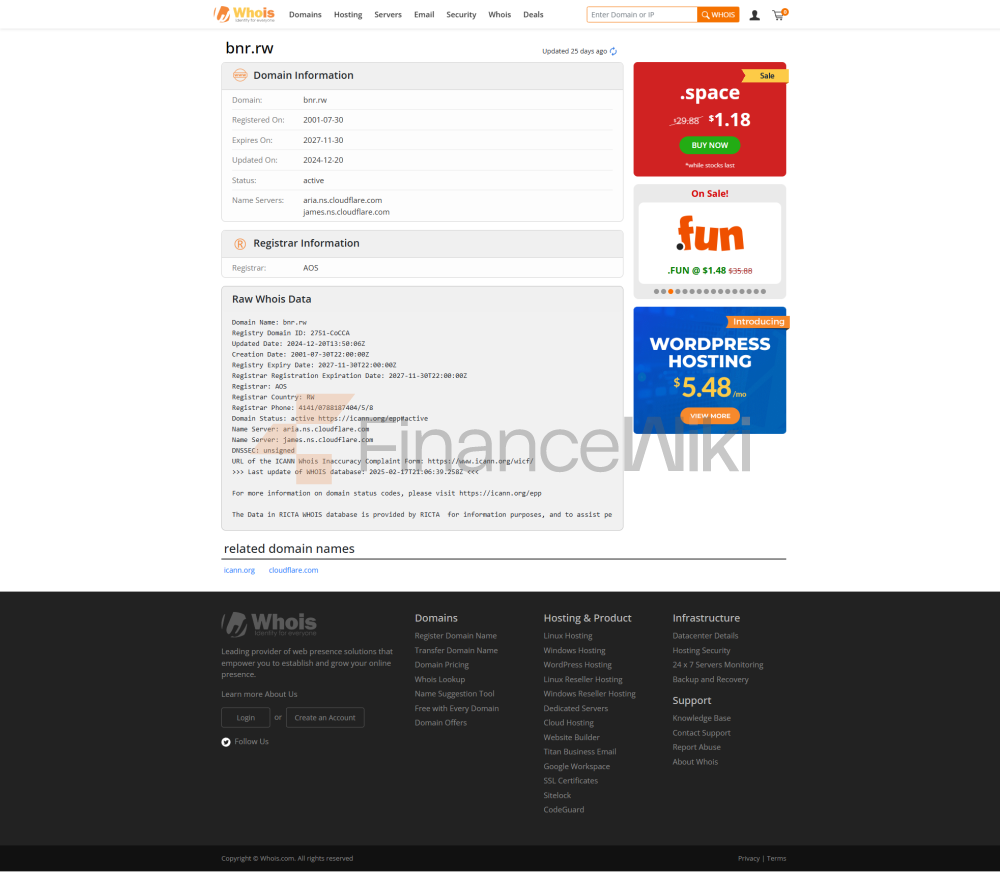

The National Bank of Rwanda (BNR) is Rwanda's central bank, founded in 1964 and headquartered in Kigali. As a state-owned institution, its core role is to maintain economic stability, set monetary policy, and supervise the financial system, rather than directly providing financial services to the public or businesses.

basic bank information

Ownership: 100% owned by the Rwandan government, with no public or private capital involved.

>Type: Central bank, state-owned.

As a central bank, BNR does not directly provide financial services to the public, and its role is more similar to that of an executor and supervisor of economic policies, which is fundamentally different from that of commercial banks (such as deposits and loans).

name and background<

ul style="list-style-type: disc" type="disc">full name: National Bank of Rwanda

Founded: 1964<

span style="font-family: sans-serif; color: black", > headquartered in Kigali, Rwanda

Shareholder Background: State-owned, Government of Rwanda

current president: Soraya Munyana Hakuziyaremye, who will take office in February 2025. She previously served as Deputy Governor (March 2021 to February 2025) and was Minister of Trade and Industry of Rwanda (October 2018 to March 2021).

historical background

National Bank of Rwanda was founded in 1964, but in the 1994 genocide, Rwanda's economic and financial system nearly collapsed. After 1994, the Rwandan government quickly initiated wide-ranging reforms and restored economic growth, with GDP growing between 0.9 and 13.8 per cent per year between 1996 and 2005. The BNR has played a key role in this recovery process, moving from post-conflict stabilization to reconstruction, while transforming into an effective central bank. The BNR has supported this recovery process through a series of reforms, including a comprehensive reform of monetary policy, the refinement of monetary policy tools, internal restructuring, and the strengthening of the banking regulatory and supervisory framework.

service scope<

ul style="list-style-type: disc" type="disc">Coverage area: Rwanda as the central bank, its policies and regulations affect the entire Rwandan financial system.

