustainable Development And Environmental Protection Projects. The Company Follows ESG (Environmental, Social, And Corporate Governance) Principles And Is Committed To Driving Sustainable Development In The Industry.

Strategic Collaboration Ecology

AC Capital Market Has Established Strategic Partnerships With Several Financial Institution Groups And Technology Companies To Further Enhance Its Technical Level And Market Competitiveness. These Collaborations Include Technology Development, Marketing Activities And Client Server Support.

Financial Health

AC Capital Market Has A Healthy Financial Position, And Its Registered Capital And Regulatory Licenses Ensure The Company's Sound Operation. As Of 2023Q3, The Company's Management Scale Exceeded $1 Billion , Demonstrating Its Important Position In The Industry.

Future Roadmap

AC Capital Market Plans To Continue To Expand Its Product Line, Optimize Trading Platform Functions, And Enhance The Client Server Experience In The Future. The Company Is Also Committed To Driving Technological Innovation To Further Strengthen Its Position In The Global Foreign Exchange Market.

The Above Is A Detailed Introduction About AC Capital Market, Covering The Company Background, Regulatory Information, Trading Products, Technology Platform, Compliance System, Market Positioning, And Future Development Plans.