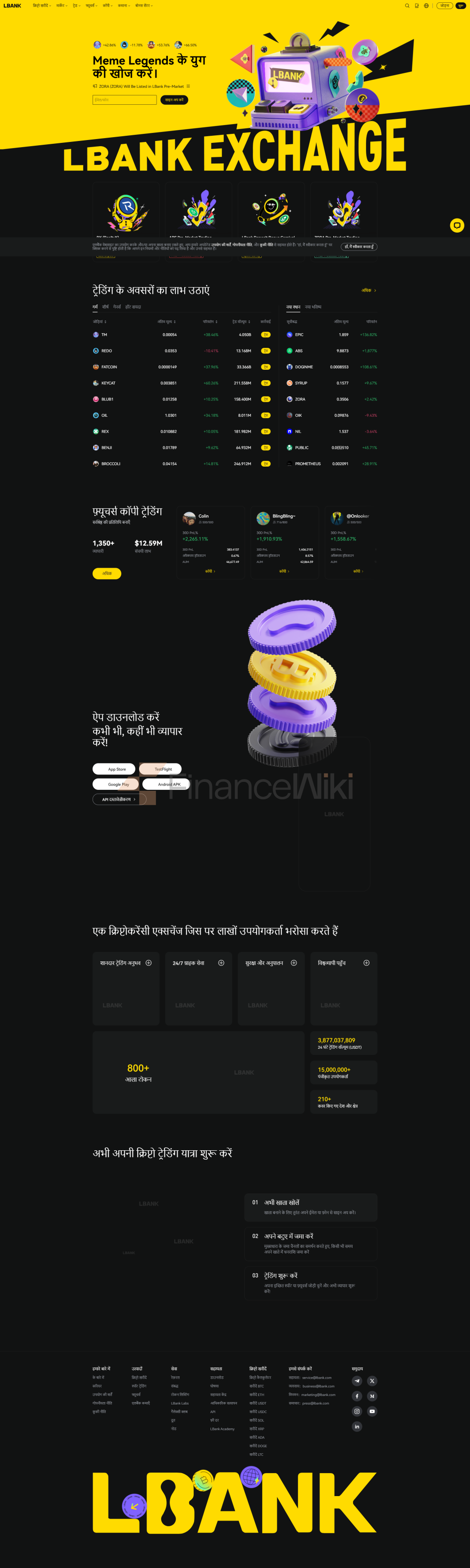

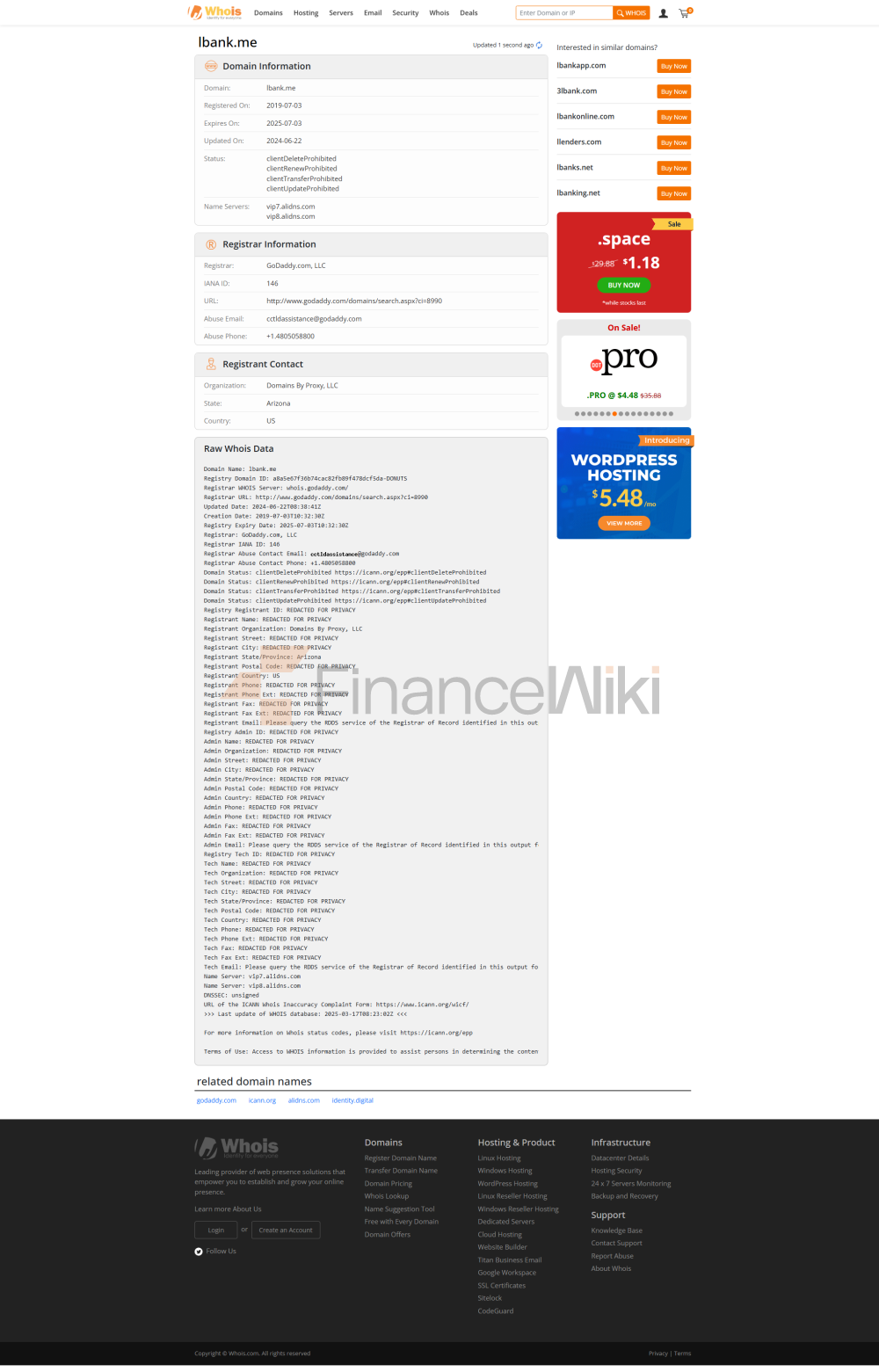

LBank Is A Hong Kong-based Centralized Exchange Platform Founded In 2015 With Offices In The British Virgin Islands, The United States, Australia And Canada. Users Can Buy And Sell Major Cryptocurrencies, Such As Bitcoin And Ethereum, On The Platform In More Than 50 Fiat Currencies And More Than 20 Payment Methods. The Company Has A Business License From The National Futures Association, The Australian Transaction Reporting And Analysis Centre, And The Canadian Money Services Business.

LBank's Products Include: Spot And Margin Trading, Cryptocurrency Futures And Options, Pledges, Non-fungible Tokens And ETF Trading Of Cryptocurrency Assets. Other Services Include Peer-to-peer (P2P) Trading, Grid Trading, And Resilient And Locked Deposits.

The Ecosystem Was Co-founded By Allen Wei, A Former IT Developer Who Is Currently The CEO Of LBank. He Was Inspired To Create The Project After Reading A White Paper On Bitcoin And Its Blockchain.

The Exchange Is Headquartered In Hong Kong And Is Owned And Operated By Superchains Network Technology Co. Ltd.

The Exchange Has Nearly 7 Million Users From More Than 200 Countries. Since LBank Is Located In Hong Kong, It May Be Subject To Legal Restrictions In Some Regions.

The Centralized Exchange Supports More Than 120 Cryptocurrencies As Well As More Than 180 Trading Pairs. The Most Popular Crypto Assets On The Platform Include BTC, ETH, LUNA, MATIC, FTM, CRO, DOGE, Etc.

The Exchange Charges A Fixed 0.10% Pending And Buying Order Fee, While The Withdrawal Fees Of Various Cryptocurrencies Vary. There Is No Fee For Deposit.

Users Of The Exchange Can Use The Spot Trading Process To Trade Leveraged ETFs. Leveraged ETFs Are A Derivative Instrument. No Margin Is Required. LBank Can Support 3x Long Leverage (3L) And 3x Short Leverage (3S).

Users Can Trade Crypto Futures With Up To 125x Leverage, Including BTCUSDT, ETHUSDT, FILUSDT, And Various Perpetual Contracts. In Addition, The Exchange Also Offers Full Position Margin And Position-by-position Margin.