BNR's primary function is to influence economic activity in Rwanda through monetary policy tools, such as interest rate adjustments and reserve requirements, rather than directly providing financial products.

services and products<

spanstyle="font-family: sans-serif; color: black">The main functions of the BNR include:

supervise and regulate the financial system, ensuring its stability and efficiency.

managing Rwanda's foreign exchange reserves.

promote financial inclusion and ensure more people have access to financial services.

participate in international financial cooperation and safeguard Rwanda's economic interests.

> setting and implementing monetary policy, maintaining price stability, and targeting inflation of 2%-8%.

these functions are accomplished in partnership with commercial banks and financial institutions in Rwanda.

financial health

BNR's financial health is reflected in the overall state of the financial system it regulates. According to the March 2024 Monetary Policy and Financial Stability Report:

Capital adequacy ratio (CAR) of the banking sector: 21.5% (minimum 15%)

non-performing loan ratio of the banking sector: 4.1% (below the 5% threshold).

microfinancial institution CAR: 33.8% (minimum 15%)

Non-performing loan ratio of microfinance institutions: 4.3% (below the 5% threshold)

these indicators indicate that Rwanda's financial system is healthy and stable.

> total assets of the financial sector: FRW 1,068.7 billion in December 2023 , an increase of 20.0% over 2022.

monetary policy

BNR has maintained its key interest rate at 6.5% as of May 2025, believing that this level is enough to keep inflation stable. The March 2024 report mentioned that inflation is expected to stabilize at 5% in the medium term, in line with the target range of 2%-8%. The monetary policy objective of the BNR is to maintain price stability while supporting economic growth.

customer service

BNR provides information to the public primarily through its official website ([National Bank of Rwanda]([invalid url, do not cite])) and through the publication of reports. At the same time, financial education and inclusion advocacy activities were carried out, such as educating 1,020 individuals about credit rights in 2023. At the same time, the number of bank deposit accounts increased by 54% to 4,553,086; The number of microfinance accounts increased by 18% to 8,041,514. These increases reflect the increasing public demand for financial services, as well as BNR's efforts to promote financial inclusion.

security measures

BNR has developed a set of guidelines to manage a variety of risks, including climate-related risks, cyberattacks, and more. For example:

issued the Shared Services Directive (No. 2600/2023-00033) in July 2023 to manage cyber risks and operational standards through shared services.

issue stress testing guidance in July 2023 to ensure financial institutions have adequate liquidity and emergency funding plans.

In addition, BNR has also carried out strict supervision of foreign exchange bureaus, conducting on-site inspections of 43 foreign exchange bureaus in 2023, suspending 6 and punishing 24 to ensure the stability and compliance of the foreign exchange market.

> published the Guidelines on Climate-related and Environmental Financial Risk Management (No. 2600/2023-0036) in November 2023, Financial institutions are required to identify and manage risks associated with climate change.

featured services and differentiations<

ul style="list-style-type: disc" type="disc">Financial Inclusion: BNR actively promotes financial inclusion, is a key member of the Alliance for Financial Inclusion, and signed the Maya Declaration at the 2011 Global Policy Forum. Commit to country-specific measures on financial inclusion. As of December 2023, 63% of Umulunge SACCOs (local savings and credit cooperatives) in Rwanda have been automated, improving the efficiency of the core banking system.

Regional integration: BNR is involved in the integration of regional payment systems, and plans to connect payment systems with countries such as Ghana to facilitate cross-border payments.

Economic stability: As a central bank, the BNR plays a key role in stabilizing Rwanda's economy and maintaining the stability of the financial system.

conclusion

The National Bank of Rwanda is the central bank of Rwanda and its role is one of macroeconomic management rather than direct financial services. Its operation reflects the typical functions of a central bank, including monetary policy enforcement, financial stability maintenance, and international cooperation. Although not directly serving the public, its role in the Rwandan economy is crucial to its financial system. The above analysis is based on publicly available information as of May 30, 2025 to ensure the accuracy and timeliness of the information.